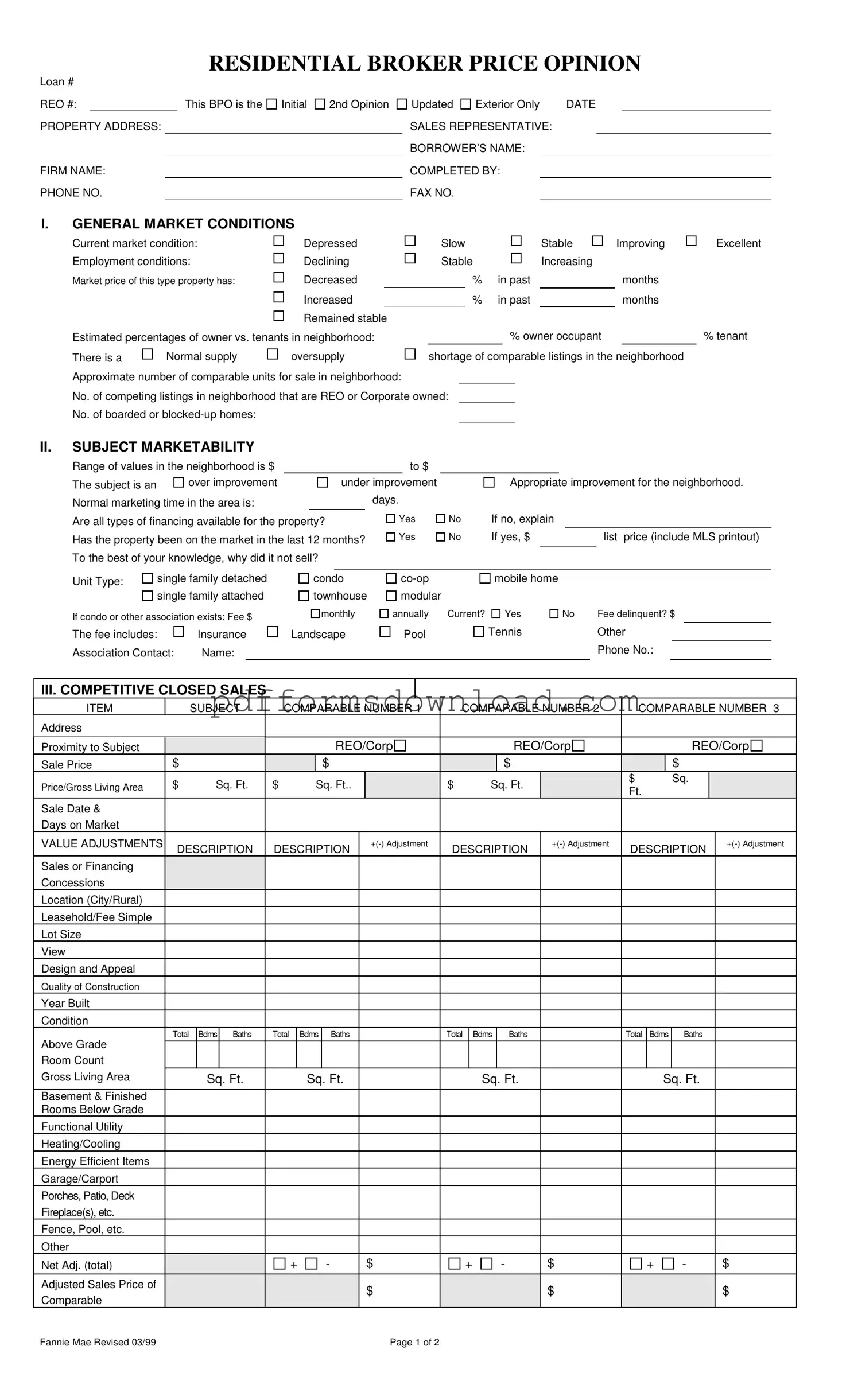

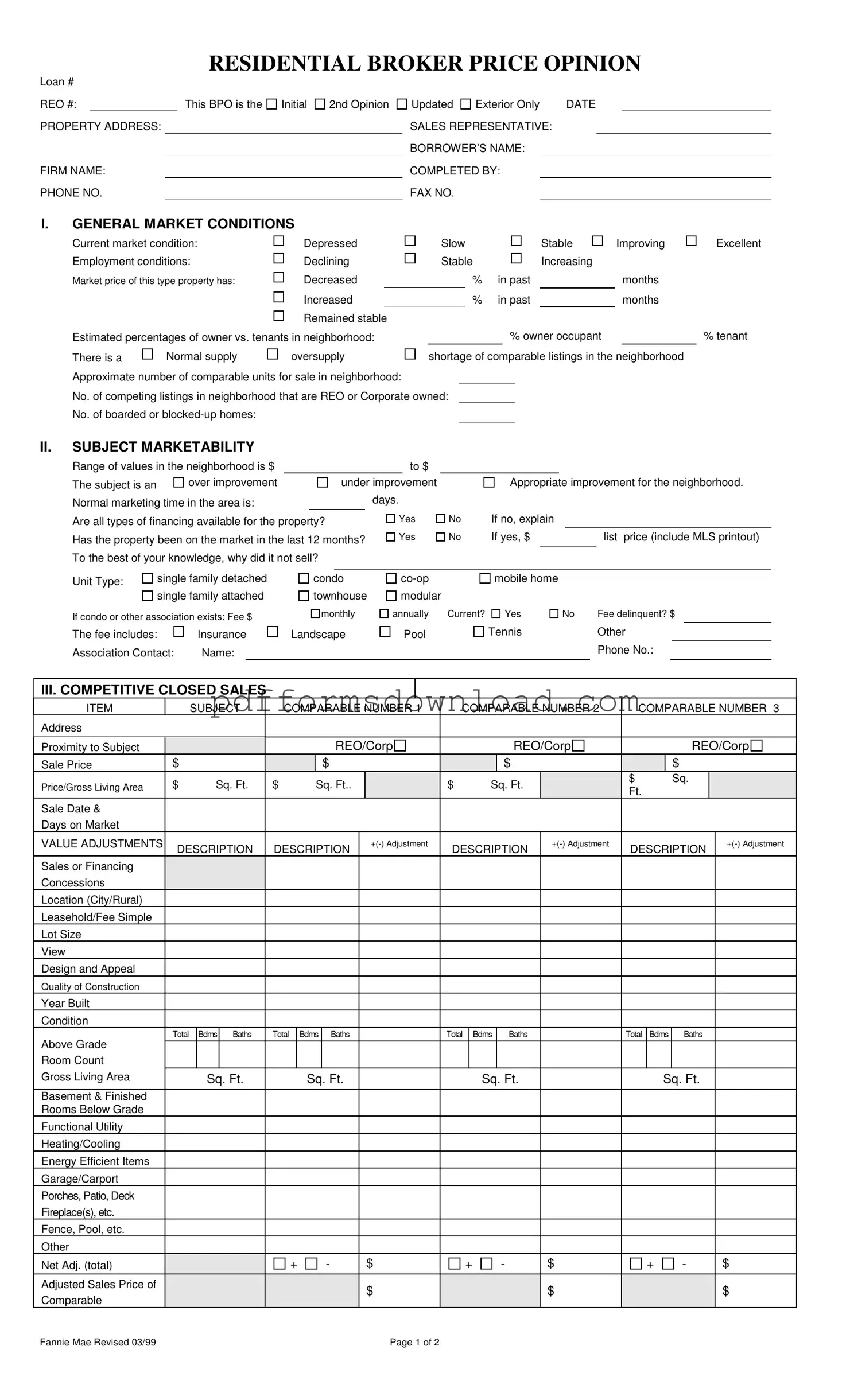

Download Broker Price Opinion Template

A Broker Price Opinion (BPO) is a document prepared by a real estate professional that provides an estimated value of a property based on various factors, including market conditions and comparable sales. This form is essential for lenders and investors to assess the potential market value of a property, particularly in the context of foreclosures or short sales. To complete the Broker Price Opinion form, please click the button below.

Make This Document Now

Download Broker Price Opinion Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Broker Price Opinion online — edit, save, and download easily.