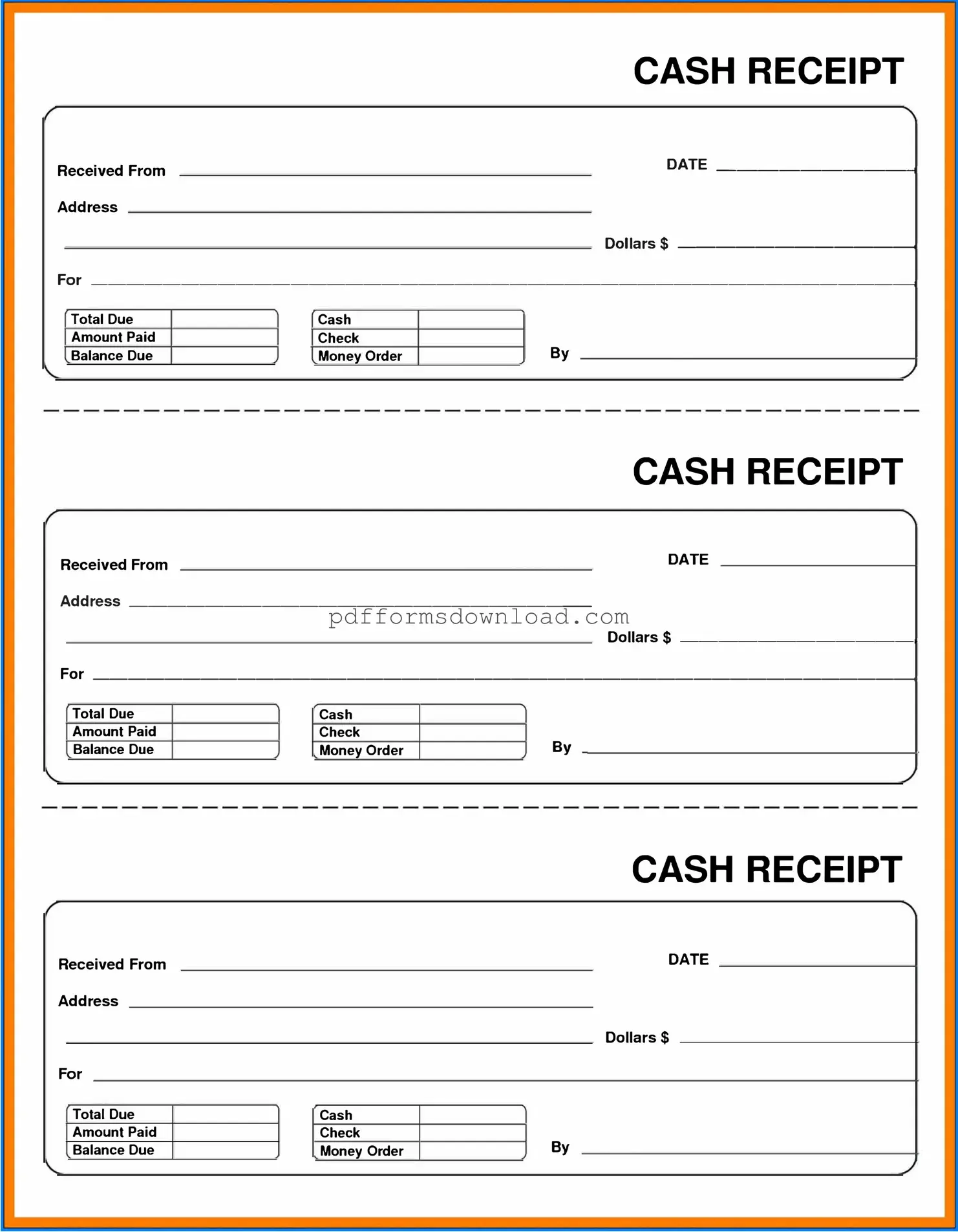

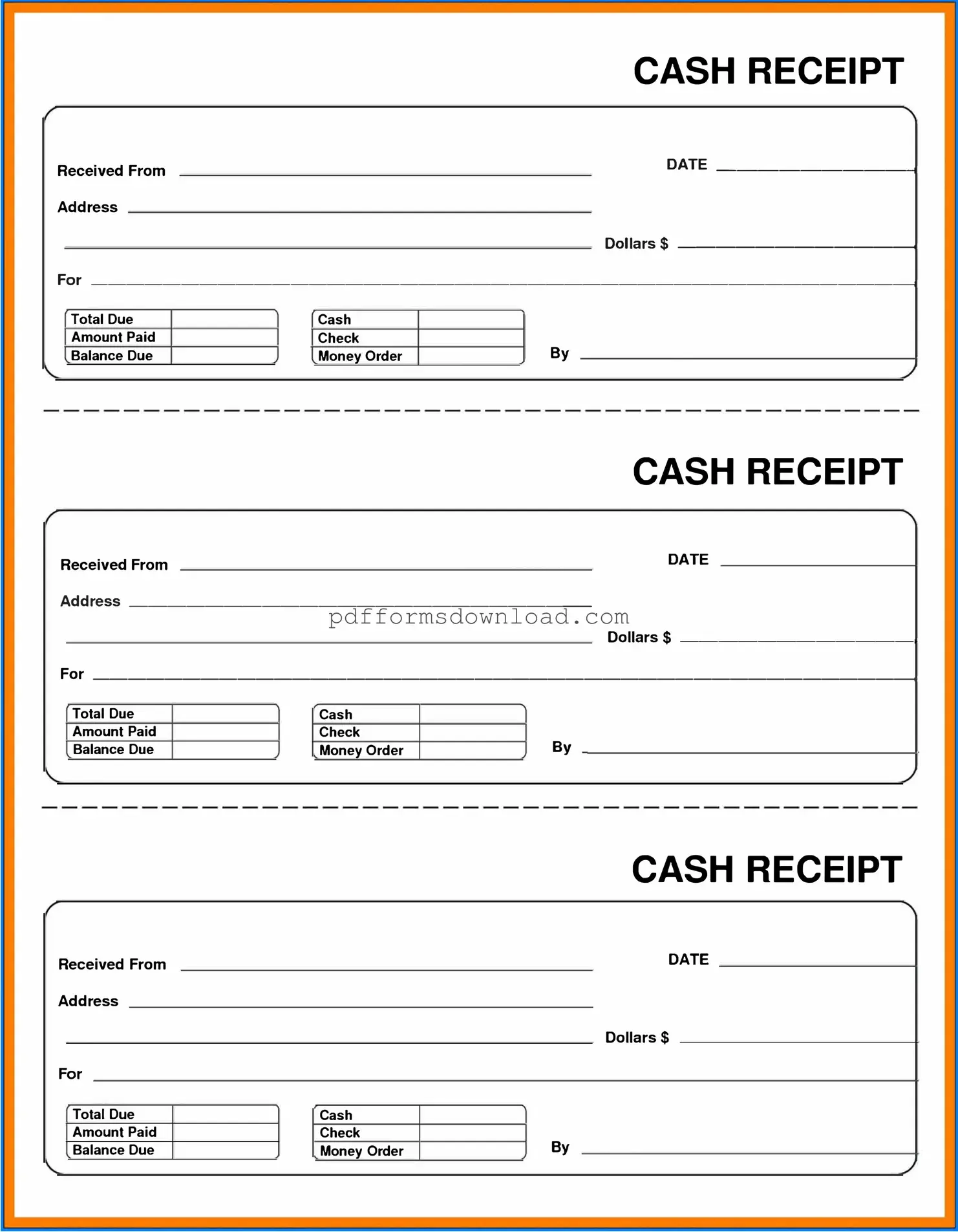

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. This form serves as proof of payment for both the payer and the recipient. It typically includes details such as the date of the transaction, the amount received, the purpose of the payment, and the signature of the person receiving the cash.

When should I use a Cash Receipt form?

You should use a Cash Receipt form whenever you receive cash payments. This can include payments for services rendered, sales of goods, or any other type of cash transaction. Using this form helps maintain accurate financial records and provides a clear record of the transaction.

What information is typically included on a Cash Receipt form?

A Cash Receipt form usually contains the following information: the date of the transaction, the name of the payer, the amount received, the method of payment (cash, check, etc.), a description of the purpose of the payment, and the signature of the person who received the cash. Some forms may also include a receipt number for tracking purposes.

Is a Cash Receipt form legally binding?

Yes, a Cash Receipt form can be considered legally binding as it serves as proof of payment. When both parties sign the form, it indicates that the transaction has occurred. However, it is always wise to keep copies of all receipts for your records in case of any disputes or audits.

Can I create my own Cash Receipt form?

Absolutely! You can create your own Cash Receipt form. Many businesses customize their forms to suit their specific needs. Just make sure to include all the essential information mentioned earlier. There are also templates available online that can help you get started.

How should I store Cash Receipt forms?

It is important to store Cash Receipt forms in a safe and organized manner. You can keep physical copies in a filing cabinet or use a digital storage system to keep them secure. Ensure that you have a backup system in place, especially if you are storing them digitally.

What should I do if I lose a Cash Receipt form?

If you lose a Cash Receipt form, try to retrieve any information related to the transaction from your records. You can also reach out to the payer for a copy if necessary. It’s a good practice to maintain a log of all transactions to help reconstruct lost documents.

Can a Cash Receipt form be modified after it is filled out?

Once a Cash Receipt form is filled out and signed, it is best not to modify it. Making changes can lead to confusion or disputes later on. If an error is discovered, it is advisable to create a new form and clearly note the reason for the new receipt.