What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner in California to transfer their real estate to a designated beneficiary upon their death. This deed enables the owner to retain full control of the property during their lifetime, avoiding probate and simplifying the transfer process for heirs after the owner's passing.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in California can use a Transfer-on-Death Deed. This includes homeowners, individuals holding title to land, or anyone with an interest in real estate. However, it is important to ensure that the property is not subject to any restrictions or liens that might complicate the transfer.

How do I create a Transfer-on-Death Deed?

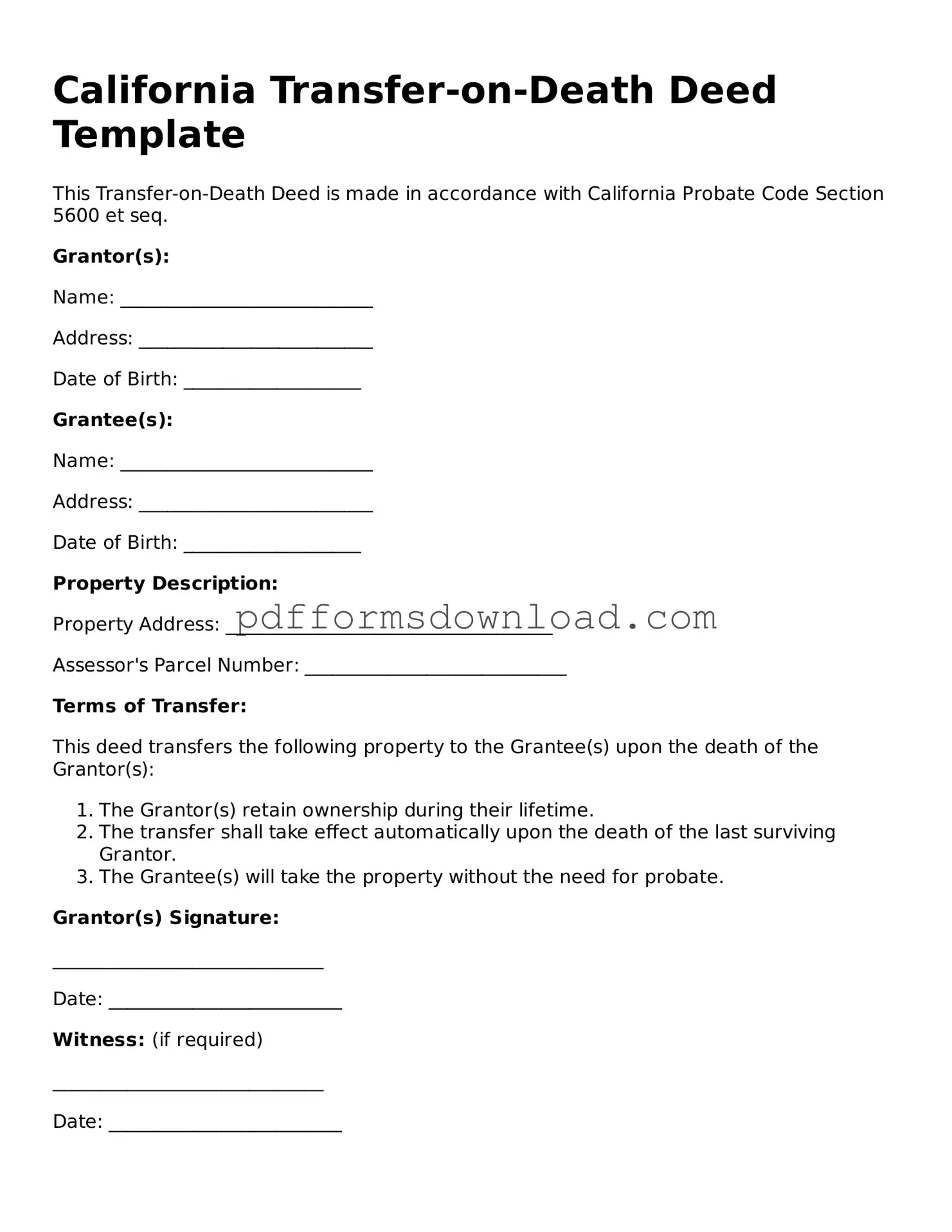

To create a Transfer-on-Death Deed, you must complete the appropriate form, which is available through various legal resources or county offices. The form requires details such as the property description, the owner's name, and the beneficiary's information. After filling it out, the deed must be signed and notarized before being recorded with the county recorder's office where the property is located.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time during your lifetime. To do this, you must create a new deed that either designates a different beneficiary or explicitly revokes the previous deed. This new deed must also be signed, notarized, and recorded with the county recorder's office to be effective.

What happens if the beneficiary dies before me?

If the designated beneficiary passes away before you, the Transfer-on-Death Deed will not automatically transfer the property to the beneficiary's heirs. Instead, the deed becomes void. To ensure that your property is transferred as you wish, you may want to designate alternate beneficiaries in the deed.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences. The property is transferred to the beneficiary without going through probate, which can help avoid some estate taxes. However, it is advisable to consult with a tax professional or estate planner to understand any potential tax implications for both you and your beneficiaries.

Is a Transfer-on-Death Deed the right choice for me?

A Transfer-on-Death Deed can be an effective estate planning tool, especially for those who wish to avoid probate and simplify the transfer of property. However, it may not be suitable for everyone. Factors such as the complexity of your estate, family dynamics, and specific wishes should be considered. Consulting with an estate planning attorney can help determine if this option aligns with your goals.