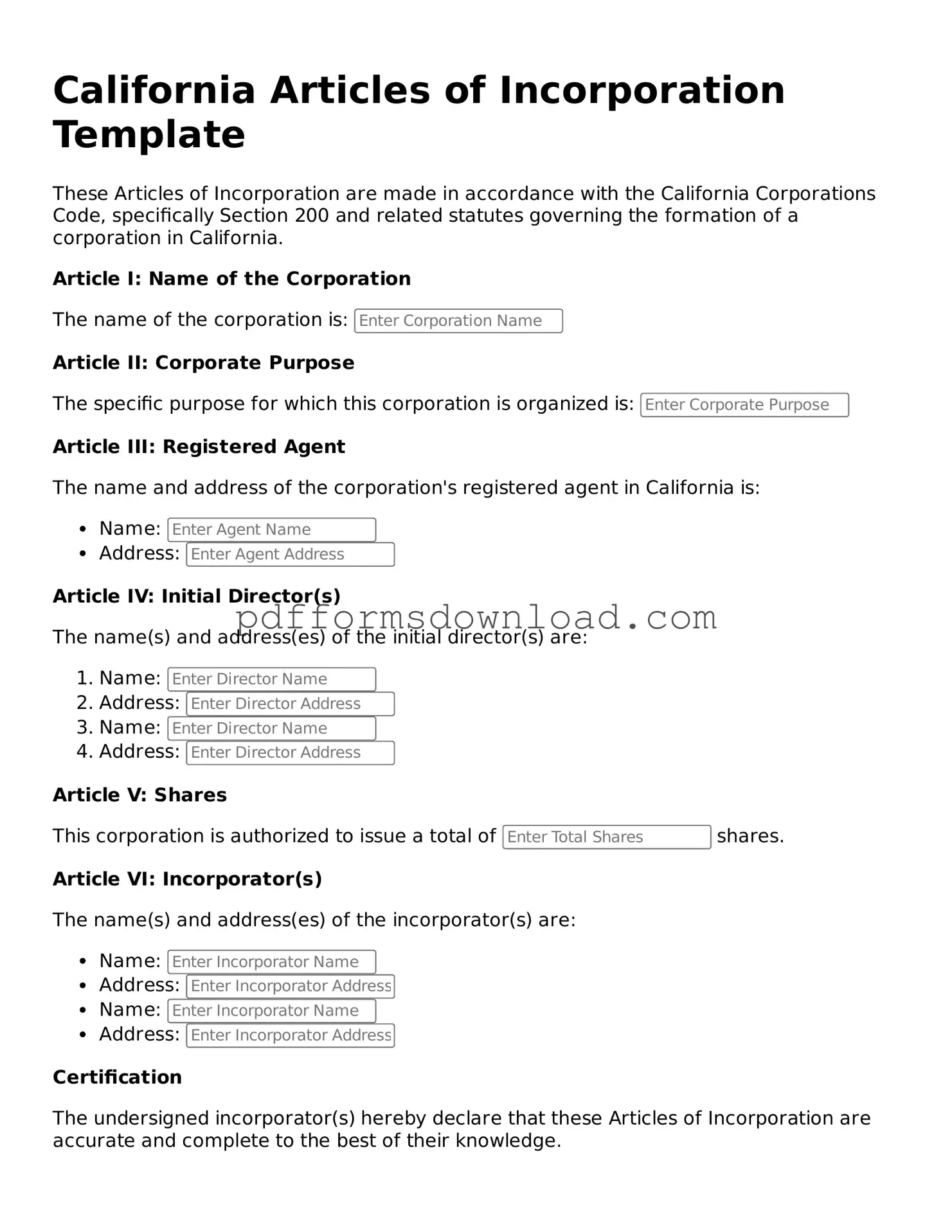

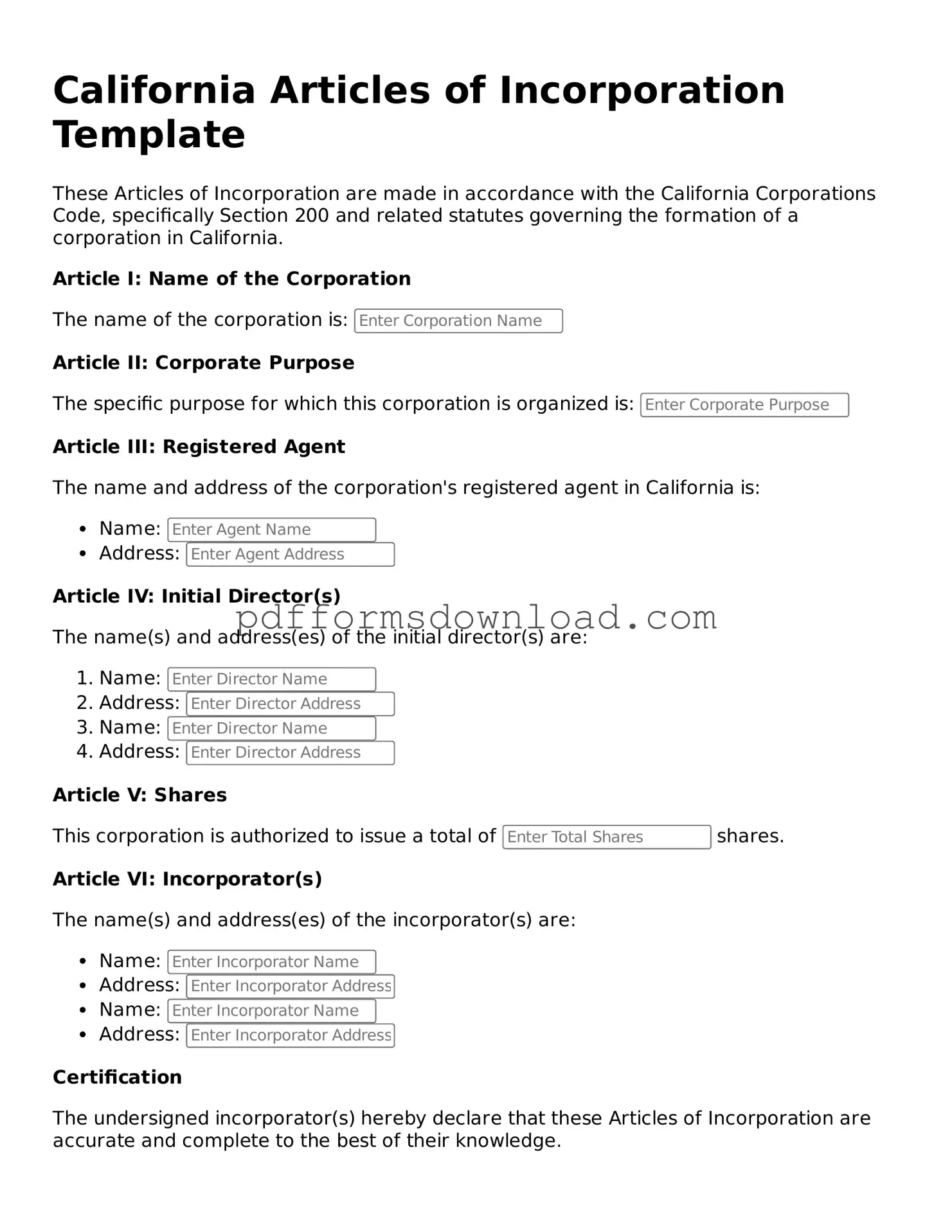

What is the California Articles of Incorporation form?

The California Articles of Incorporation form is a legal document that establishes a corporation in the state of California. It serves as the foundation for your business entity and outlines essential details such as the corporation's name, purpose, and address. Filing this form is a crucial step in the process of forming a corporation, as it officially registers your business with the state.

Who needs to file the Articles of Incorporation?

Anyone looking to create a corporation in California must file the Articles of Incorporation. This includes individuals or groups planning to start a for-profit corporation, a nonprofit organization, or a professional corporation. If you intend to limit your personal liability and establish a formal business structure, this form is necessary.

What information is required on the form?

The Articles of Incorporation form requires several key pieces of information. You will need to provide the name of your corporation, the purpose of the business, the address of the corporation's initial office, and the name and address of the agent for service of process. Additionally, you may need to include details about the number of shares the corporation is authorized to issue, depending on the type of corporation you are forming.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation, you can either submit the form online through the California Secretary of State's website or send a paper copy via mail. If you choose to file online, follow the provided instructions for completing the form and make sure to pay the required filing fee. For mail submissions, print the completed form, include the payment, and send it to the appropriate address listed on the Secretary of State's website.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation varies based on the type of corporation you are forming. As of October 2023, the fee for filing a standard for-profit corporation is typically around $100. Nonprofit corporations may have different fees, so it's essential to check the California Secretary of State's website for the most current information and any additional fees that may apply.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Generally, if you file online, you may receive confirmation of your filing within a few business days. Mail submissions may take longer, often up to several weeks, depending on the volume of applications being processed. If you need expedited service, there are options available for an additional fee.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, your corporation is officially formed. You will receive a stamped copy of the Articles from the Secretary of State, which serves as proof of your corporation's existence. Following this, you should consider obtaining an Employer Identification Number (EIN) from the IRS, setting up a corporate bank account, and complying with any local business licenses or permits required to operate your business legally.

Can I amend the Articles of Incorporation later?

Yes, you can amend the Articles of Incorporation after they have been filed. If there are changes to your corporation's name, purpose, or other details, you must file an amendment with the California Secretary of State. This process involves submitting the appropriate form and paying any applicable fees. Keeping your Articles of Incorporation up to date is essential for maintaining compliance with state regulations.