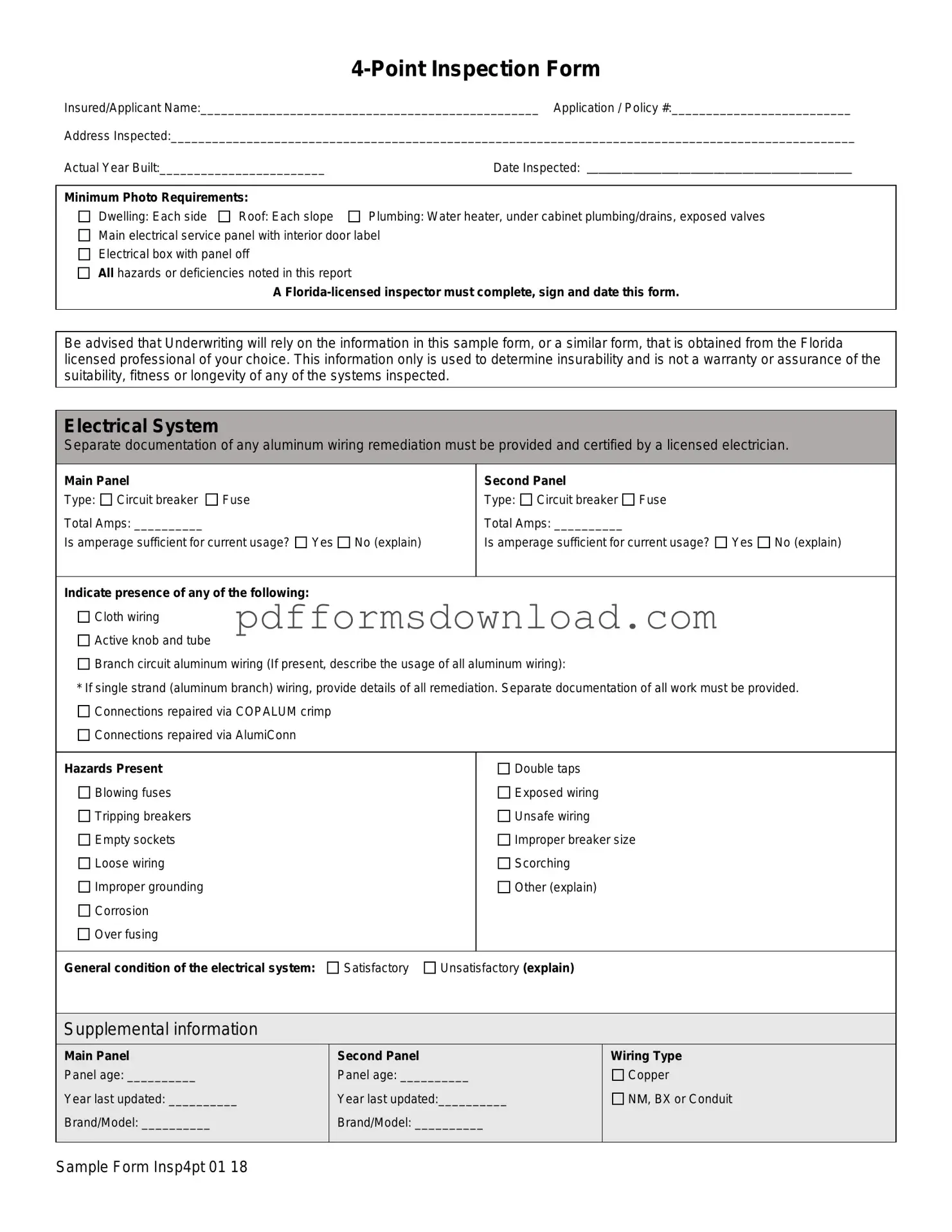

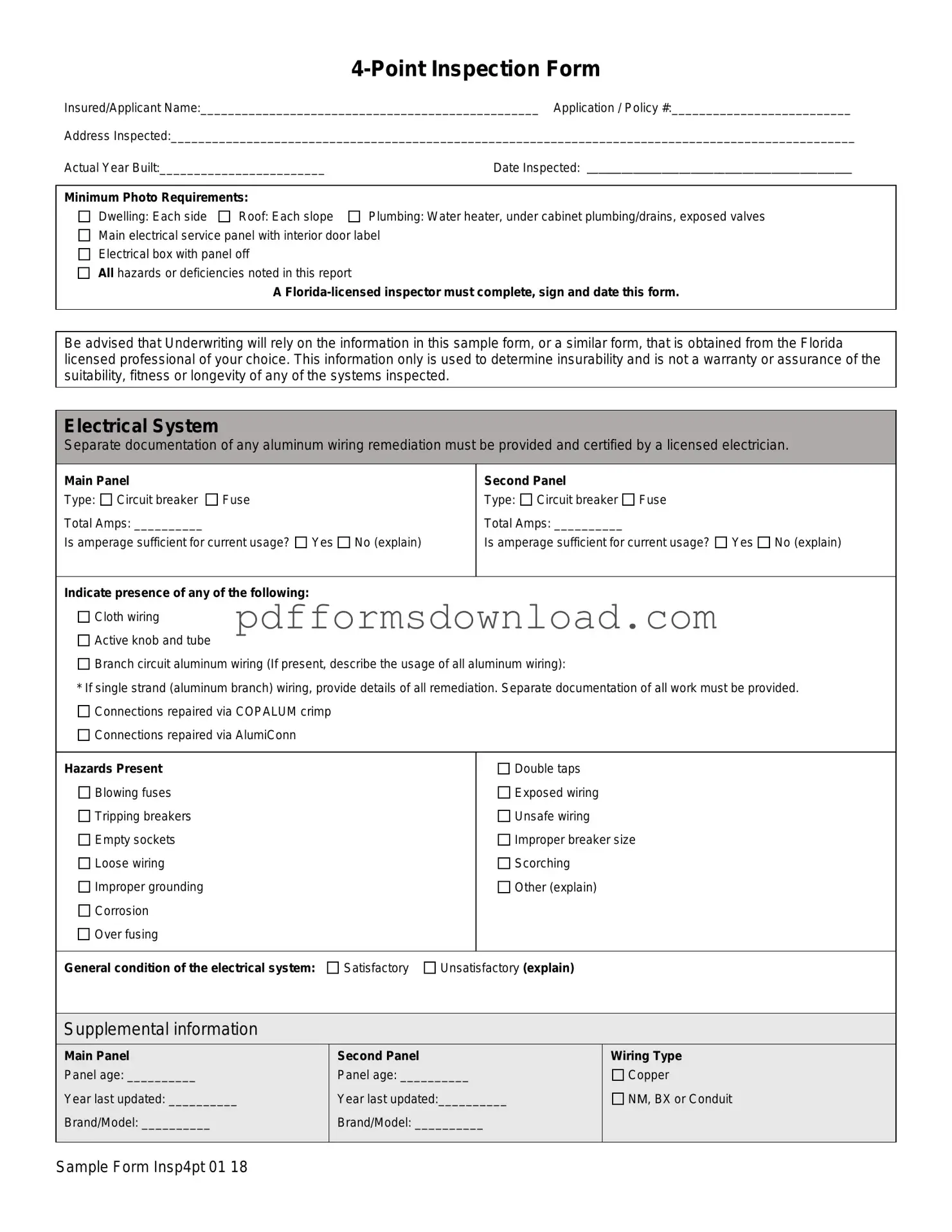

What is a 4 Point Inspection Form?

The 4 Point Inspection Form is a document used primarily in Florida to assess the condition of four key systems in a home: the roof, electrical, HVAC (heating, ventilation, and air conditioning), and plumbing. This inspection is often required by insurance companies to determine whether a property is insurable. The form must be completed by a licensed Florida inspector, who will evaluate each system and report any hazards or deficiencies.

Why is a 4 Point Inspection necessary?

A 4 Point Inspection is necessary because it helps insurance providers assess the risk associated with insuring a property. By examining the roof, electrical, HVAC, and plumbing systems, insurers can identify potential issues that may lead to claims in the future. This evaluation is crucial for determining the insurability of the home and ensuring that it meets safety standards.

Who can perform a 4 Point Inspection?

A licensed Florida professional must conduct the 4 Point Inspection. Acceptable inspectors include general contractors, residential contractors, building code inspectors, and home inspectors. It's important to note that a trade-specific licensed professional can only sign off on the section of the form that pertains to their area of expertise. For example, an electrician can only certify the electrical system.

What information is required on the 4 Point Inspection Form?

