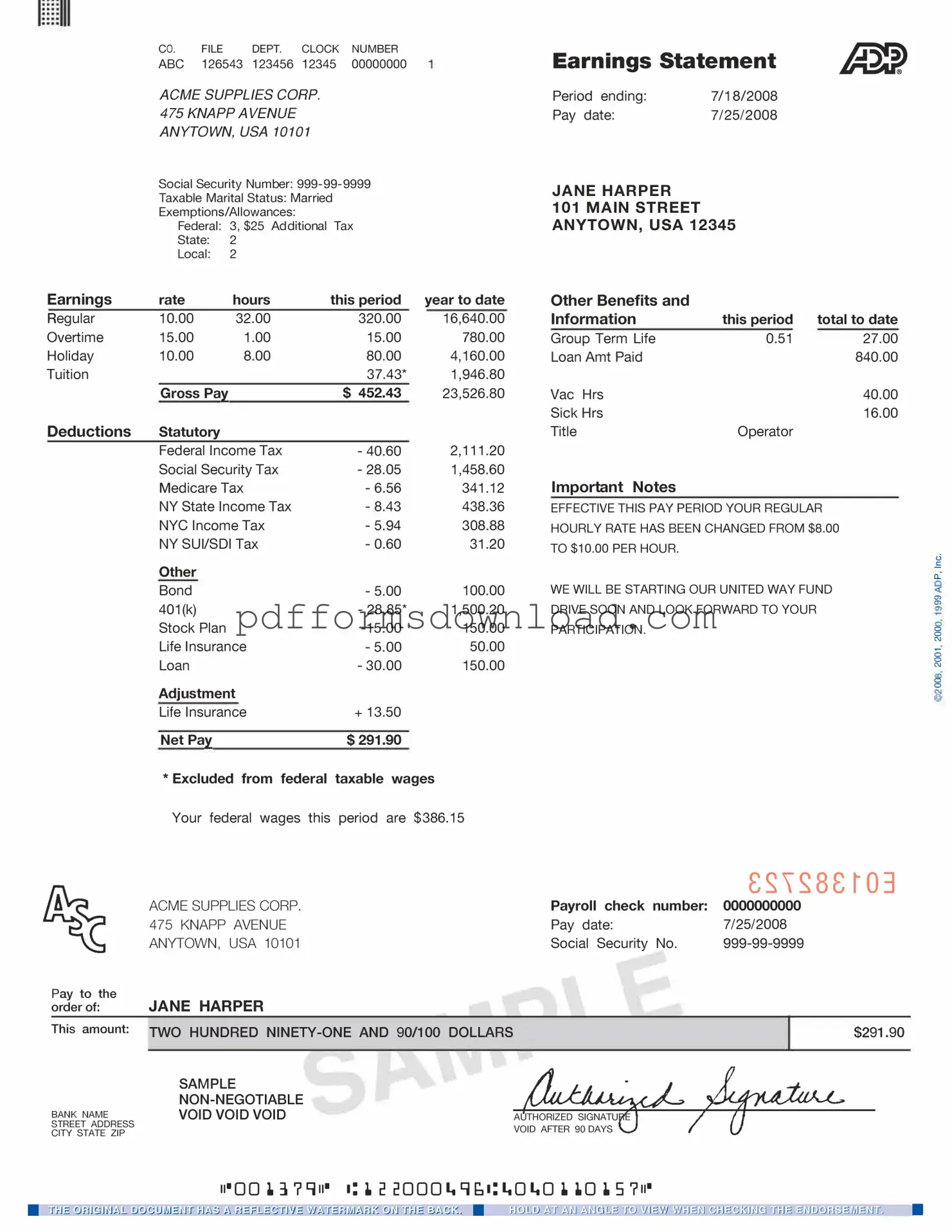

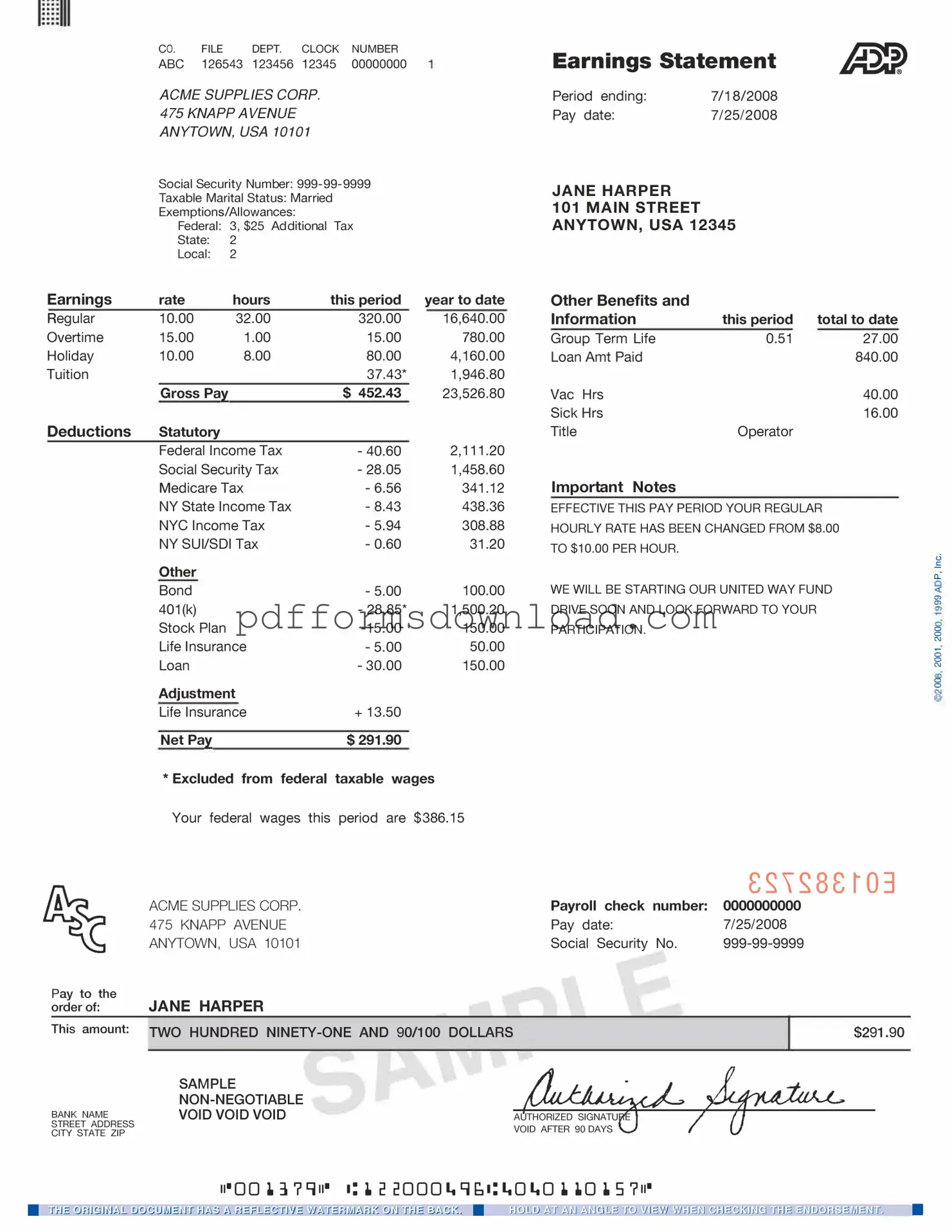

Download Adp Pay Stub Template

The ADP Pay Stub form is a document that provides employees with a detailed summary of their earnings and deductions for a specific pay period. This essential tool helps workers understand their compensation, track hours worked, and verify tax withholdings. Ready to take control of your payroll information? Fill out the form by clicking the button below!

Make This Document Now

Download Adp Pay Stub Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Adp Pay Stub online — edit, save, and download easily.