What is a Deed?

A deed is a legal document that conveys ownership of property from one party to another. It serves as proof of the transfer and includes important details such as the names of the parties involved, a description of the property, and any conditions or restrictions related to the transfer.

What types of Deeds are there?

There are several types of deeds, including warranty deeds, quitclaim deeds, and grant deeds. A warranty deed guarantees that the seller has clear title to the property and can defend against any claims. A quitclaim deed transfers whatever interest the seller has without guarantees. A grant deed provides some assurances about the title but is less comprehensive than a warranty deed.

Do I need a lawyer to prepare a Deed?

While it is not legally required to have a lawyer prepare a deed, it is often advisable, especially for complex transactions. If you are comfortable with the process and understand the implications, you can prepare a deed on your own or use a legal document preparer.

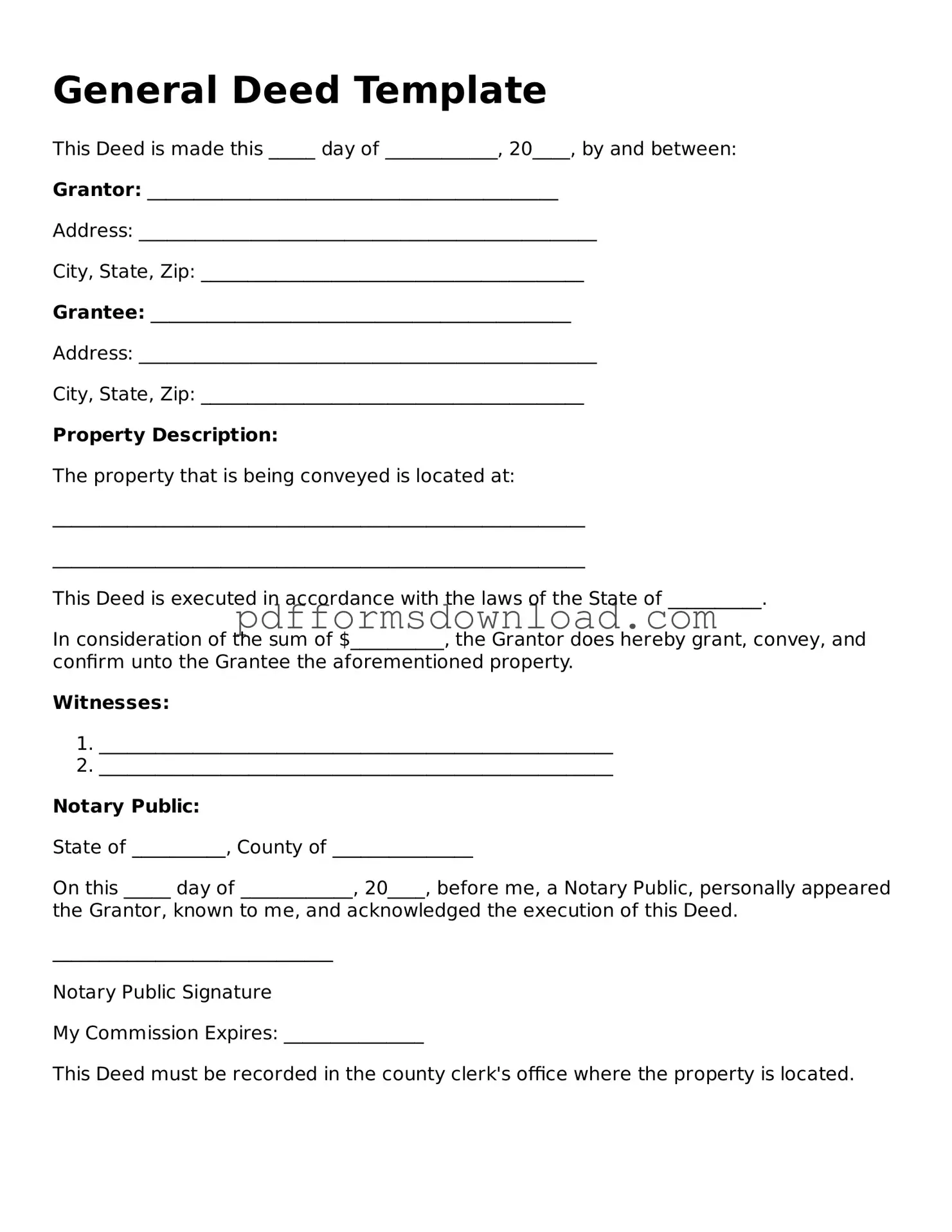

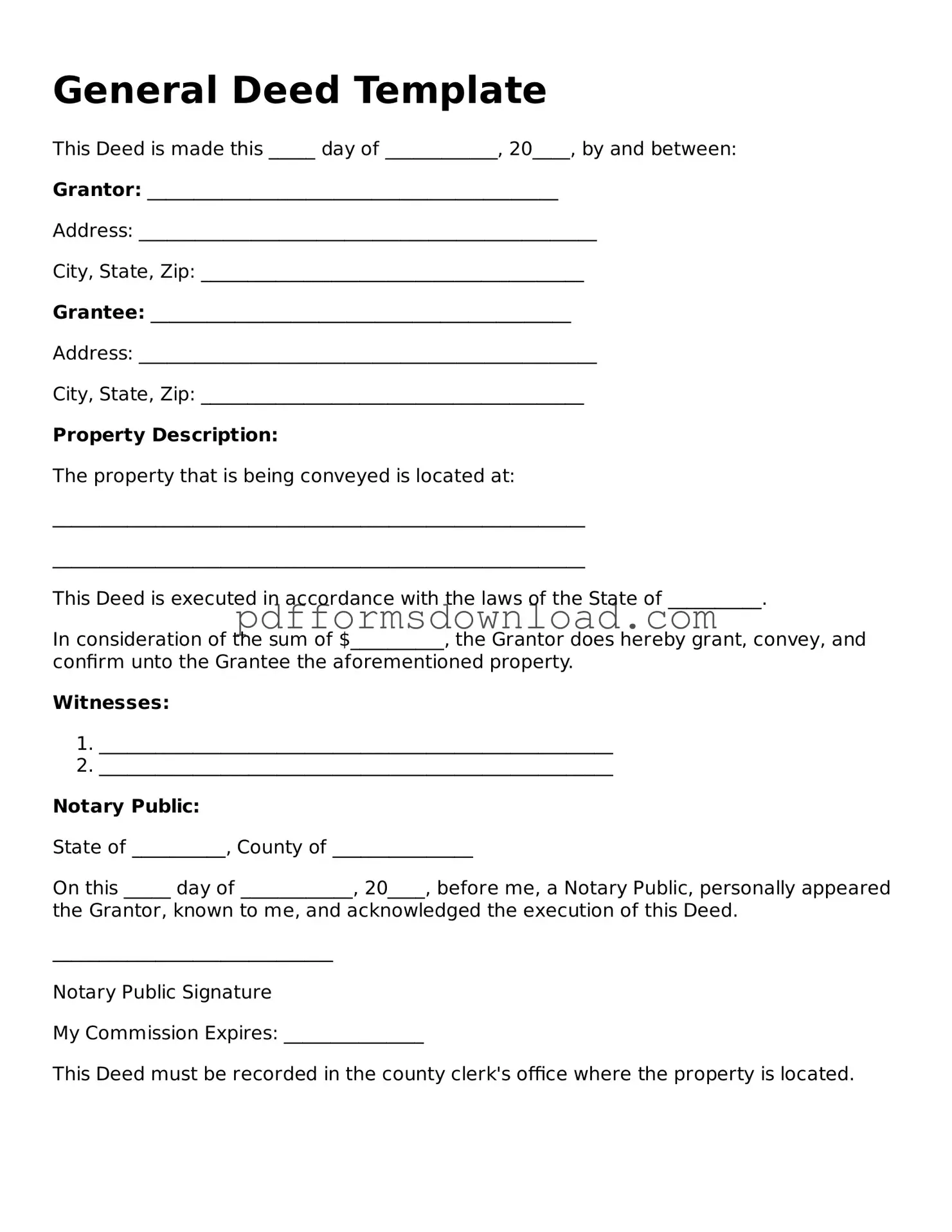

How do I fill out a Deed?

To fill out a deed, start by entering the names of the grantor (seller) and grantee (buyer). Next, provide a legal description of the property, which can often be found in previous deeds or property tax records. Finally, include any necessary details about the transaction, such as consideration (the amount paid) and any conditions or restrictions.

Is a Deed required to transfer property?

Yes, a deed is typically required to legally transfer ownership of real property. Without a deed, the transfer may not be recognized by the courts or other parties, and it could lead to disputes over ownership.

How do I record a Deed?

To record a deed, you must take the completed document to the local county recorder’s office where the property is located. There may be a fee for recording, and it is important to ensure that all required signatures are present before submission. Recording the deed makes the transfer official and provides public notice of ownership.

What happens if I don’t record my Deed?

If you do not record your deed, the transfer of ownership may not be legally recognized. This can lead to complications, especially if there are disputes over the property. Recording protects your ownership rights and helps prevent claims from others.

Can a Deed be revoked?

In general, a deed cannot be revoked once it has been executed and delivered, as it is a final transfer of ownership. However, certain conditions, such as fraud or mutual agreement between the parties, may allow for legal challenges or modifications. Consulting a legal professional can provide guidance in such situations.