The form requires detailed information about the condition of the roof, electrical, HVAC, and plumbing systems. This includes the age of each system, any visible hazards or deficiencies, and the general condition of each system. Additionally, photos must be provided to document the condition of the dwelling, roof, plumbing, and electrical systems. Each section must be completed, signed, and dated by the inspector.

What are the minimum photo requirements for the inspection?

When submitting the 4 Point Inspection Form, certain photos must accompany it. These include images of each side of the dwelling, each slope of the roof, the water heater, under-cabinet plumbing and drains, exposed valves, the open main electrical panel, and the electrical box with the panel off. These photos help verify the information provided in the inspection report.

What happens if a system is found to be unsatisfactory?

If any of the systems are deemed unsatisfactory during the inspection, the inspector must provide detailed comments and descriptions regarding the issues. This information is crucial for the insurance company, as it may affect the insurability of the property. Agents should ensure that any properties with unsatisfactory systems are not submitted for coverage until the issues are resolved.

How should agents handle the 4 Point Inspection Form?

Agents must carefully review the completed 4 Point Inspection Form before submitting it with an application for coverage. It's their responsibility to ensure that all requirements are met and that the property does not have any unresolved hazards or deficiencies. Submitting an application for a property with unsatisfactory systems could lead to complications in obtaining insurance coverage.