What is a California Loan Agreement?

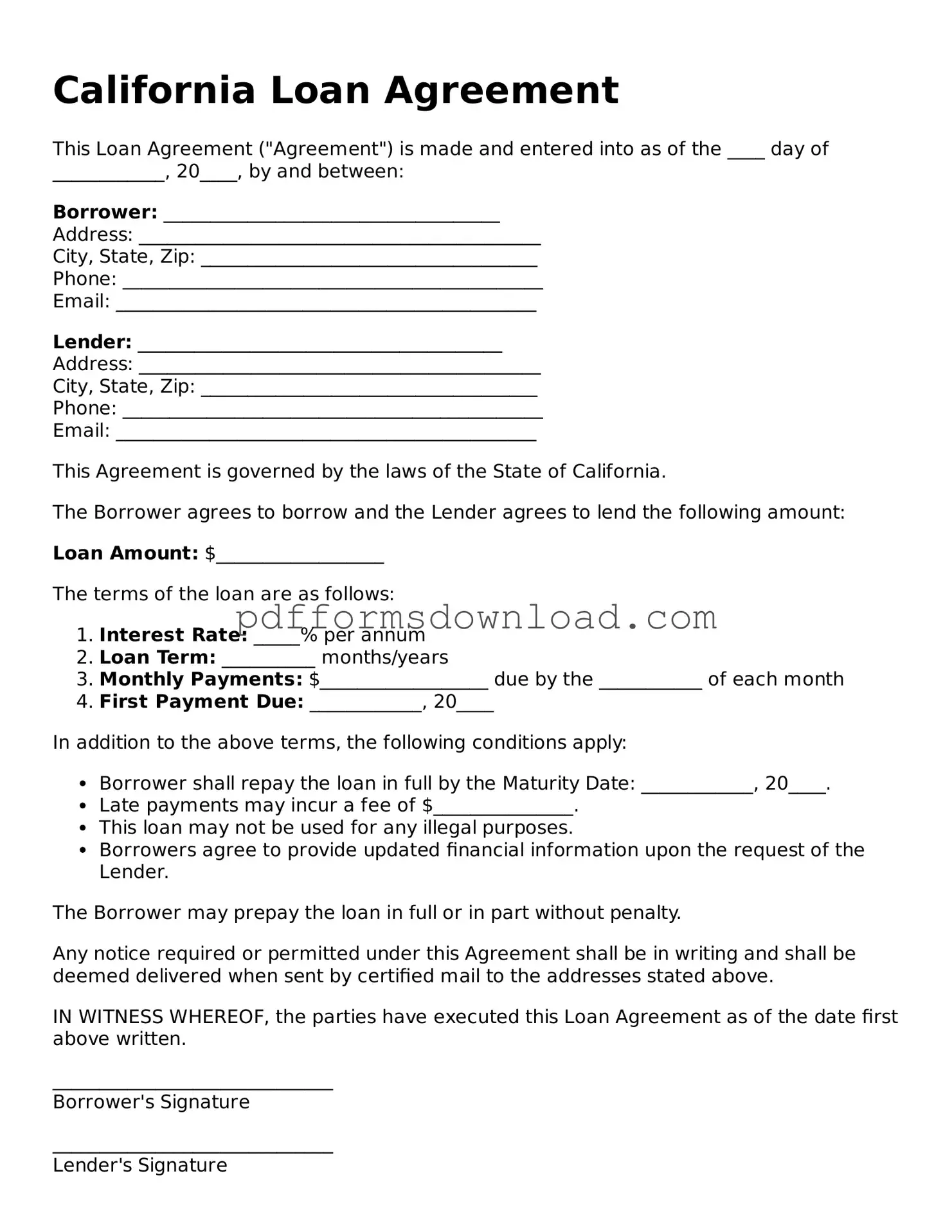

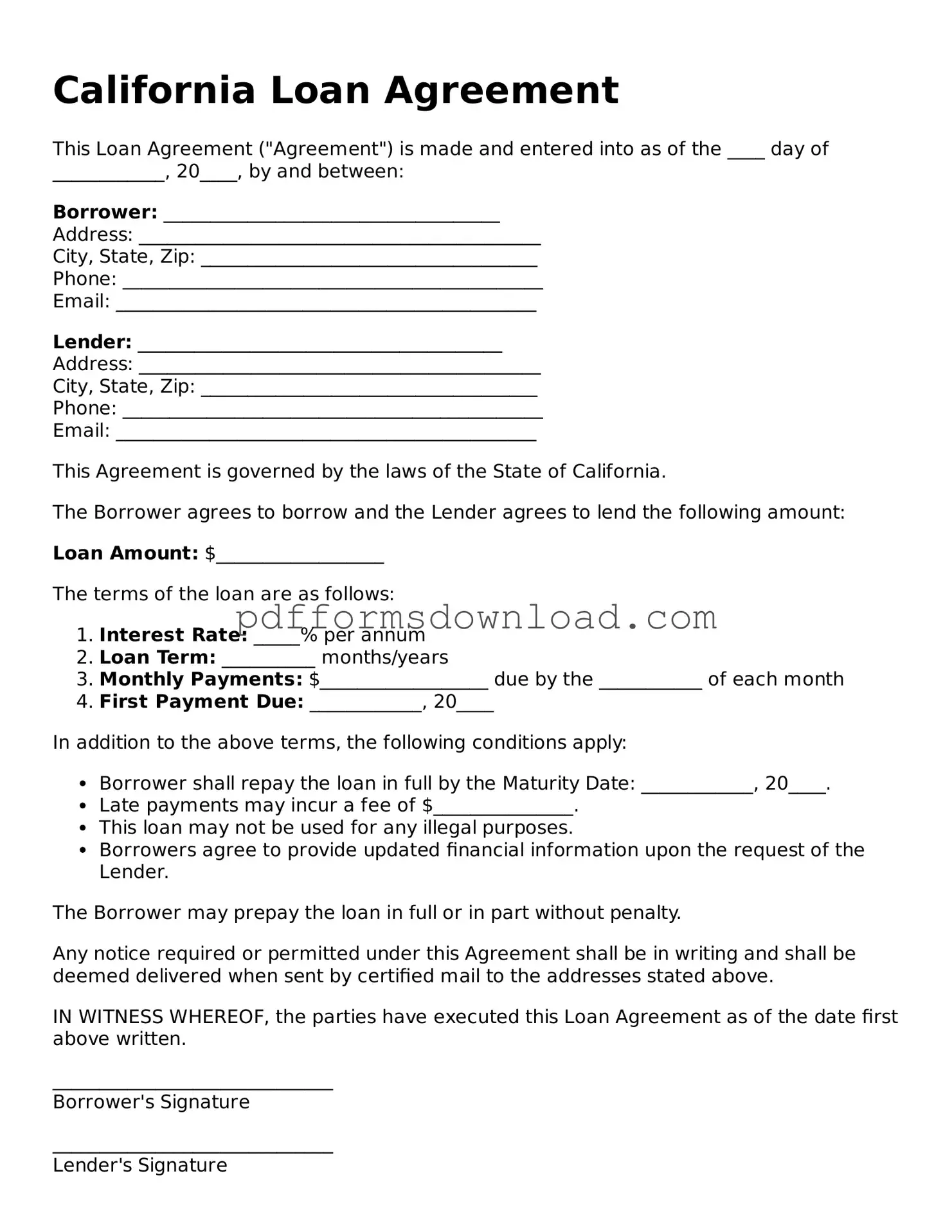

A California Loan Agreement is a legal document outlining the terms and conditions of a loan between a lender and a borrower. It specifies details such as the loan amount, interest rate, repayment schedule, and any collateral involved. This document helps protect the rights of both parties and ensures clarity in the loan process.

Who can use a California Loan Agreement?

Any individual or business in California can use a Loan Agreement. This includes personal loans between friends or family members, as well as formal loans between businesses or financial institutions. It is important that both parties understand the terms before signing.

What are the key components of a California Loan Agreement?

Key components typically include the loan amount, interest rate, repayment terms, due dates, and any fees associated with the loan. Additionally, the agreement may outline the consequences of defaulting on the loan and any collateral that secures the loan.

Is a California Loan Agreement legally binding?

Yes, once both parties sign the Loan Agreement, it becomes a legally binding contract. This means that both the lender and borrower are obligated to adhere to the terms outlined in the document. If either party fails to comply, legal action may be pursued.

Do I need a lawyer to create a California Loan Agreement?

While it is not legally required to have a lawyer draft a Loan Agreement, it is advisable to seek legal counsel if you have questions or concerns. A lawyer can help ensure that the agreement complies with California laws and meets the specific needs of both parties.

Can I modify a California Loan Agreement after it is signed?

Yes, a Loan Agreement can be modified after it is signed, but both parties must agree to the changes. It is recommended to document any modifications in writing and have both parties sign the amended agreement to avoid future disputes.

What happens if I default on a loan outlined in the California Loan Agreement?

If a borrower defaults on the loan, the lender may take legal action to recover the owed amount. This could include pursuing collections or initiating a lawsuit. The specific consequences of defaulting should be clearly stated in the Loan Agreement.

How can I ensure my California Loan Agreement is enforceable?

To ensure enforceability, both parties should fully understand the terms before signing. The agreement should be clear, concise, and free of ambiguous language. Additionally, it is important to keep a signed copy of the agreement for your records.