Download Business Credit Application Template

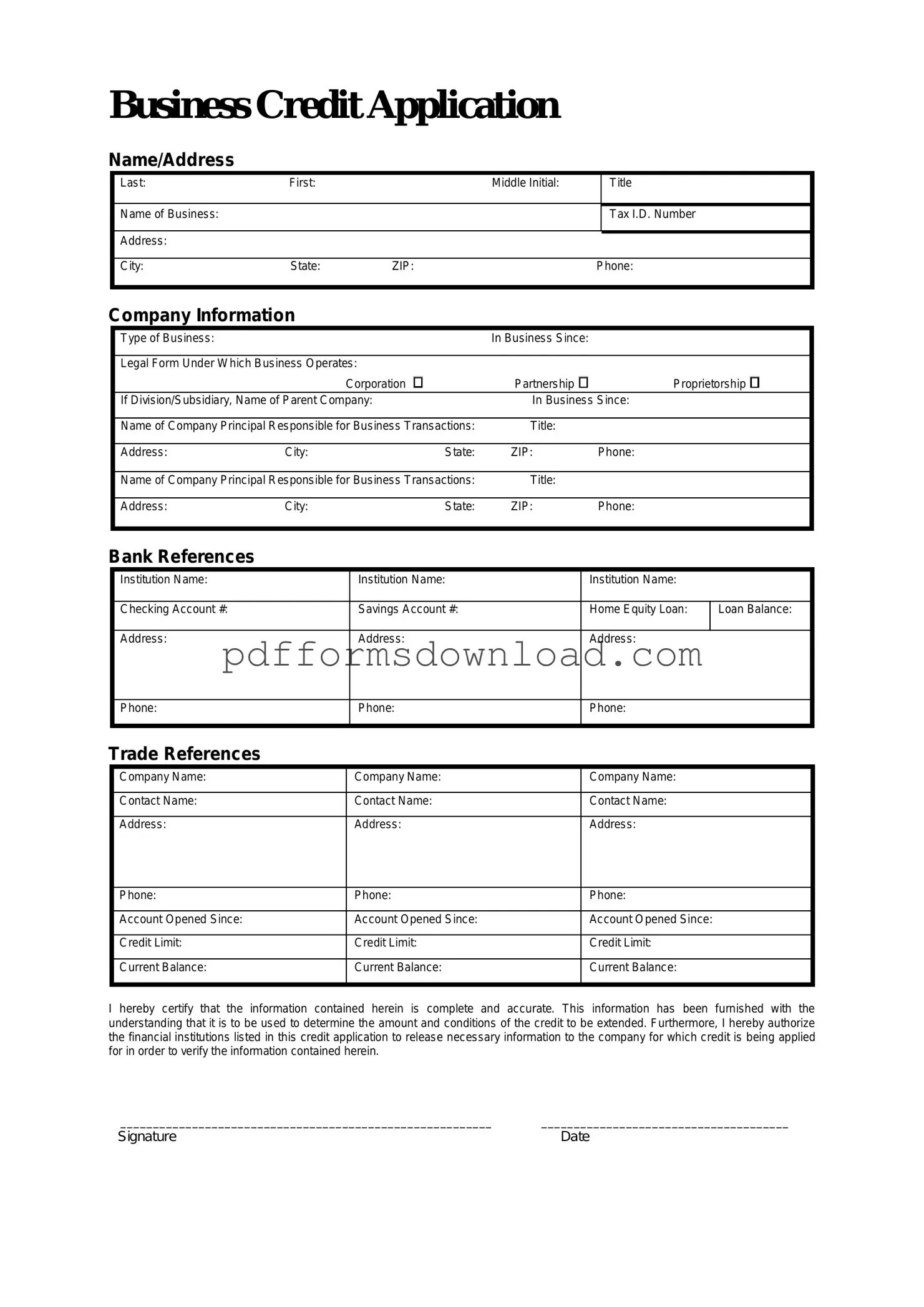

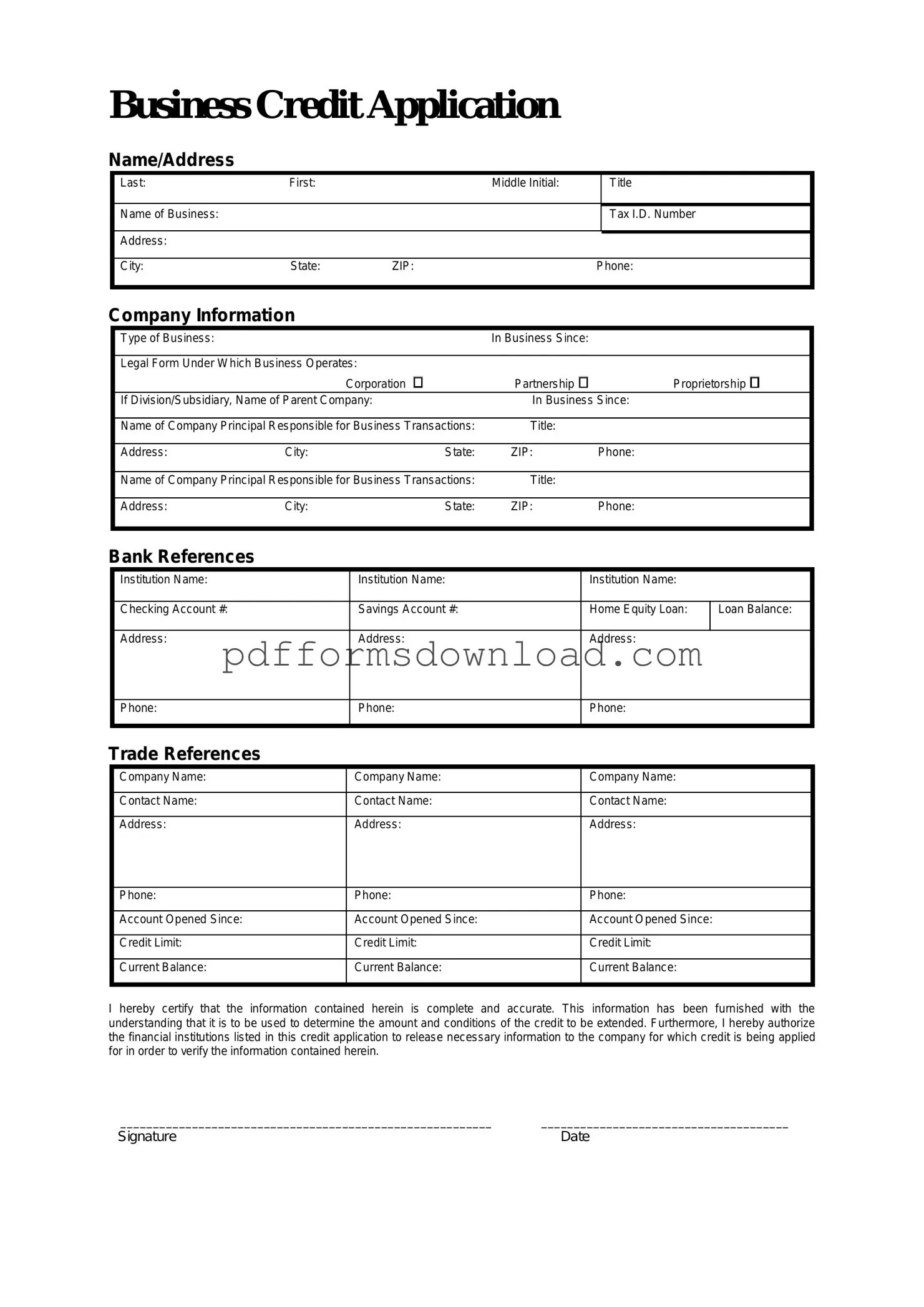

A Business Credit Application form is a document that businesses complete to request credit from suppliers or lenders. This form collects essential information about the business's financial history and creditworthiness. Understanding how to fill out this form accurately can streamline the credit approval process, so be sure to take the time to complete it carefully.

Ready to get started? Fill out the form by clicking the button below.

Make This Document Now

Download Business Credit Application Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Business Credit Application online — edit, save, and download easily.