What is the Citibank Direct Deposit form?

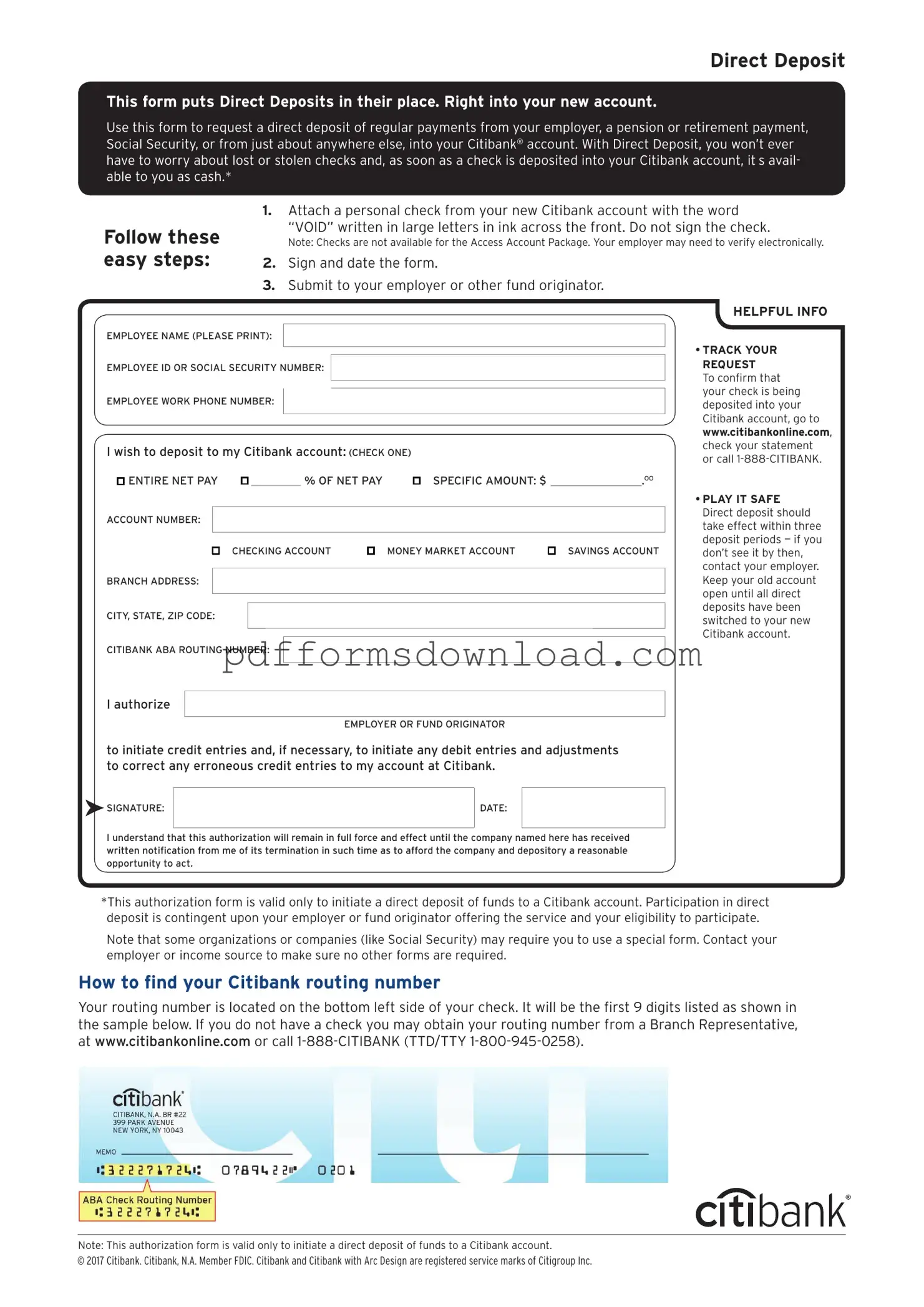

The Citibank Direct Deposit form is a document that allows you to authorize your employer or other payers to deposit your paycheck or other payments directly into your Citibank account. This process is secure and convenient, eliminating the need for paper checks.

How do I obtain the Citibank Direct Deposit form?

You can easily obtain the Citibank Direct Deposit form by visiting the Citibank website or contacting customer service. Many employers also provide their own versions of this form, so check with your HR department as well.

What information do I need to fill out the form?

