A Corrective Deed is a legal document used to amend or correct errors in a previously recorded deed. This could include mistakes in the names of the parties, property descriptions, or other critical details. The goal is to ensure that the public record accurately reflects the true intentions of the parties involved in the property transfer.

You should consider using a Corrective Deed if you discover an error in a deed after it has been recorded. Common reasons include misspelled names, incorrect legal descriptions of the property, or changes in ownership structure. Addressing these issues promptly can help avoid complications in future transactions or disputes.

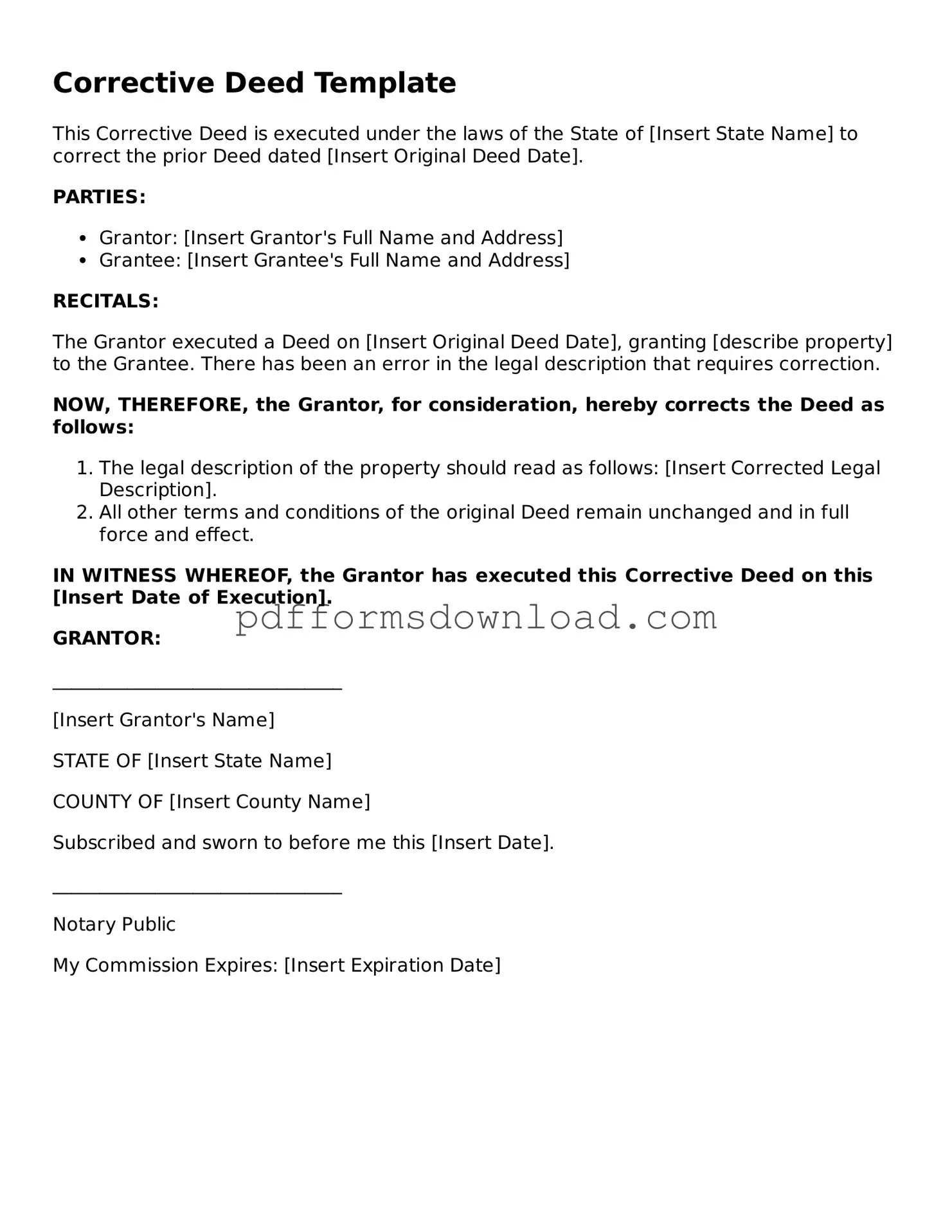

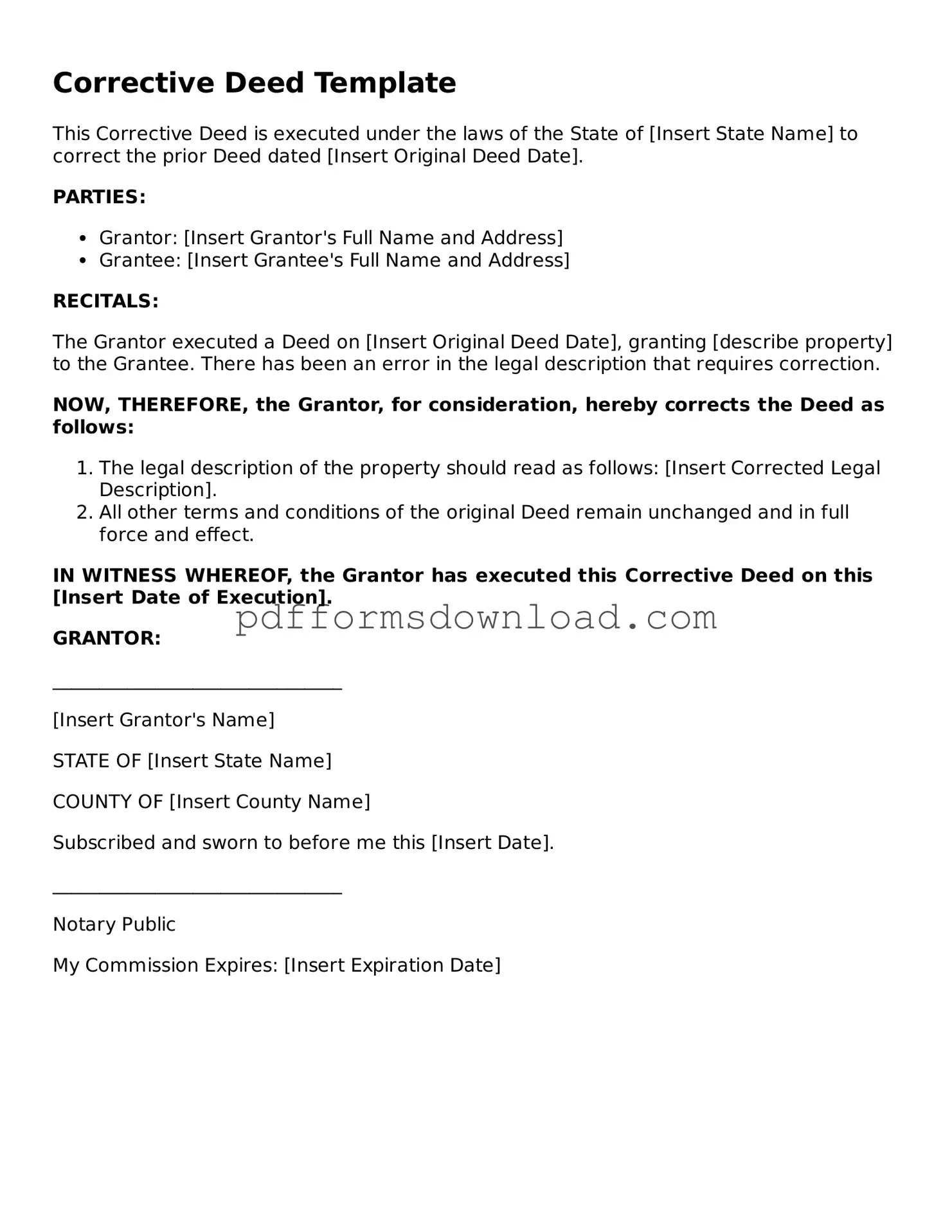

What information is needed to complete a Corrective Deed?

To complete a Corrective Deed, you will need the original deed, details of the errors to be corrected, and the correct information to be included. This may involve the names of the parties, the legal description of the property, and any other relevant details. It's important to ensure that the information is accurate to avoid further issues.

How is a Corrective Deed different from a Quitclaim Deed?

A Corrective Deed is specifically designed to fix errors in an existing deed, while a Quitclaim Deed is used to transfer ownership of a property without guaranteeing that the title is clear. Essentially, a Quitclaim Deed relinquishes any interest in the property without warranties, whereas a Corrective Deed aims to clarify and correct existing records.

Do I need to notarize a Corrective Deed?

Yes, a Corrective Deed typically needs to be notarized to be legally binding. The notary public serves as an impartial witness to the signing of the document, which helps prevent fraud and ensures that all parties are signing willingly and knowingly.

Where do I file a Corrective Deed?

A Corrective Deed should be filed with the county recorder's office where the original deed was recorded. This ensures that the correction is officially recognized and becomes part of the public record. It’s advisable to check with your local office for any specific filing requirements or fees.

Will a Corrective Deed affect my property taxes?

Generally, a Corrective Deed does not directly affect property taxes. However, if the correction involves a change in ownership or property description, it may prompt a reassessment by the local tax authority. It’s wise to consult with a tax professional to understand any potential implications.

Can I prepare a Corrective Deed myself?

How long does it take for a Corrective Deed to be processed?