What is a California Promissory Note?

A California Promissory Note is a written agreement where one party promises to pay a specific amount of money to another party under agreed-upon terms. It outlines the loan amount, interest rate, repayment schedule, and any other conditions related to the loan.

Who can use a Promissory Note in California?

Any individual or business can use a Promissory Note in California. It is commonly used in personal loans, business loans, and real estate transactions. Both lenders and borrowers should be clear about the terms to avoid misunderstandings.

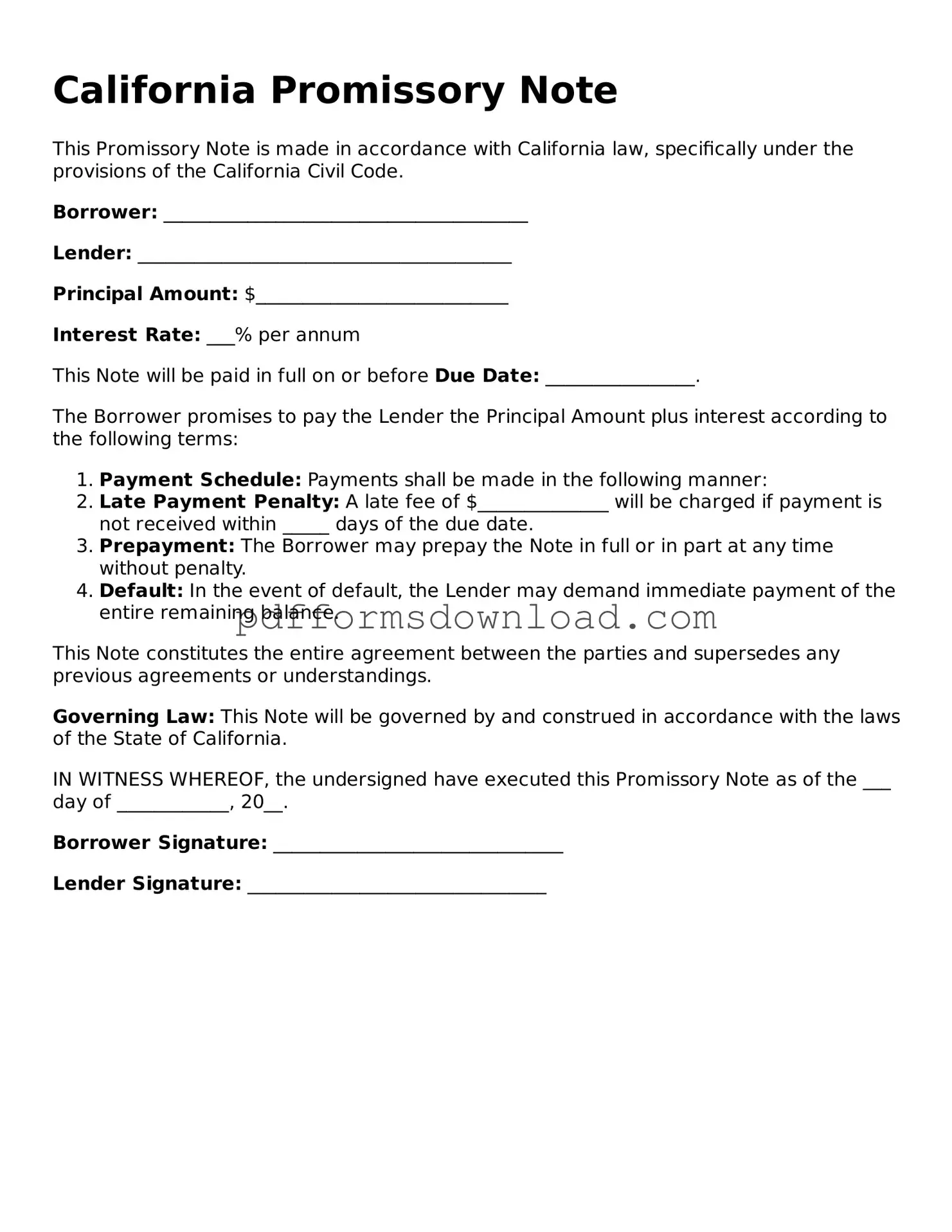

What are the key components of a California Promissory Note?

A typical Promissory Note includes the following key components: the names of the parties involved, the principal amount, the interest rate, the repayment schedule, any late fees, and the terms for default. It may also include clauses about prepayment and governing law.

Is a Promissory Note legally binding in California?

Yes, a Promissory Note is legally binding in California as long as it meets certain requirements. Both parties must agree to the terms, and the document must be signed. If properly executed, it can be enforced in court if necessary.

Do I need a lawyer to create a Promissory Note?

While it is not required to have a lawyer draft a Promissory Note, consulting one can be beneficial. A legal professional can ensure that the document complies with California laws and adequately protects your interests.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or pursuing other collection methods. The specific actions depend on the terms outlined in the Promissory Note.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement to avoid confusion later.

Is a witness or notarization required for a Promissory Note in California?

California law does not require a witness or notarization for a Promissory Note to be valid. However, having it notarized can provide an additional layer of security and help prove the authenticity of the signatures if disputes arise.

How long is a Promissory Note valid in California?

The validity of a Promissory Note depends on the terms set within it. Generally, the statute of limitations for enforcing a written contract in California is four years. After this period, the lender may lose the right to collect the debt.

Can a Promissory Note be used for business loans?

Absolutely. A Promissory Note is commonly used for business loans. It helps formalize the loan agreement between the lender and the business borrower, ensuring that both parties understand their obligations and rights.