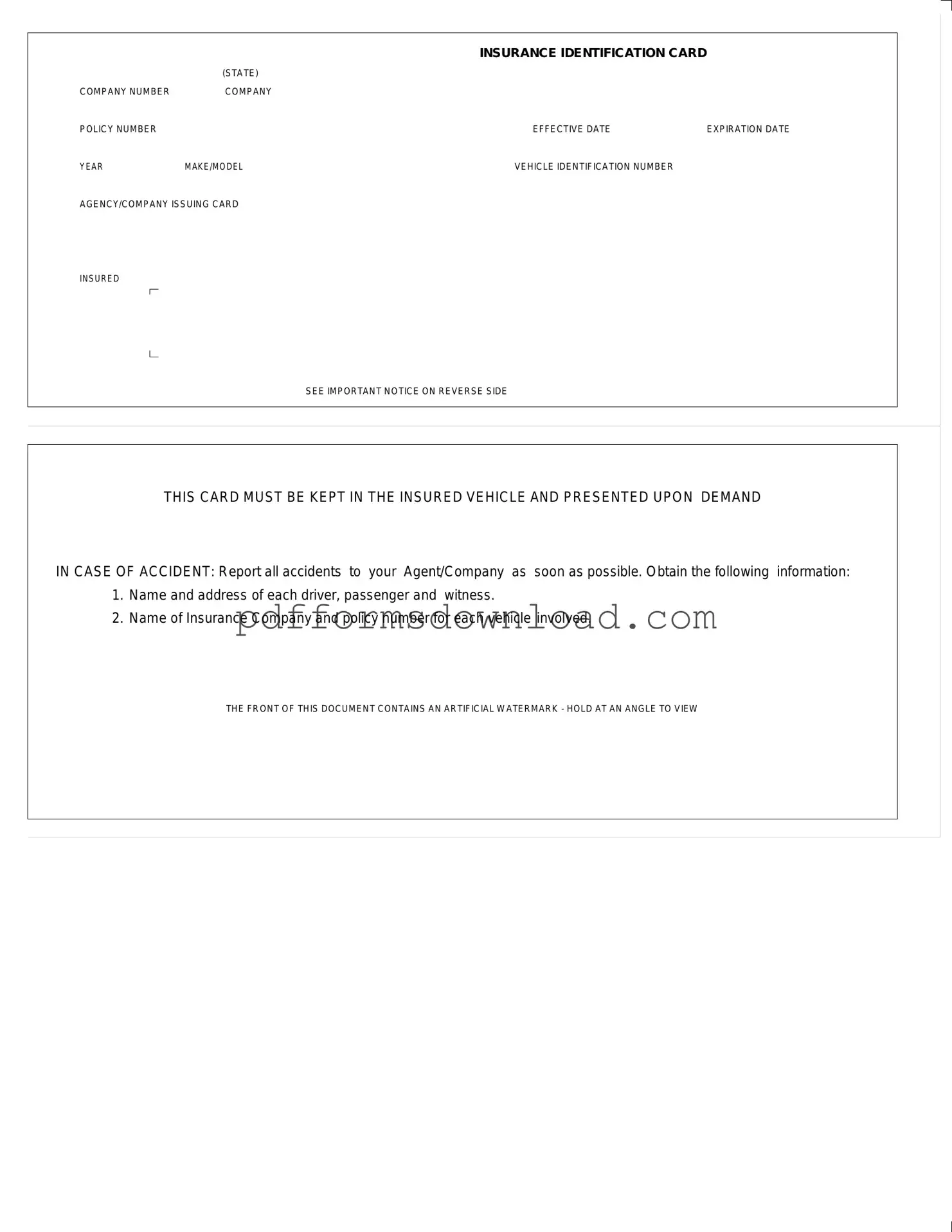

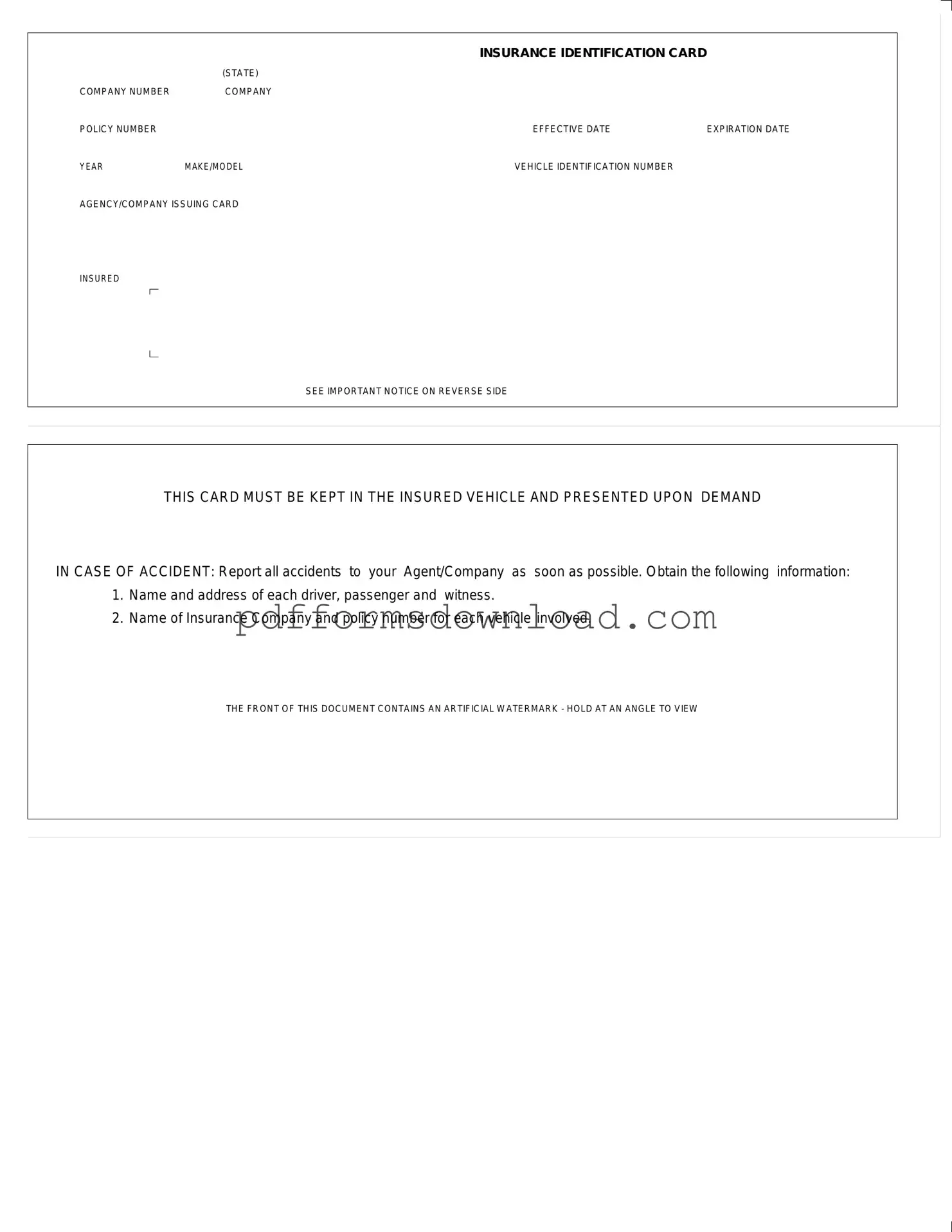

Download Auto Insurance Card Template

The Auto Insurance Card serves as proof of insurance coverage for a vehicle. It includes essential details such as the company number, policy number, effective dates, and vehicle identification information. Keeping this card in your vehicle is crucial, as it must be presented upon demand in case of an accident.

Ensure you have the necessary information readily available, and take the first step towards responsible driving by filling out the form below.

Make This Document Now

Download Auto Insurance Card Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Auto Insurance Card online — edit, save, and download easily.