What is a Business Bill of Sale?

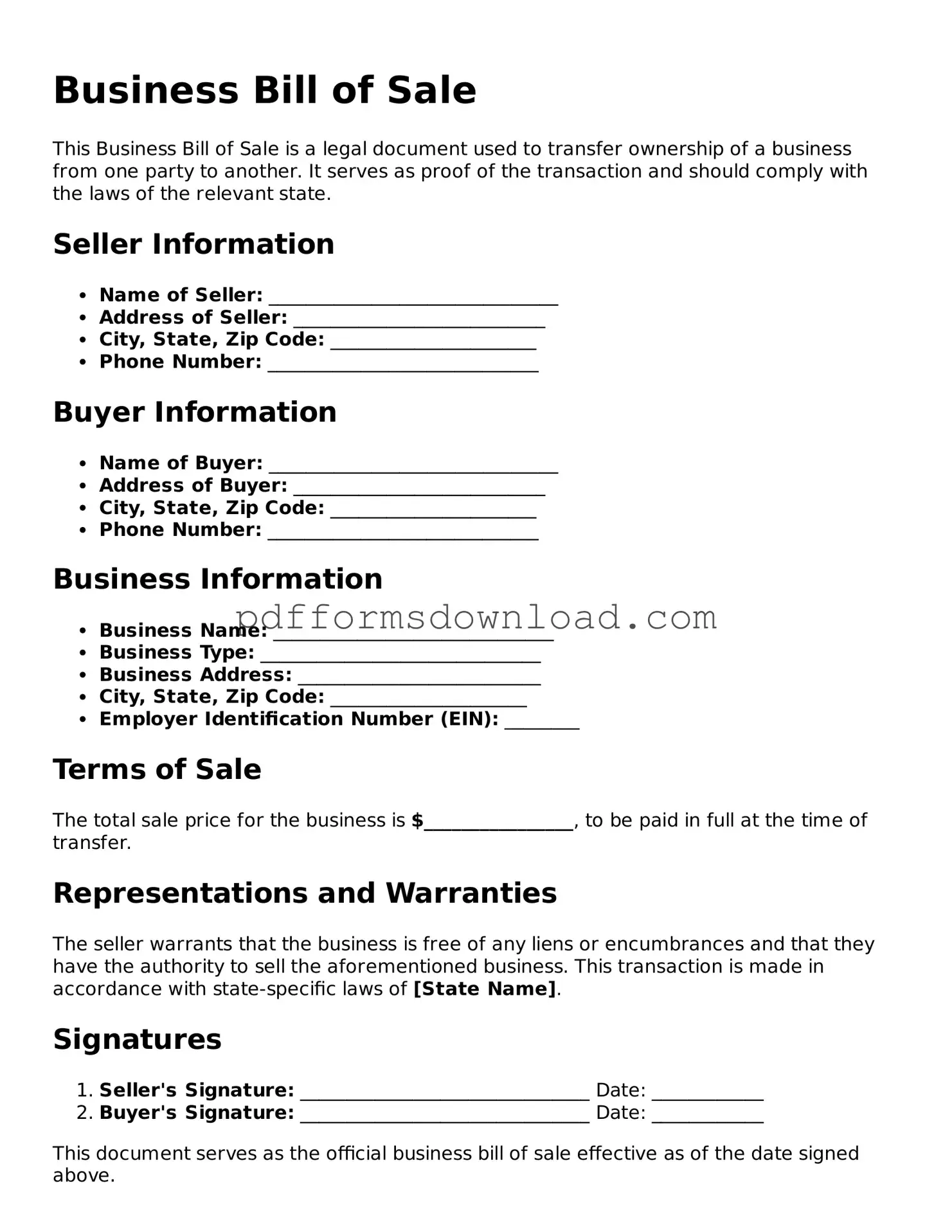

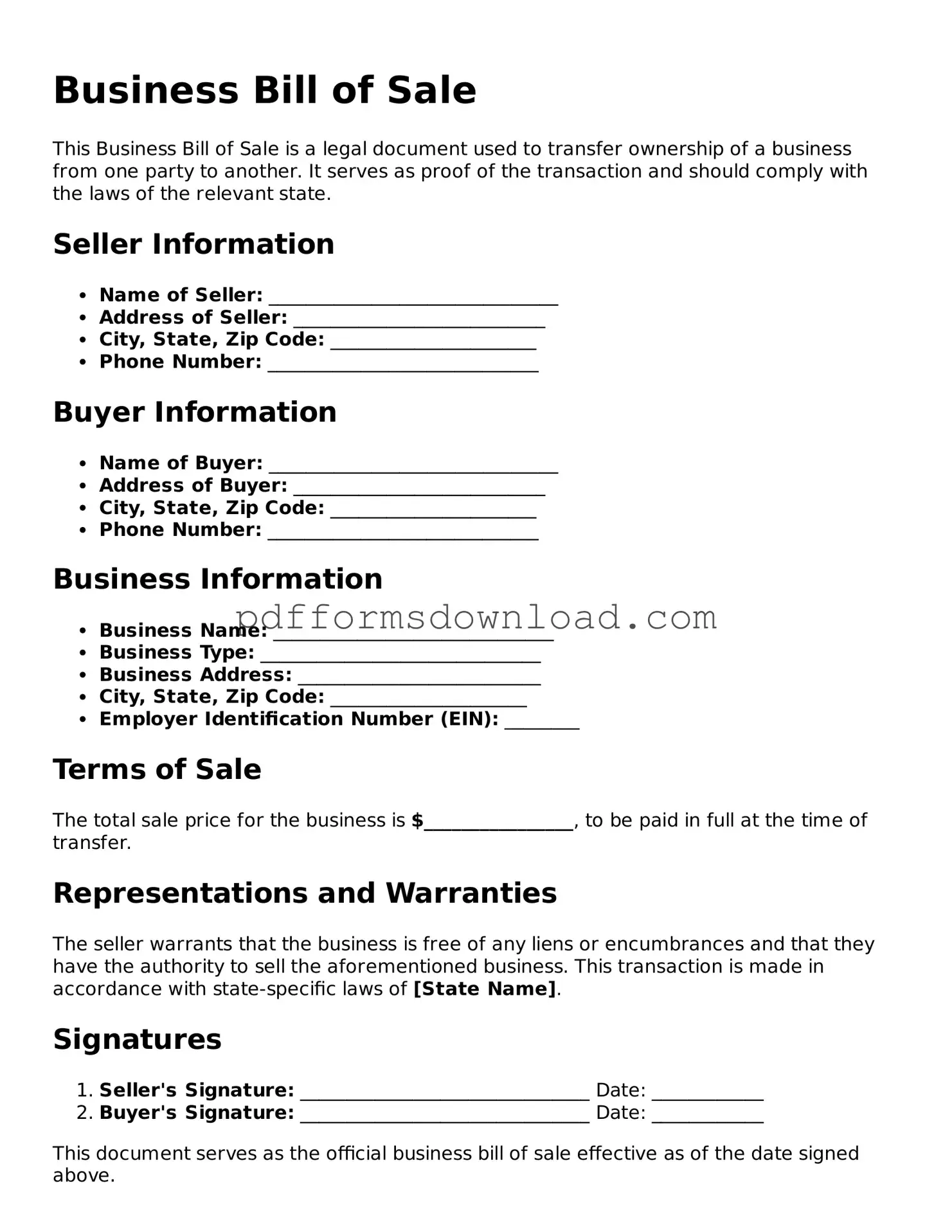

A Business Bill of Sale is a legal document that records the transfer of ownership of a business or its assets from one party to another. It serves as proof of the transaction and outlines the details of the sale, including the parties involved, the items being sold, and the sale price. This document is essential for both the seller and the buyer to ensure clarity and protect their rights during the transaction.

When do I need a Business Bill of Sale?

You need a Business Bill of Sale when you are selling or buying a business or its assets. This includes equipment, inventory, or intellectual property. Having this document is crucial for formalizing the transaction and can be important for tax purposes and future legal reference.

What information should be included in a Business Bill of Sale?

A comprehensive Business Bill of Sale should include the names and addresses of both the seller and the buyer, a detailed description of the business or assets being sold, the sale price, and the date of the transaction. Additionally, any terms or conditions related to the sale should be clearly outlined to avoid misunderstandings.

Is a Business Bill of Sale legally binding?

Yes, a Business Bill of Sale is legally binding as long as it is properly executed. This means that both parties must sign the document, and it should include all necessary information. Once signed, it serves as a formal agreement that can be enforced in court if necessary.

Do I need a notary for a Business Bill of Sale?

While it is not always required to have a Business Bill of Sale notarized, doing so can add an extra layer of authenticity and protection. A notary public verifies the identities of the parties involved and ensures that they are signing the document willingly. This can be particularly useful if disputes arise in the future.

