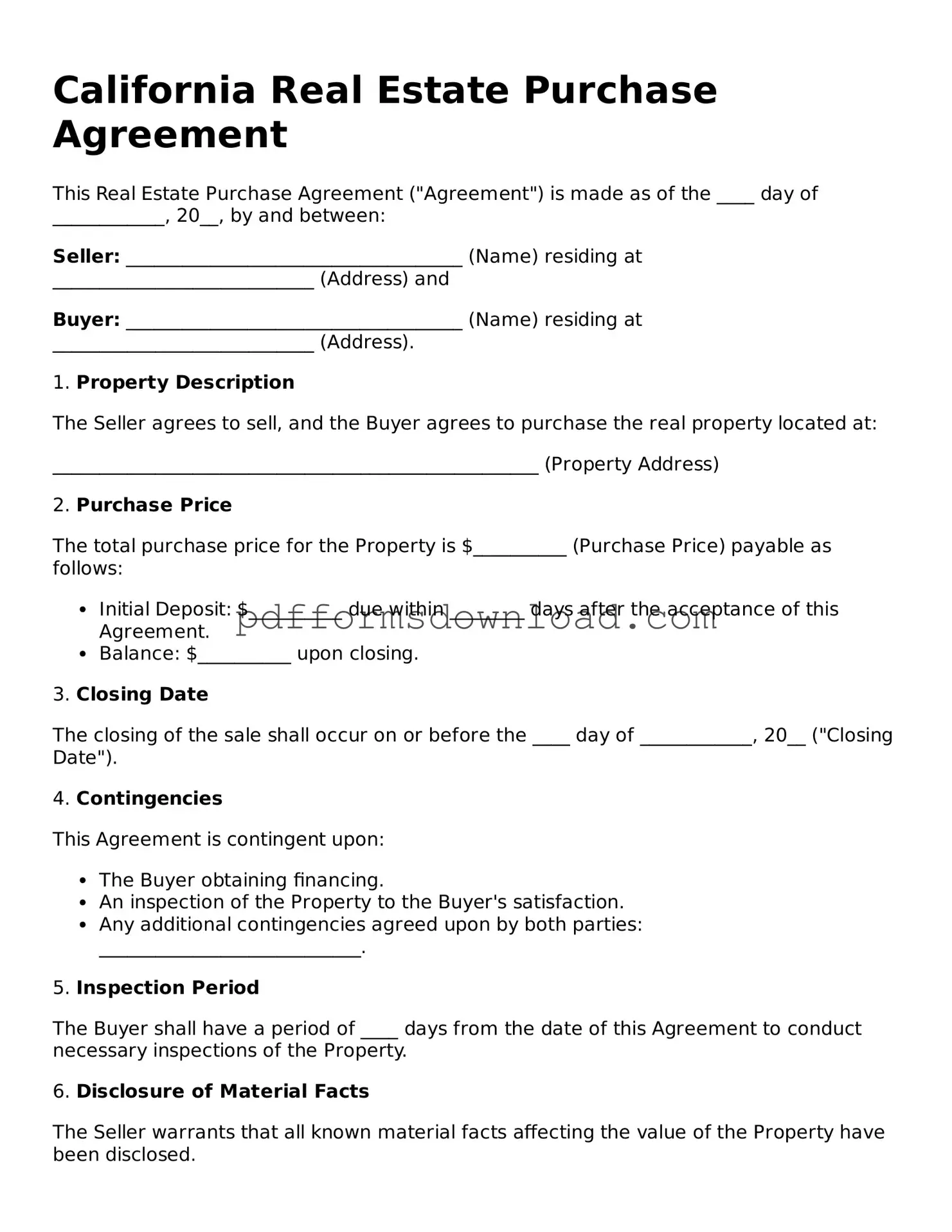

Printable California Real Estate Purchase Agreement Form

The California Real Estate Purchase Agreement form is a legal document used to outline the terms and conditions of a property sale in California. This agreement protects the interests of both buyers and sellers, ensuring a clear understanding of the transaction. For a smooth process, consider filling out the form by clicking the button below.

Make This Document Now

Printable California Real Estate Purchase Agreement Form

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Real Estate Purchase Agreement online — edit, save, and download easily.