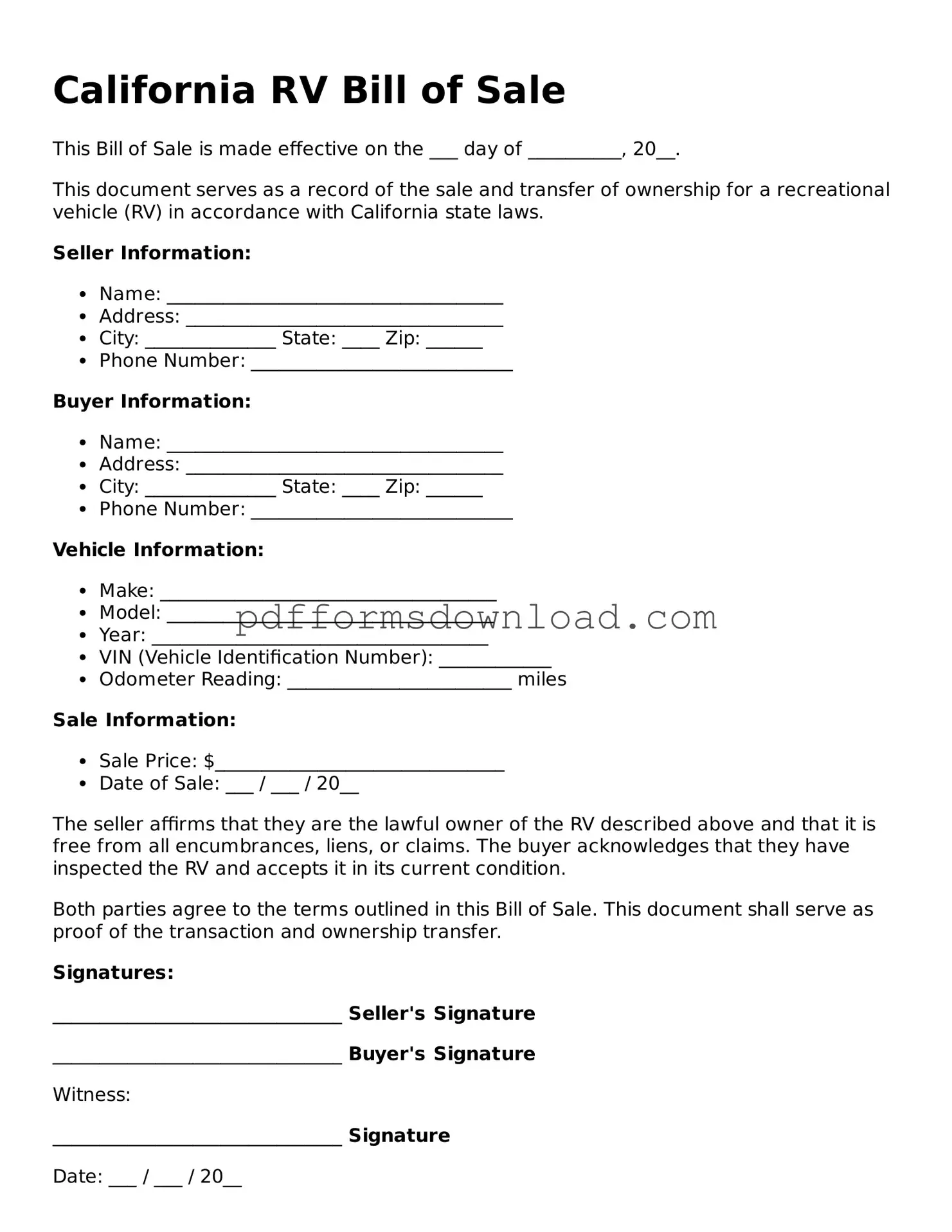

What is a California RV Bill of Sale form?

The California RV Bill of Sale form is a legal document that records the sale of a recreational vehicle (RV) between a seller and a buyer. This form serves as proof of ownership transfer and includes essential details about the transaction, such as the vehicle's make, model, year, and identification number.

Why is a Bill of Sale important?

A Bill of Sale is crucial for several reasons. It provides legal evidence of the transaction, protects both the buyer and seller in case of disputes, and is often required for registration purposes with the California Department of Motor Vehicles (DMV). Having this document can help clarify ownership and prevent potential misunderstandings.

What information is needed to complete the form?

To complete the California RV Bill of Sale form, you will need to provide specific details. This includes the names and addresses of both the buyer and seller, the RV's make, model, year, and vehicle identification number (VIN). You should also include the sale price and the date of the transaction.

Do I need a notary for the Bill of Sale?

In California, a notary is not required for the RV Bill of Sale to be valid. However, having the document notarized can add an extra layer of security and authenticity. It may also be beneficial if you plan to register the RV in another state or if the buyer requests it.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale as long as it contains all the necessary information. However, using a standardized form can help ensure that you include all required details and comply with state regulations. Many templates are available online that can guide you in drafting your document.

Is there a fee to file the Bill of Sale with the DMV?

There is no fee specifically for filing a Bill of Sale with the DMV in California. However, when registering the RV in the buyer's name, there may be registration fees, taxes, and other charges that apply. It is advisable to check the DMV's website or contact them directly for the most current fee schedule.

What should I do if I lose the Bill of Sale?

If you lose the Bill of Sale, it is important to take action quickly. You can request a duplicate from the seller if you are the buyer. If you are the seller, you may need to create a new Bill of Sale and have both parties sign it again. Keep in mind that having a copy is important for registration and future transactions.

How long should I keep a copy of the Bill of Sale?

It is recommended to keep a copy of the Bill of Sale for as long as you own the RV. Once you sell the vehicle, you should retain it for at least a few years in case any issues arise regarding the sale or ownership. This record can be useful for tax purposes or in case of disputes.

What if the RV has a lien on it?

If the RV has a lien, the seller must disclose this information to the buyer. The lienholder must be paid off before the sale can be completed. It is essential to ensure that the title is clear of any liens before finalizing the sale to avoid complications for the new owner.

Can I use the Bill of Sale for other types of vehicles?

While the California RV Bill of Sale form is specifically designed for recreational vehicles, you can often use similar forms for other types of vehicles, such as cars or motorcycles. However, it is advisable to use the appropriate form for each vehicle type to ensure compliance with state regulations.