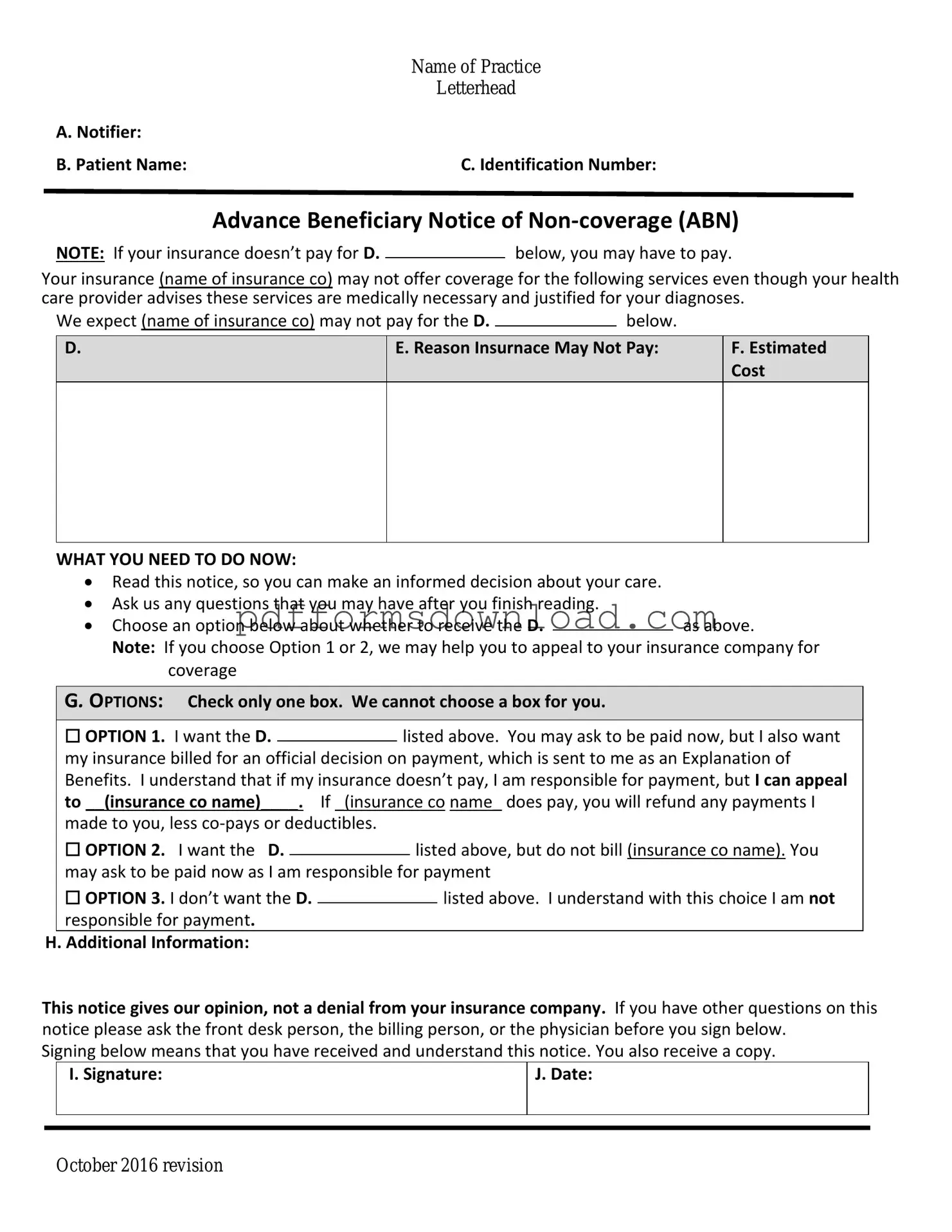

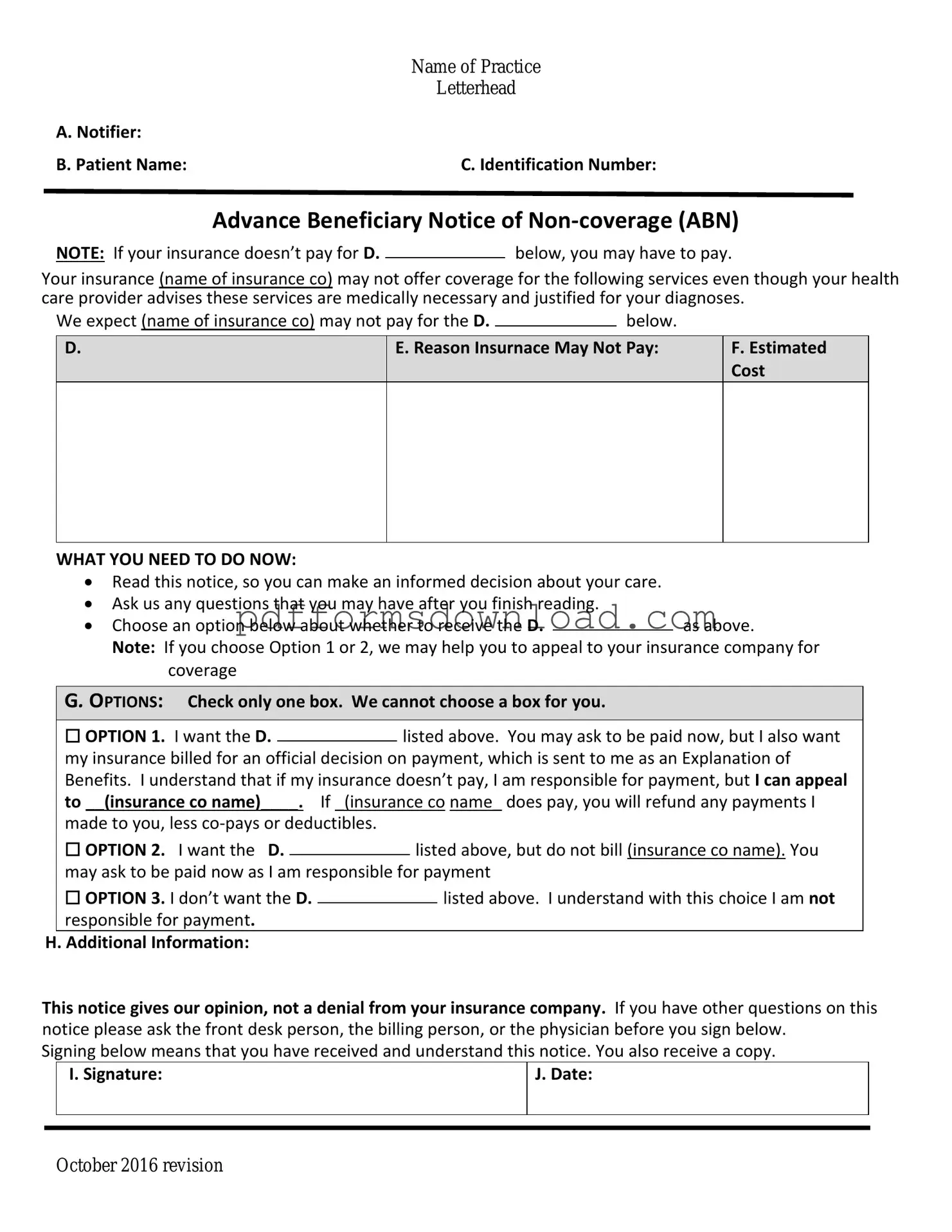

What is the Advance Beneficiary Notice of Non-coverage (ABN)?

The Advance Beneficiary Notice of Non-coverage, commonly known as the ABN, is a form that healthcare providers use to inform Medicare beneficiaries that a particular service or item may not be covered by Medicare. This notice allows patients to understand their financial responsibilities before receiving the service.

When should I receive an ABN?

You should receive an ABN when your healthcare provider believes that Medicare may not pay for a specific service or item. This typically occurs before the service is rendered, giving you the opportunity to decide whether to proceed with the service knowing you might have to pay for it out-of-pocket.

What information is included in the ABN?

The ABN includes details about the service or item in question, the reason Medicare may deny coverage, and an estimate of the costs you might incur if you choose to proceed. It also provides options for you to consider, including whether you want to receive the service despite the potential lack of coverage.

Do I have to sign the ABN?

Signing the ABN is not mandatory, but it is highly recommended. By signing, you acknowledge that you understand the potential for non-coverage and the associated costs. If you choose not to sign, your provider may still proceed with the service, but you may not have the same level of protection regarding payment responsibilities.

What happens if I don’t sign the ABN?

If you do not sign the ABN, your provider may still provide the service, but you may be billed for the full cost if Medicare denies coverage. In some cases, the provider may choose not to perform the service at all without your acknowledgment of the potential costs.

Can I appeal a Medicare denial after receiving an ABN?

Yes, you can appeal a Medicare denial even after receiving an ABN. If Medicare denies payment, you have the right to challenge that decision. The ABN serves as documentation that you were informed of the potential for non-coverage, which can be helpful in the appeals process.

How long is the ABN valid?

The ABN is valid for the specific service or item listed on the form. It does not cover future services or items. If you need additional services that may also not be covered, your provider will need to issue a new ABN for each instance.

What should I do if I have questions about the ABN?

If you have questions about the ABN or the services in question, it is best to discuss them with your healthcare provider. They can explain the reasons for potential non-coverage and help you understand your options moving forward.

Where can I find more information about the ABN?

For more information about the Advance Beneficiary Notice of Non-coverage, you can visit the official Medicare website or contact Medicare directly. They provide resources and guidance that can help you better understand your rights and responsibilities regarding healthcare services.