What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This type of deed is typically used when a property owner wishes to give their property as a gift to a family member or friend. It is important to note that the transfer is done voluntarily and without consideration, meaning the recipient does not pay for the property.

How do I complete a Gift Deed in California?

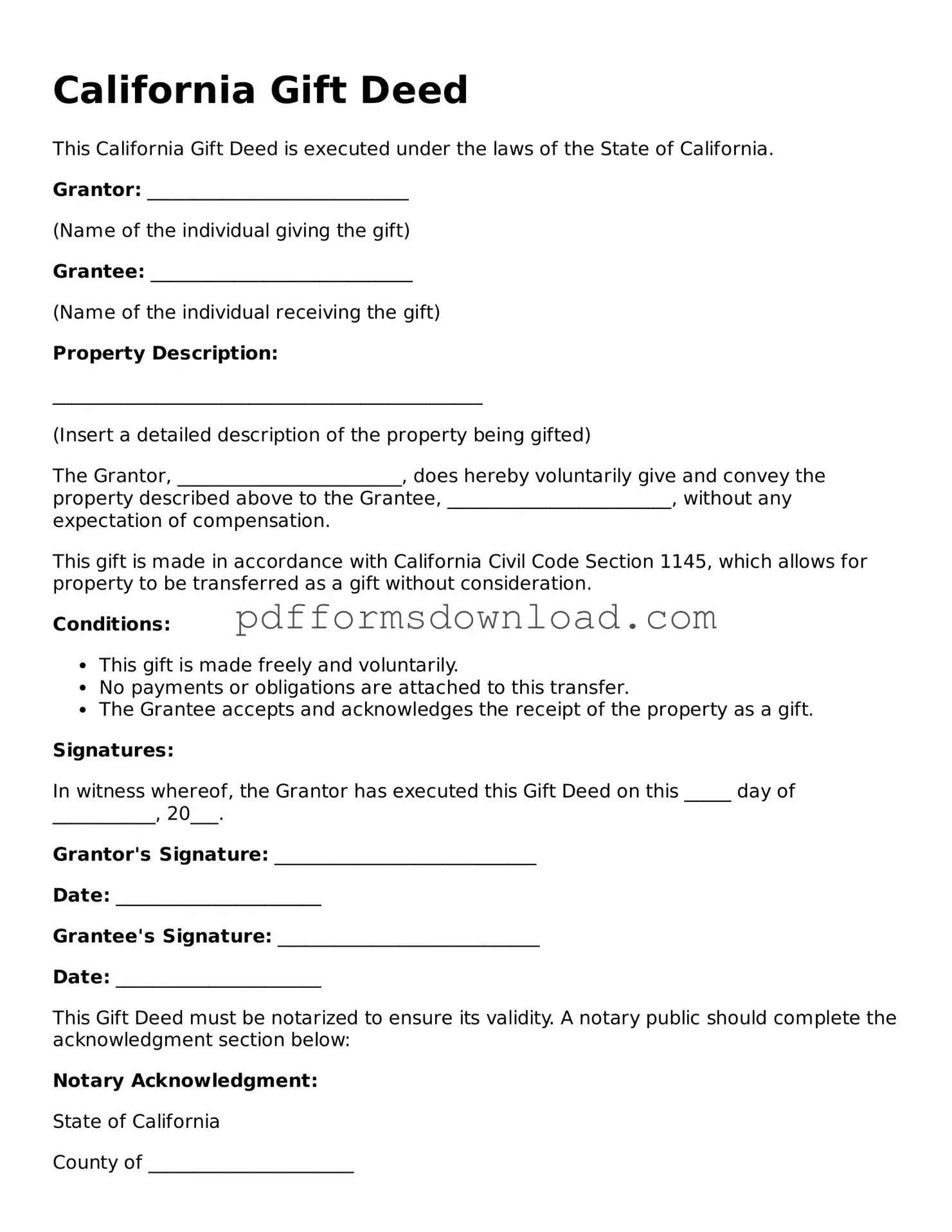

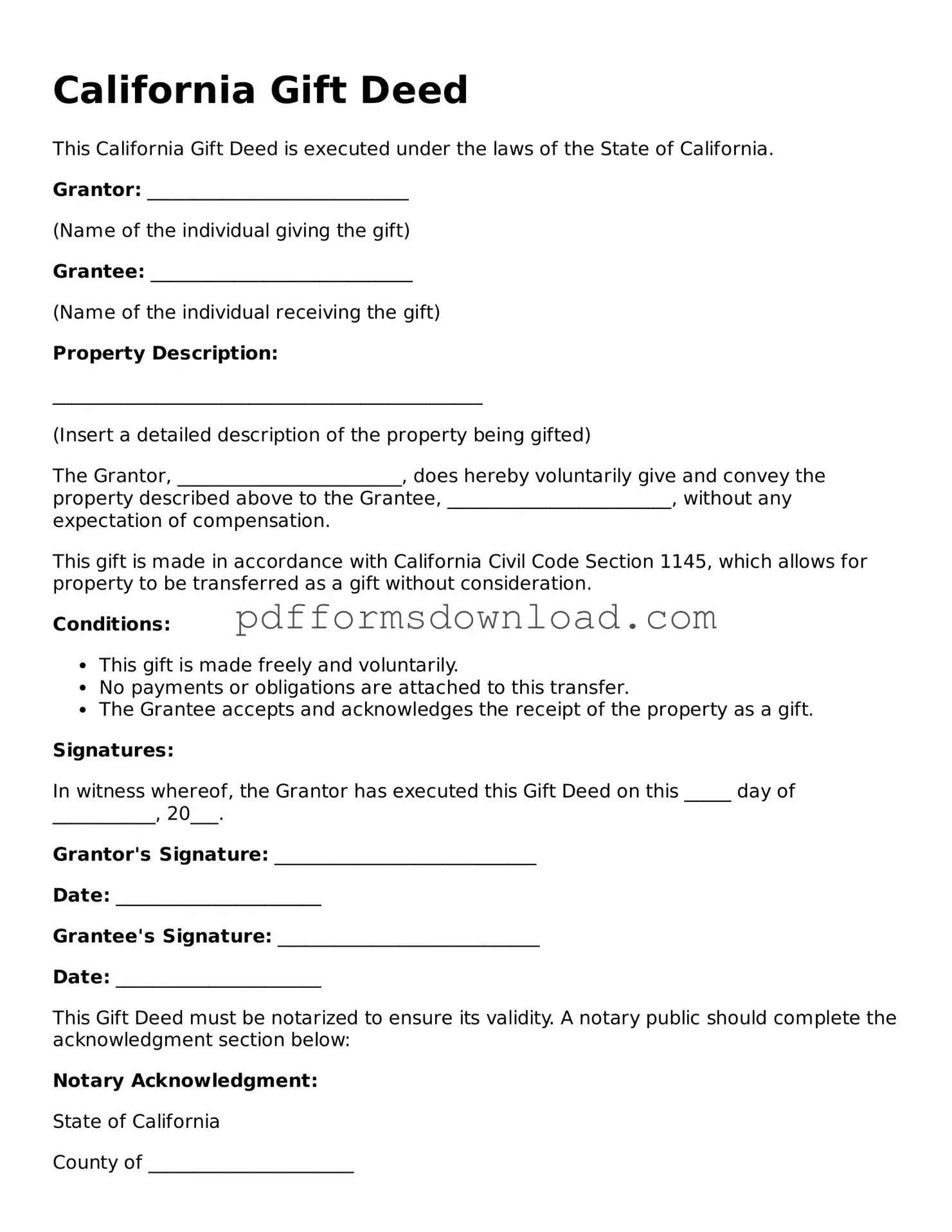

To complete a Gift Deed, you need to provide specific information, including the names of the giver (grantor) and the recipient (grantee), a legal description of the property, and the date of the gift. It is essential to ensure that the deed is signed by the grantor in front of a notary public. After completing the deed, you must record it with the county recorder's office where the property is located to make the transfer official.

Are there any tax implications when using a Gift Deed?

Yes, there may be tax implications. While the recipient of the gift may not have to pay income tax on the value of the property received, the giver may need to consider gift tax rules. In California, gifts above a certain value may require the filing of a gift tax return. It is advisable to consult a tax professional to understand the specific implications for your situation.

Can a Gift Deed be revoked?

Once a Gift Deed is executed and recorded, it generally cannot be revoked. The transfer of property is considered complete. However, if the grantor wishes to retain some control over the property, they may consider other options, such as a life estate. It is crucial to understand that once the gift is made, the property belongs to the recipient.

What happens if the grantor dies after executing a Gift Deed?

If the grantor dies after executing a Gift Deed, the property remains with the recipient. The gift is considered complete, and the property does not become part of the grantor's estate. This can help avoid probate for the gifted property, but it is essential to ensure that the deed is properly executed and recorded.

Can I use a Gift Deed for any type of property?

A Gift Deed can be used for various types of real property, including residential homes, land, and commercial properties. However, it cannot be used for personal property, such as vehicles or jewelry. Ensure that the property you wish to transfer is real estate and that you have a clear title to it before proceeding.

Do I need an attorney to create a Gift Deed?

While it is not legally required to have an attorney to create a Gift Deed, consulting with one can be beneficial. An attorney can help ensure that the deed is properly drafted, executed, and recorded. They can also advise on any potential tax implications and assist in addressing any specific concerns related to the property transfer.