Can I use a generic Bill of Sale template for my business sale?

Using a generic Bill of Sale template can be a starting point, but it is advisable to tailor the document to fit the specific details of your transaction. Each sale may have unique aspects that need to be addressed. Consulting with a legal professional can help ensure that all necessary elements are included and that the document complies with local laws.

What happens if the seller has outstanding debts?

If the seller has outstanding debts, it can complicate the sale. Creditors may have claims against the business or its assets. Buyers should conduct due diligence to understand any potential liabilities before finalizing the sale. It may be wise to include a clause in the Bill of Sale that addresses the responsibility for debts and liabilities.

How does a Business Bill of Sale affect taxes?

A Business Bill of Sale can have tax implications for both the seller and the buyer. The seller may need to report the sale as income, while the buyer may be able to deduct certain expenses related to the purchase. It is important to consult with a tax professional to understand how the sale will impact your tax situation.

What should I do after signing the Business Bill of Sale?

After signing the Business Bill of Sale, both parties should keep copies for their records. The buyer should also ensure that any necessary changes are made to business licenses, permits, or registrations. It may be beneficial to consult with an attorney to ensure all legal requirements are met following the sale.

Can a Business Bill of Sale be contested?

Yes, a Business Bill of Sale can be contested under certain circumstances. If one party believes the sale was not conducted fairly or if there was fraud involved, they may seek to contest the agreement. Having a well-drafted Bill of Sale that clearly outlines the terms can help minimize the risk of disputes.