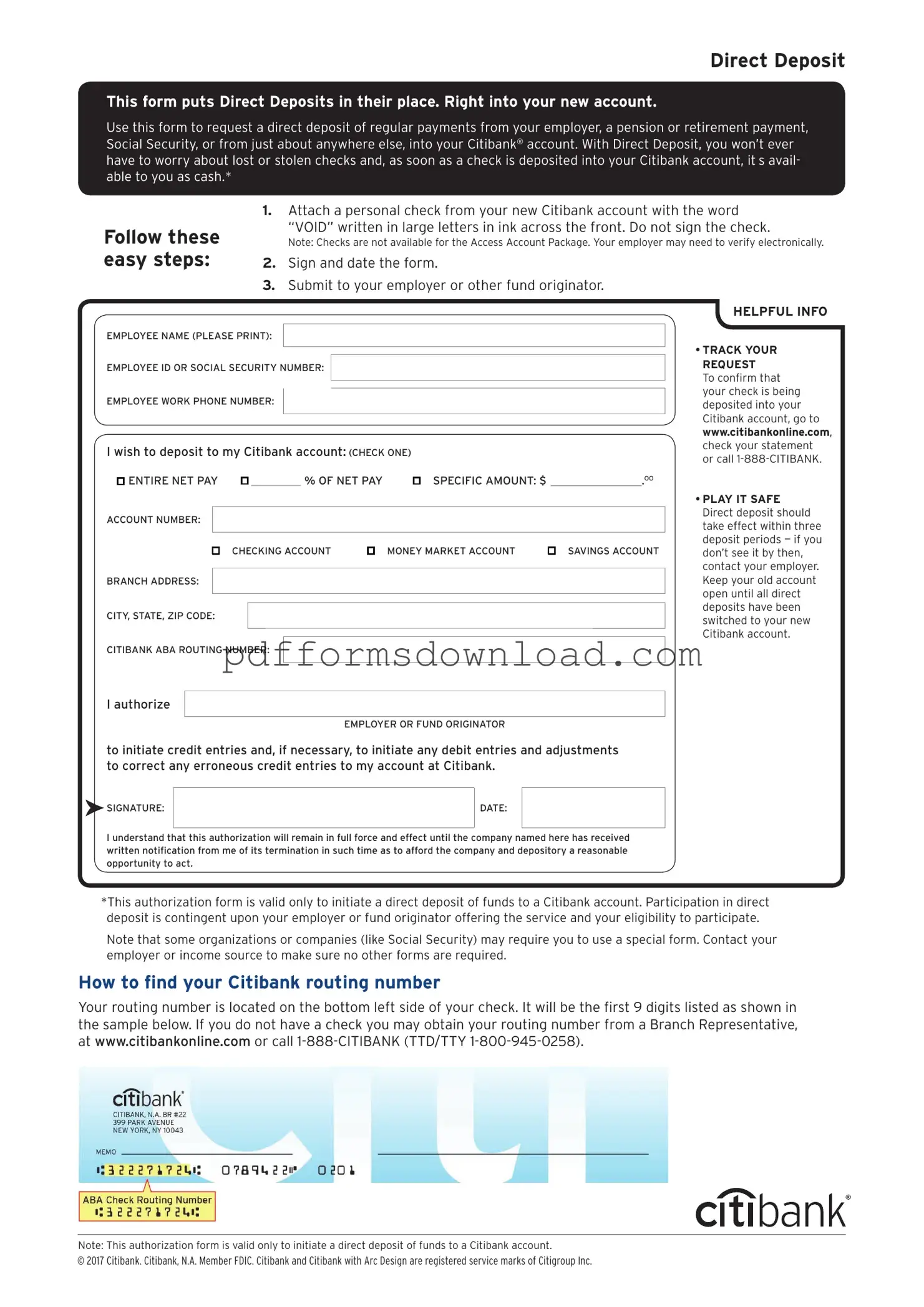

To complete the form, you will need to provide your personal information, including your name, address, and Social Security number. You will also need your Citibank account number and the bank's routing number. Make sure to double-check all entries for accuracy.

How do I submit the completed form?

After filling out the form, you typically submit it to your employer's payroll department. Some employers may allow you to submit it electronically, while others may require a physical copy. Confirm the preferred method with your employer.

How long does it take for direct deposits to start?

The time it takes for direct deposits to begin can vary. Generally, it may take one to two pay cycles after your employer receives the completed form. However, it’s best to check with your employer for their specific timeline.

Can I change my direct deposit information later?

Yes, you can change your direct deposit information at any time. You will need to fill out a new Citibank Direct Deposit form and submit it to your employer. Keep in mind that it may take some time for the changes to take effect.

What should I do if my direct deposit is incorrect?

If you notice an error with your direct deposit, contact your employer’s payroll department immediately. They can investigate the issue and work with Citibank to resolve it. Always check your bank statements regularly to catch any discrepancies early.

Is there a fee for using direct deposit with Citibank?

Typically, there are no fees associated with receiving direct deposits into your Citibank account. However, it’s a good idea to review your account terms and conditions or contact Citibank directly for any specific details.

What if I close my Citibank account?

If you close your Citibank account, you will need to update your direct deposit information with your employer. Provide them with your new banking details to ensure that your deposits continue without interruption.

Can I use the Citibank Direct Deposit form for multiple accounts?

Generally, the form allows you to designate only one account for direct deposit. If you want to split your deposit between multiple accounts, check with your employer to see if they have a process in place for that. Some employers may allow a percentage to go into different accounts.