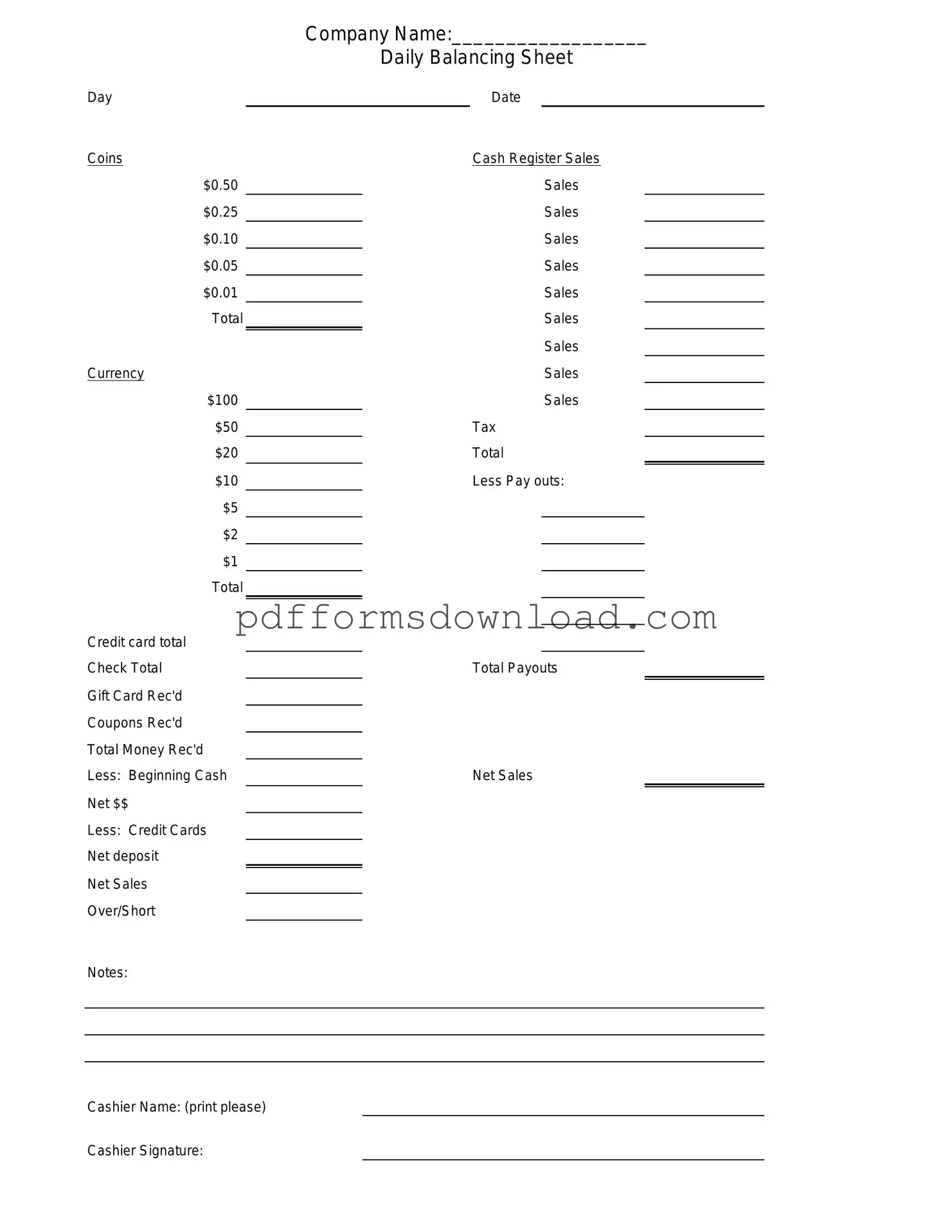

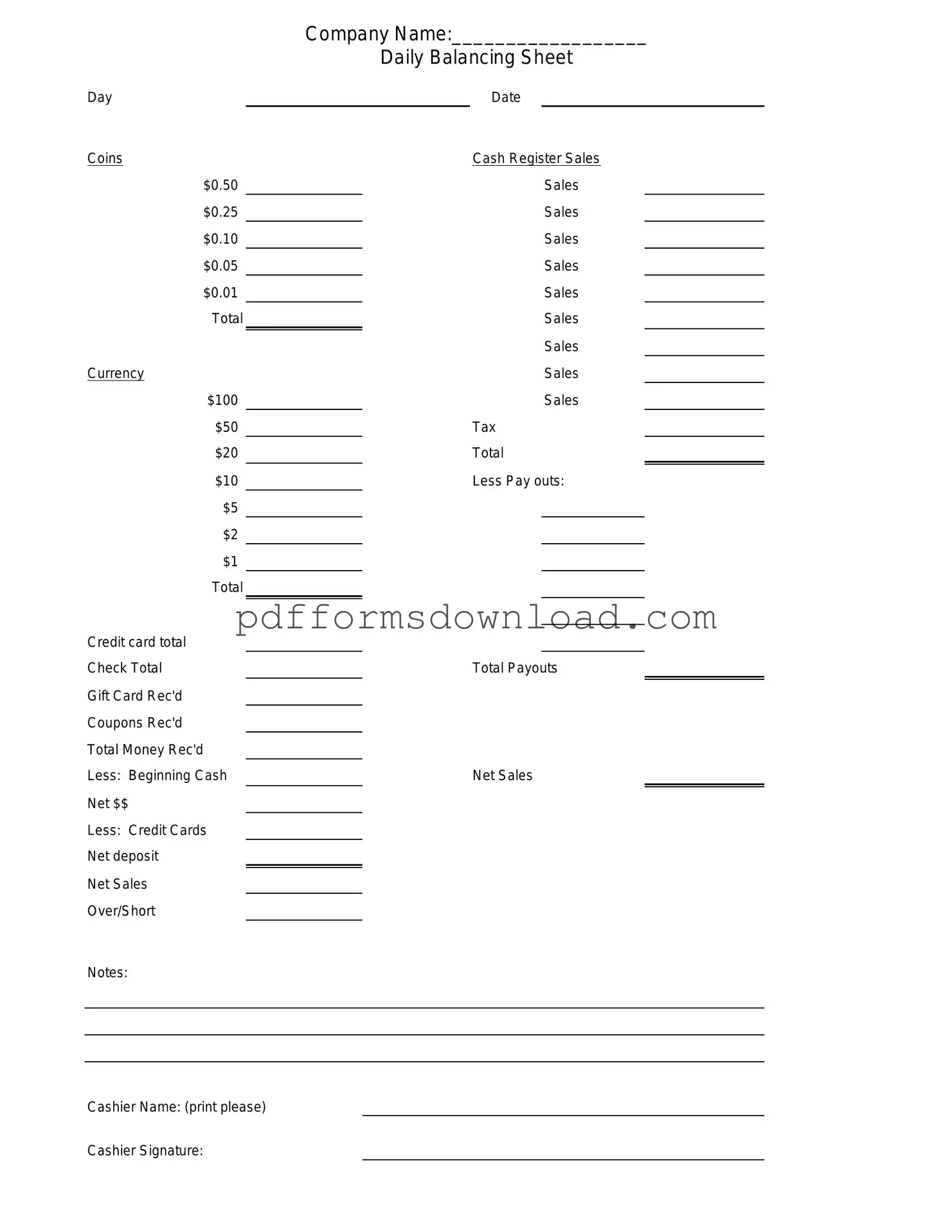

What is a Cash Drawer Count Sheet?

A Cash Drawer Count Sheet is a document used by businesses to track the cash in their cash drawers at the end of a shift or business day. This form helps ensure that the amount of cash in the drawer matches the sales recorded during that period. It serves as a tool for accountability and helps prevent discrepancies in cash handling.

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for maintaining accurate financial records. It helps identify any cash shortages or overages, which can indicate errors in transactions or potential theft. Regularly using this form promotes transparency and can help in training employees on proper cash handling procedures.

How do I fill out a Cash Drawer Count Sheet?

To fill out a Cash Drawer Count Sheet, start by entering the date and the name of the person responsible for counting the cash. Next, count the cash in the drawer, including bills and coins, and record each denomination separately. Finally, total the amounts to ensure they match the expected cash balance based on sales records.

What should I do if there is a cash discrepancy?

If you find a discrepancy while using the Cash Drawer Count Sheet, it’s important to investigate immediately. Review the transaction records for that shift to identify any mistakes. Speak with employees who handled cash during that time. Document any findings and adjust your records accordingly. If discrepancies are frequent, consider reviewing cash handling policies.

Can the Cash Drawer Count Sheet be used for multiple drawers?

