What is a prenuptial agreement in California?

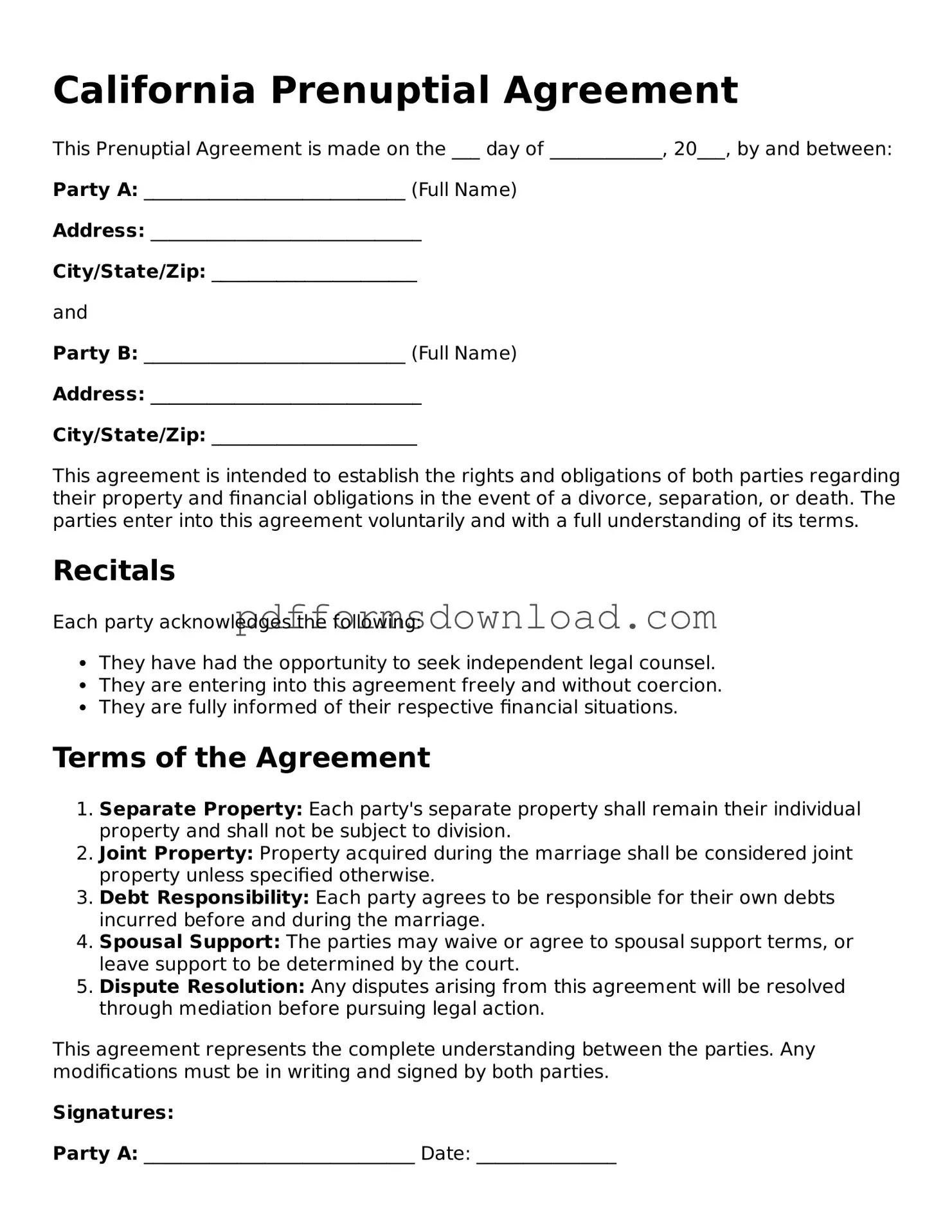

A prenuptial agreement, often called a prenup, is a legal document that a couple signs before they get married. This agreement outlines how assets and debts will be divided in the event of a divorce or separation. In California, prenuptial agreements are governed by the Uniform Premarital Agreement Act, which provides specific guidelines to ensure that the agreement is enforceable and fair to both parties.

Why should I consider a prenuptial agreement?

Many couples opt for a prenuptial agreement to protect their individual assets and clarify financial responsibilities. It can also help prevent misunderstandings about finances during the marriage. For individuals entering a second marriage or those with significant assets, a prenup can safeguard personal property and ensure that children from previous relationships are taken care of.

What should be included in a California prenuptial agreement?

A comprehensive prenuptial agreement typically includes provisions regarding the division of property, spousal support, and debt responsibilities. Couples can also address how future income and assets will be treated. It’s important to be clear and specific to avoid confusion or disputes later on.

How is a prenuptial agreement enforced in California?

For a prenuptial agreement to be enforceable in California, it must meet certain legal requirements. Both parties should fully disclose their assets and debts. The agreement must be in writing and signed voluntarily by both parties. It’s also advisable for each person to have independent legal counsel to ensure that their rights are protected and that they understand the terms of the agreement.

Can a prenuptial agreement be modified or revoked?

Yes, a prenuptial agreement can be modified or revoked after marriage. Both parties must agree to any changes, and these modifications should also be made in writing and signed by both individuals. It’s crucial to follow the same legal guidelines as the original agreement to ensure that any changes are enforceable.

What happens if we don’t have a prenuptial agreement?

If a couple does not have a prenuptial agreement, California law will determine how assets and debts are divided in the event of a divorce. California is a community property state, meaning that most assets acquired during the marriage are considered jointly owned and will be divided equally. Without a prenup, couples may face lengthy legal battles to determine the division of property.

Is a prenuptial agreement only for wealthy individuals?

No, prenuptial agreements are not just for wealthy individuals. They can benefit anyone who wants to clarify financial expectations and protect personal assets. Even couples with modest assets can find value in having a prenup, as it can help establish clear guidelines for financial matters and reduce potential conflicts in the future.