What is a Power of Attorney in California?

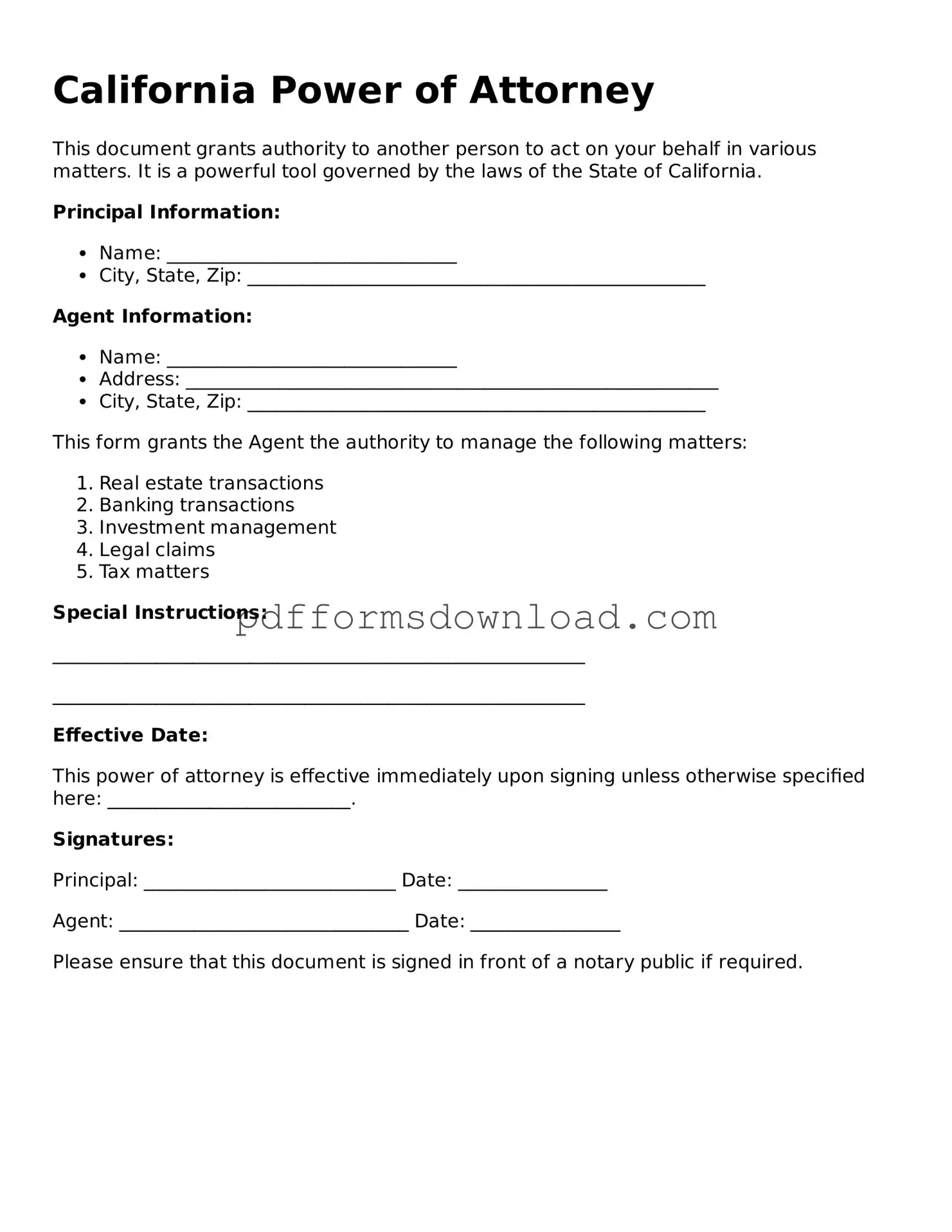

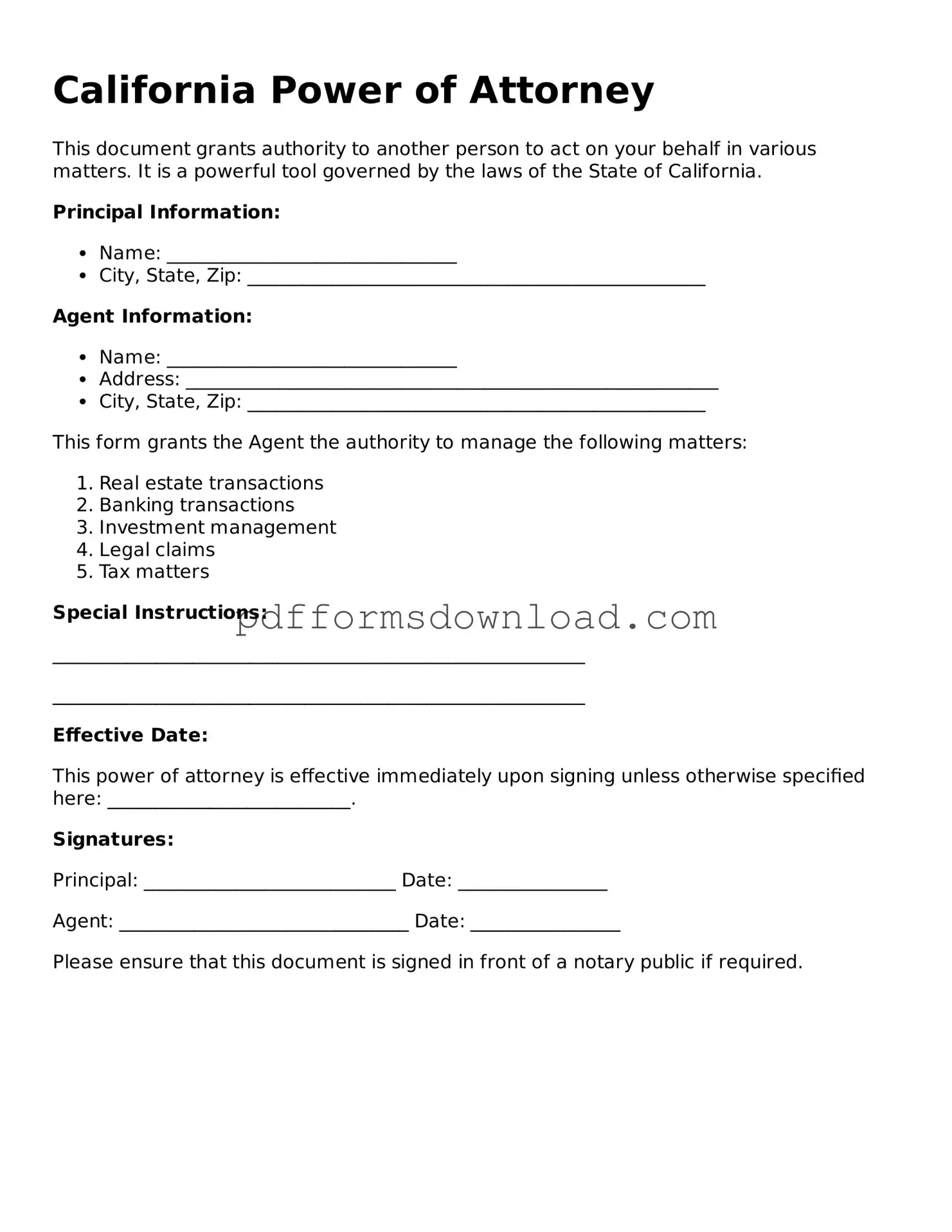

A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another person in legal or financial matters. In California, this document can be customized to give broad or limited powers, depending on the needs of the individual granting the authority. It is an important tool for ensuring that your affairs are managed according to your wishes if you become unable to handle them yourself.

Who can create a Power of Attorney in California?

Any adult who is mentally competent can create a Power of Attorney in California. This means you must be able to understand the nature and consequences of the decisions you are making. If you are under 18 or declared mentally incompetent by a court, you cannot create a POA.

What types of Powers of Attorney are available in California?

California recognizes several types of Powers of Attorney. The most common include a General Power of Attorney, which grants broad powers to the agent, and a Limited Power of Attorney, which restricts the agent's authority to specific tasks or time periods. Additionally, there is a Durable Power of Attorney, which remains effective even if the principal becomes incapacitated, and a Springing Power of Attorney, which only takes effect under certain conditions, such as incapacity.

How do I choose an agent for my Power of Attorney?

Choosing an agent is a crucial decision. Your agent should be someone you trust completely, as they will have the authority to make significant decisions on your behalf. Consider their reliability, financial acumen, and willingness to take on this responsibility. It’s also wise to discuss your wishes with them beforehand to ensure they are comfortable and aligned with your goals.

Do I need to notarize my Power of Attorney in California?

Yes, in California, a Power of Attorney must be signed by the principal and either notarized or signed by two witnesses. Notarization adds an extra layer of authenticity and can help prevent disputes about the validity of the document later on.

Can I revoke my Power of Attorney once it is created?

Absolutely. You can revoke a Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any relevant institutions or individuals that may have relied on the original POA. It’s important to keep a record of the revocation to avoid any confusion in the future.

What happens if I do not have a Power of Attorney and become incapacitated?

If you become incapacitated without a Power of Attorney in place, your loved ones may need to go through a court process to establish a conservatorship. This can be time-consuming, costly, and may not reflect your wishes. Having a Power of Attorney allows you to designate someone you trust to make decisions on your behalf, helping to avoid this situation.