What is a California Deed form?

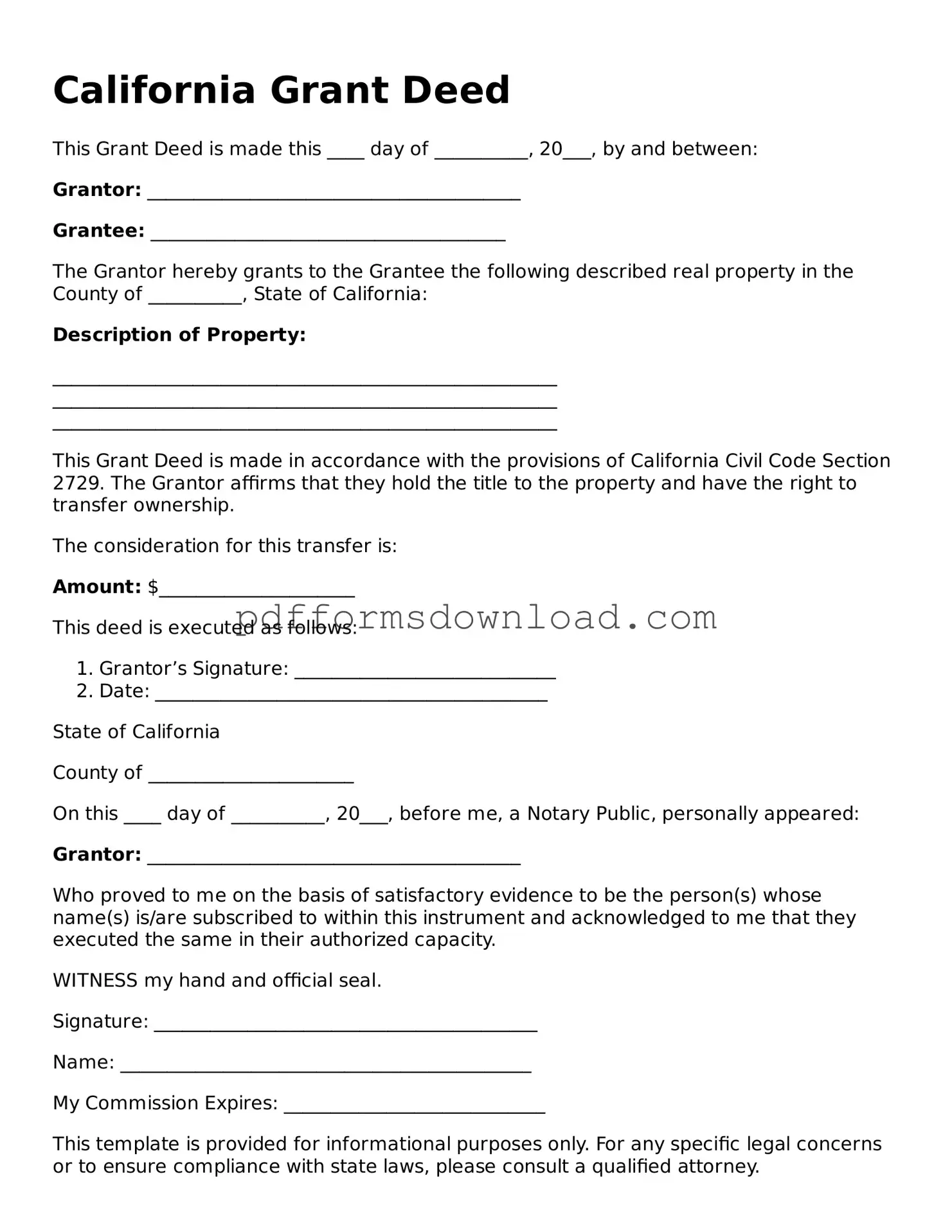

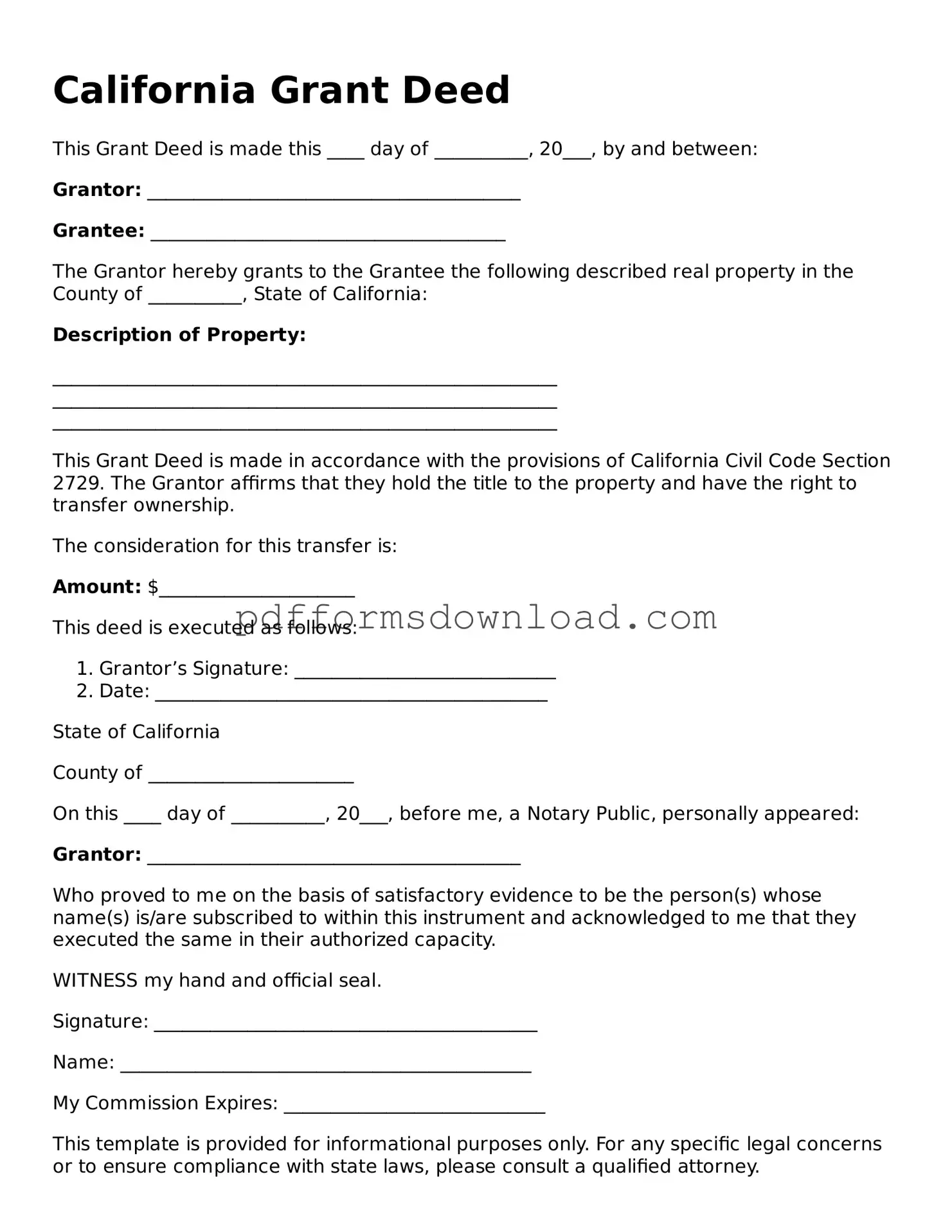

A California Deed form is a legal document used to transfer ownership of real property in the state of California. It outlines the details of the transaction, including the parties involved, the property description, and any conditions or restrictions related to the transfer.

What types of Deeds are available in California?

California recognizes several types of Deeds, including Grant Deeds, Quitclaim Deeds, and Warranty Deeds. Each type serves a different purpose. For example, a Grant Deed provides certain guarantees about the property, while a Quitclaim Deed transfers whatever interest the grantor has without any warranties.

Do I need to notarize a California Deed?

Yes, a California Deed must be notarized to be legally valid. The notarization process helps ensure that the signatures on the document are authentic and that the parties involved have willingly entered into the agreement.

How do I complete a California Deed form?

To complete a California Deed form, you need to fill in the required information, including the names of the grantor and grantee, a legal description of the property, and any terms of the transfer. Ensure that all parties sign the document in the presence of a notary.

Where do I file a California Deed?

A California Deed should be filed with the county recorder’s office in the county where the property is located. This filing officially records the transfer of ownership and makes it a matter of public record.

Is there a fee to file a California Deed?

Yes, there is typically a fee associated with filing a California Deed. The fee can vary by county, so it’s important to check with the local county recorder’s office for the exact amount and payment methods accepted.

Can I create my own California Deed form?

While it is possible to create your own California Deed form, it is highly recommended to use a standardized form or consult a legal professional. This ensures that all necessary legal requirements are met and reduces the risk of errors that could affect the validity of the transfer.

What happens if I don’t file the Deed?

If you do not file the Deed, the transfer of ownership may not be recognized legally. This could lead to complications in proving ownership, selling the property in the future, or dealing with property taxes.

Can a California Deed be revoked or changed?

Once a California Deed is executed and recorded, it generally cannot be revoked or changed unilaterally. However, the parties involved may agree to execute a new Deed to modify the terms or revert the transfer, depending on the circumstances.

What should I do if I have questions about my California Deed?

If you have questions about your California Deed, it’s best to consult with a real estate attorney or a professional familiar with property law in California. They can provide guidance tailored to your specific situation and help you navigate any complexities.