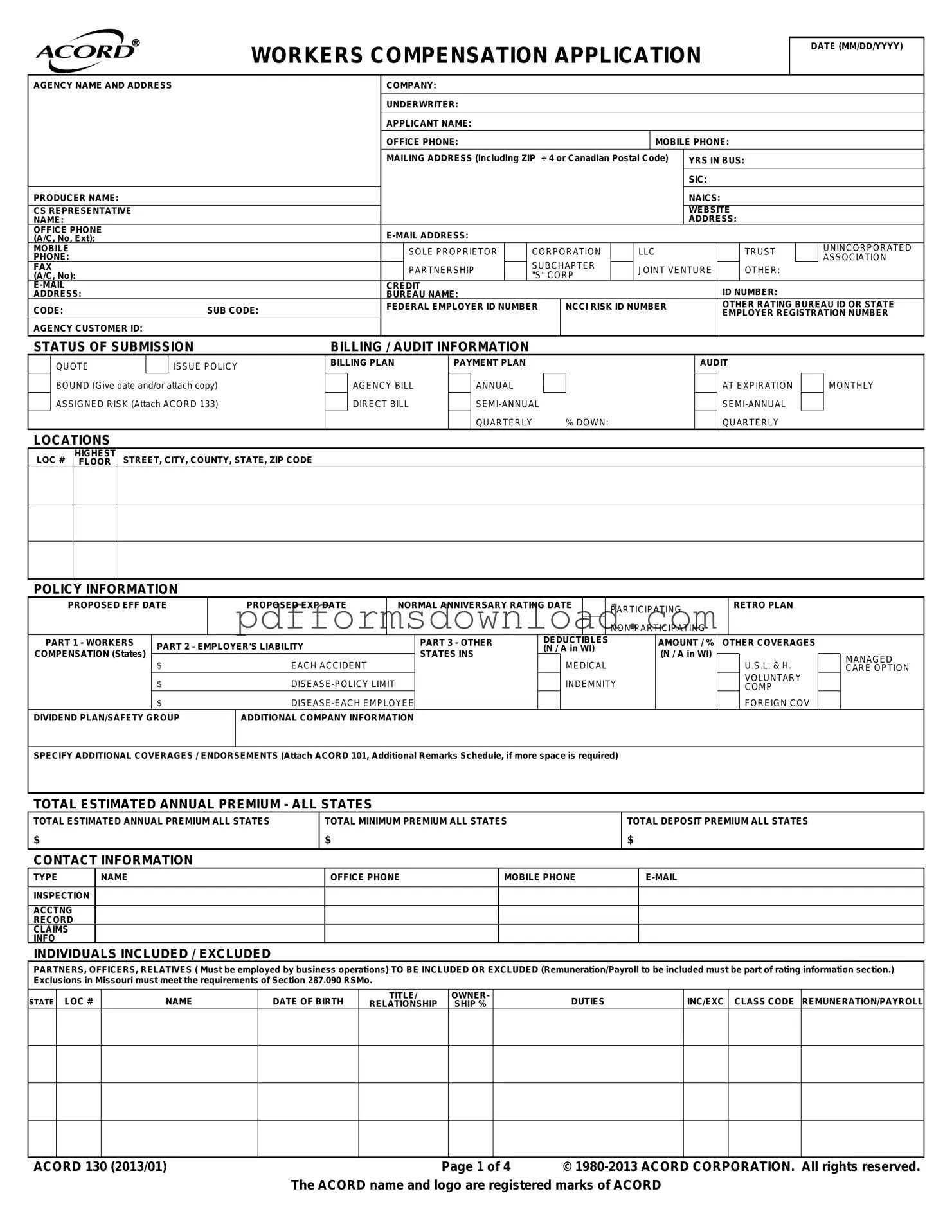

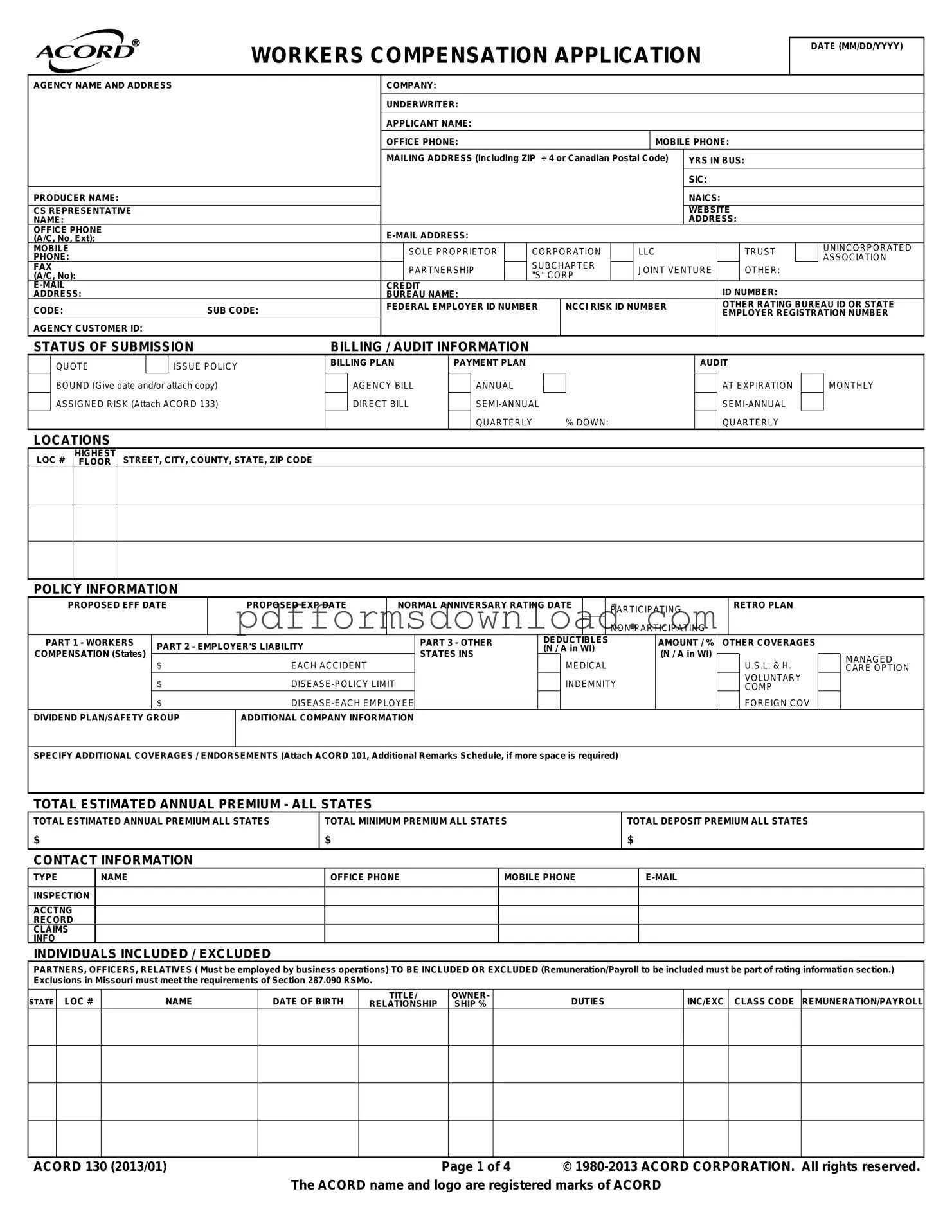

What is the Acord 130 form used for?

The Acord 130 form is primarily used to apply for workers' compensation insurance. It collects essential information about the business, including its operations, employee details, and insurance needs. This information helps insurance providers assess risk and determine appropriate coverage and premiums.

Who needs to fill out the Acord 130 form?

Any business seeking workers' compensation insurance must complete the Acord 130 form. This includes sole proprietors, corporations, partnerships, and other business entities. It is crucial for accurately representing the business's operations and employee structure to obtain suitable coverage.

What information is required on the Acord 130 form?

The form requires various details, such as the applicant's name, business address, contact information, years in business, and type of entity (e.g., LLC, corporation). Additionally, it asks for information about employees, payroll estimates, prior insurance coverage, and any claims history. Providing accurate and complete information is vital for the insurance application process.

How does the Acord 130 form affect my insurance premium?

The information provided on the Acord 130 form directly impacts the insurance premium. Insurers evaluate factors like the type of business, employee classifications, and historical claims to calculate the premium. Accurate payroll estimates and the nature of operations are particularly important in determining the final cost of coverage.

What if my business has multiple locations?

If your business operates in multiple locations, you should indicate this on the Acord 130 form. Each location may have different risks and payroll estimates, which could affect the overall insurance premium. Be sure to provide details for each location to ensure comprehensive coverage.

Can I exclude certain employees from coverage?

Yes, the Acord 130 form allows for the exclusion of specific employees, such as partners, officers, or relatives, under certain conditions. However, you must provide the necessary details about these individuals, including their roles and payroll information. Ensure that exclusions comply with state regulations.

What should I do if I have a history of claims?

If your business has a history of claims, you must disclose this information on the Acord 130 form. This includes providing details about past claims, the nature of the incidents, and any payments made. Transparency about your claims history is crucial, as it can influence your eligibility and premium rates.

How do I submit the Acord 130 form?

The Acord 130 form can be submitted through your insurance agent or broker. They will help ensure that all necessary information is complete and accurate before submission. It's essential to keep a copy of the form for your records and follow up with your agent to confirm receipt and processing.