Yes, the Cash Drawer Count Sheet can be adapted for use with multiple cash drawers. If your business has several registers, each drawer should have its own count sheet. This ensures that each location is accurately accounted for and allows for easier tracking of cash flow across different areas of the business.

How often should I complete a Cash Drawer Count Sheet?

It is advisable to complete a Cash Drawer Count Sheet at the end of each shift or business day. This practice helps maintain accurate records and allows for timely identification of any discrepancies. For businesses with high cash volume, more frequent counts may be necessary to ensure accountability.

Who is responsible for completing the Cash Drawer Count Sheet?

The responsibility for completing the Cash Drawer Count Sheet typically falls to the employee who is closing out the cash drawer. This could be a cashier or a manager, depending on the business structure. It is essential that the person filling out the form is trained in cash handling procedures to ensure accuracy.

What should I do with the completed Cash Drawer Count Sheet?

Once the Cash Drawer Count Sheet is completed, it should be securely stored as part of the business’s financial records. This documentation can be useful for audits, financial reviews, and resolving any future discrepancies. Some businesses may also choose to keep digital copies for easier access and record-keeping.

Is there a specific format for a Cash Drawer Count Sheet?

While there is no universally mandated format for a Cash Drawer Count Sheet, it should include key elements such as the date, the name of the person completing the count, a breakdown of cash denominations, and a total cash amount. Many businesses create their own templates to suit their specific needs, ensuring all necessary information is captured.