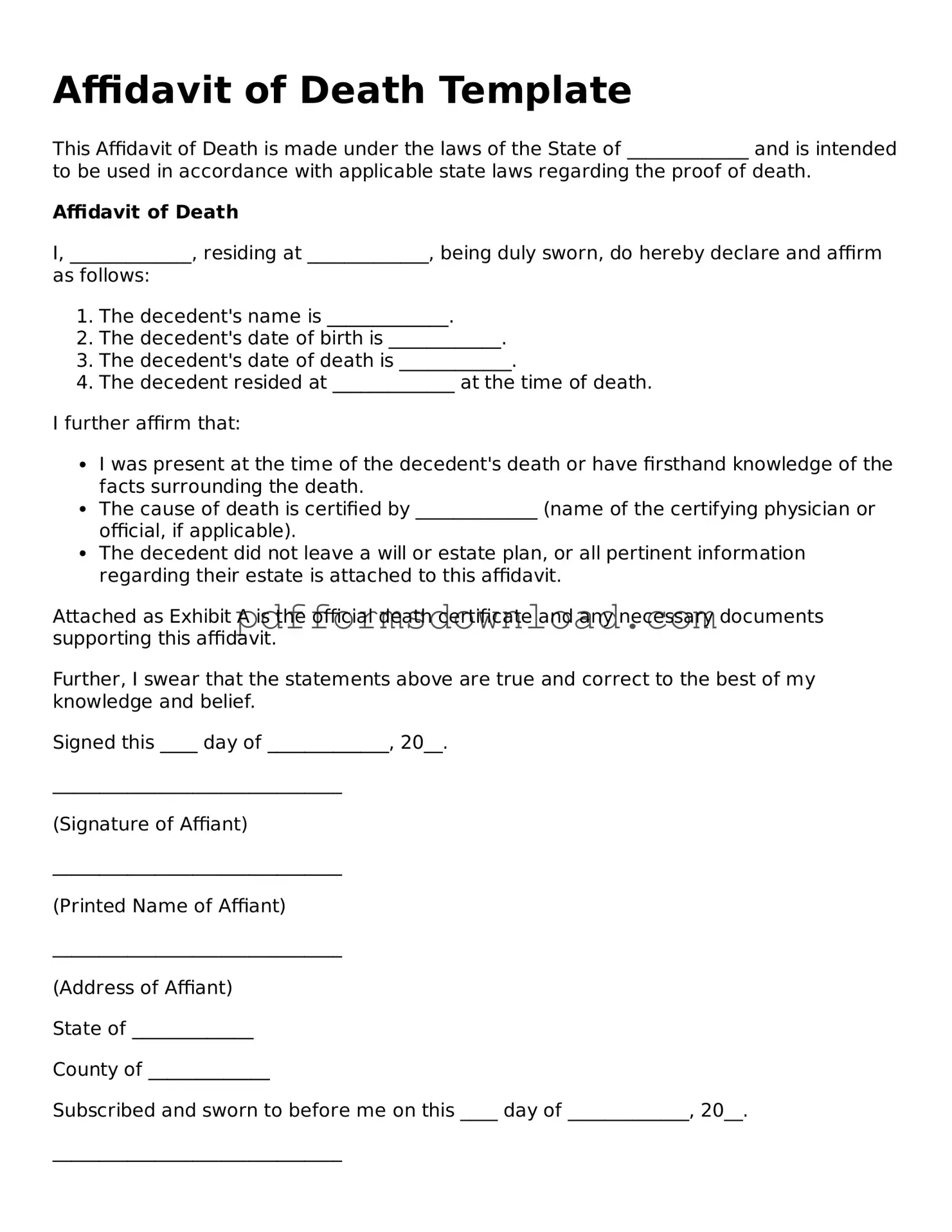

Official Affidavit of Death Document

An Affidavit of Death form is a legal document used to officially declare that an individual has passed away. This form can be essential for settling estates, transferring property, or managing financial accounts after a person's death. To ensure you handle this process correctly, consider filling out the form by clicking the button below.

Make This Document Now

Official Affidavit of Death Document

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Affidavit of Death online — edit, save, and download easily.