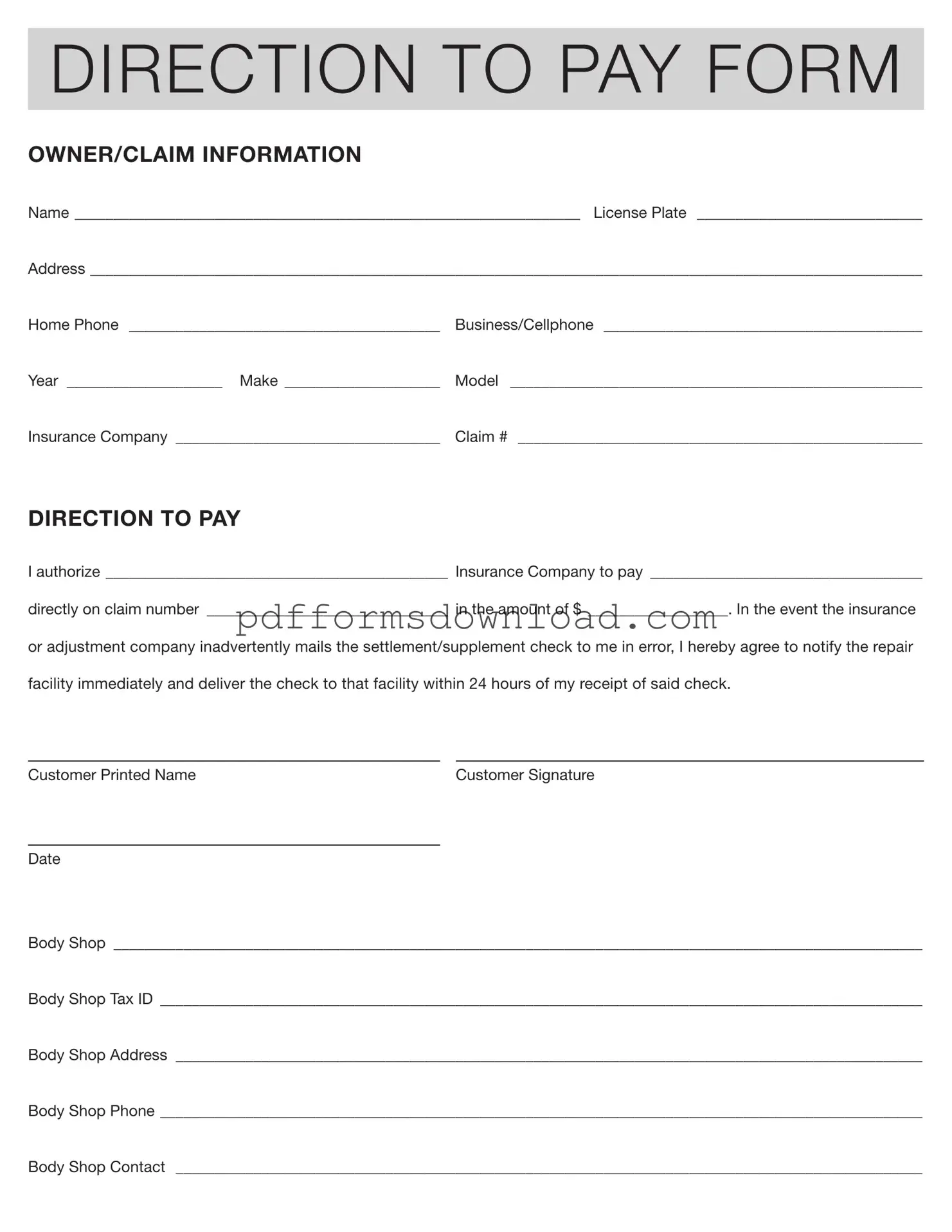

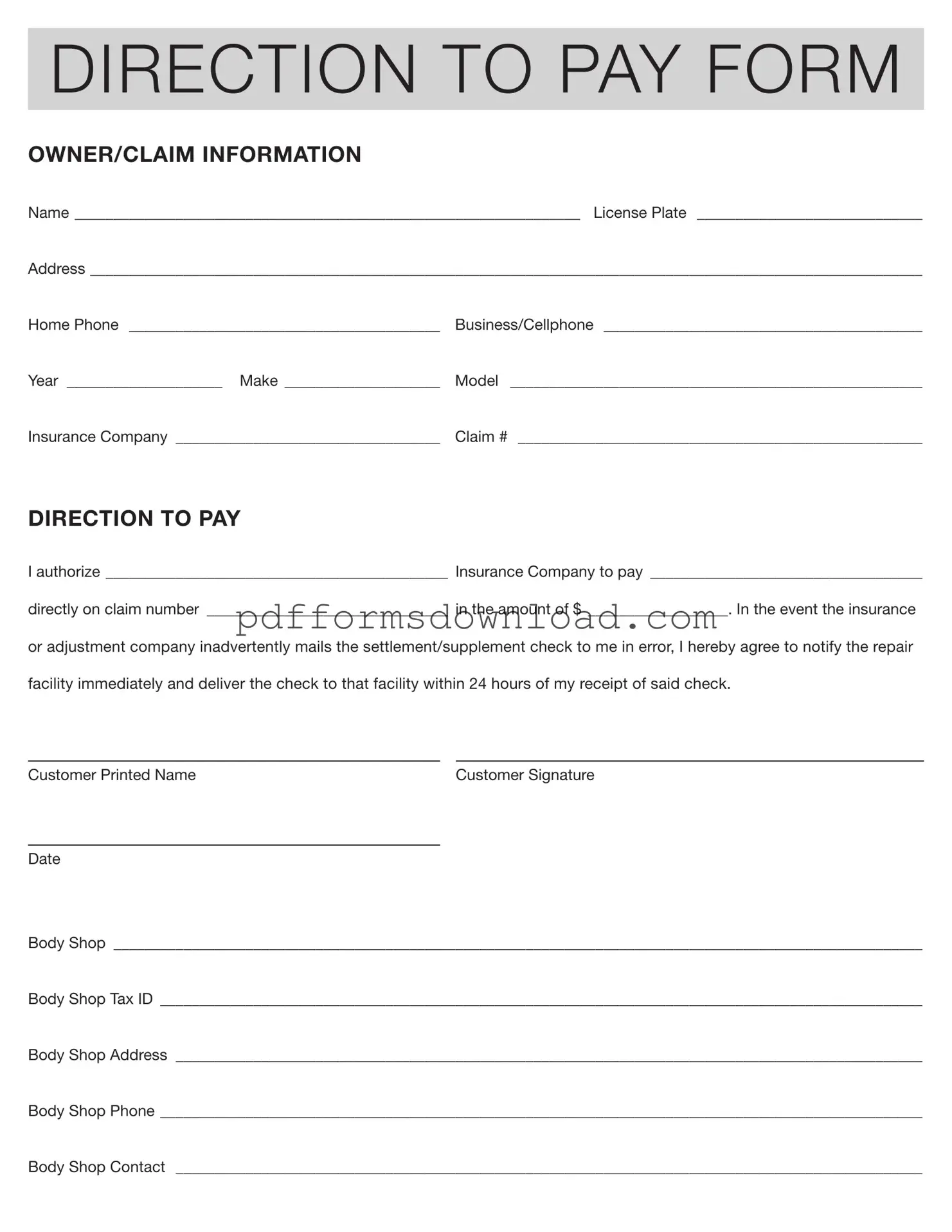

Download Authorization And Direction Pay Template

The Authorization And Direction Pay form is a document that allows an insurance company to directly pay a repair facility for services rendered on a vehicle claim. This form ensures that the payment process is streamlined, reducing delays in repairs and helping vehicle owners get back on the road more quickly. If you are ready to authorize payment, please fill out the form by clicking the button below.

Make This Document Now

Download Authorization And Direction Pay Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Authorization And Direction Pay online — edit, save, and download easily.