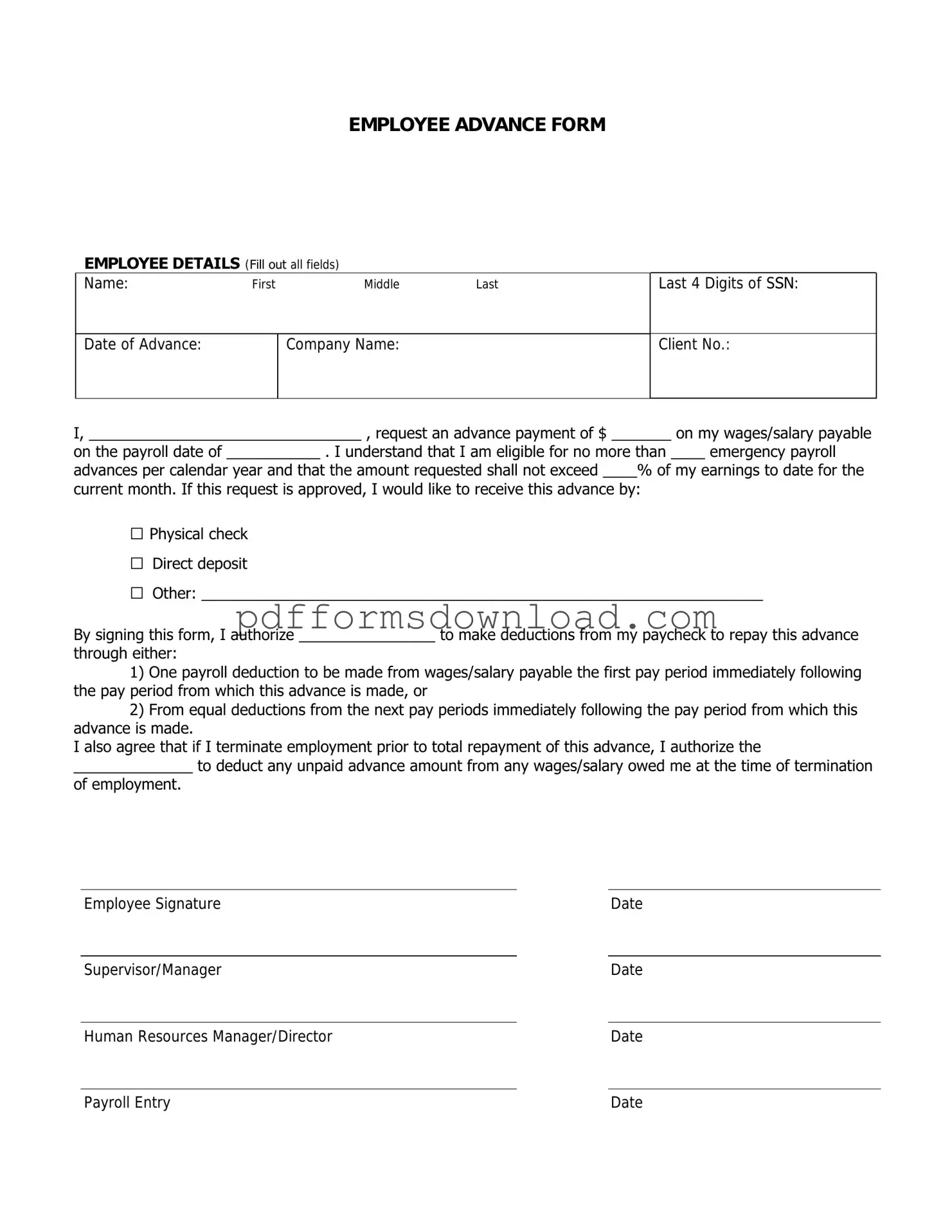

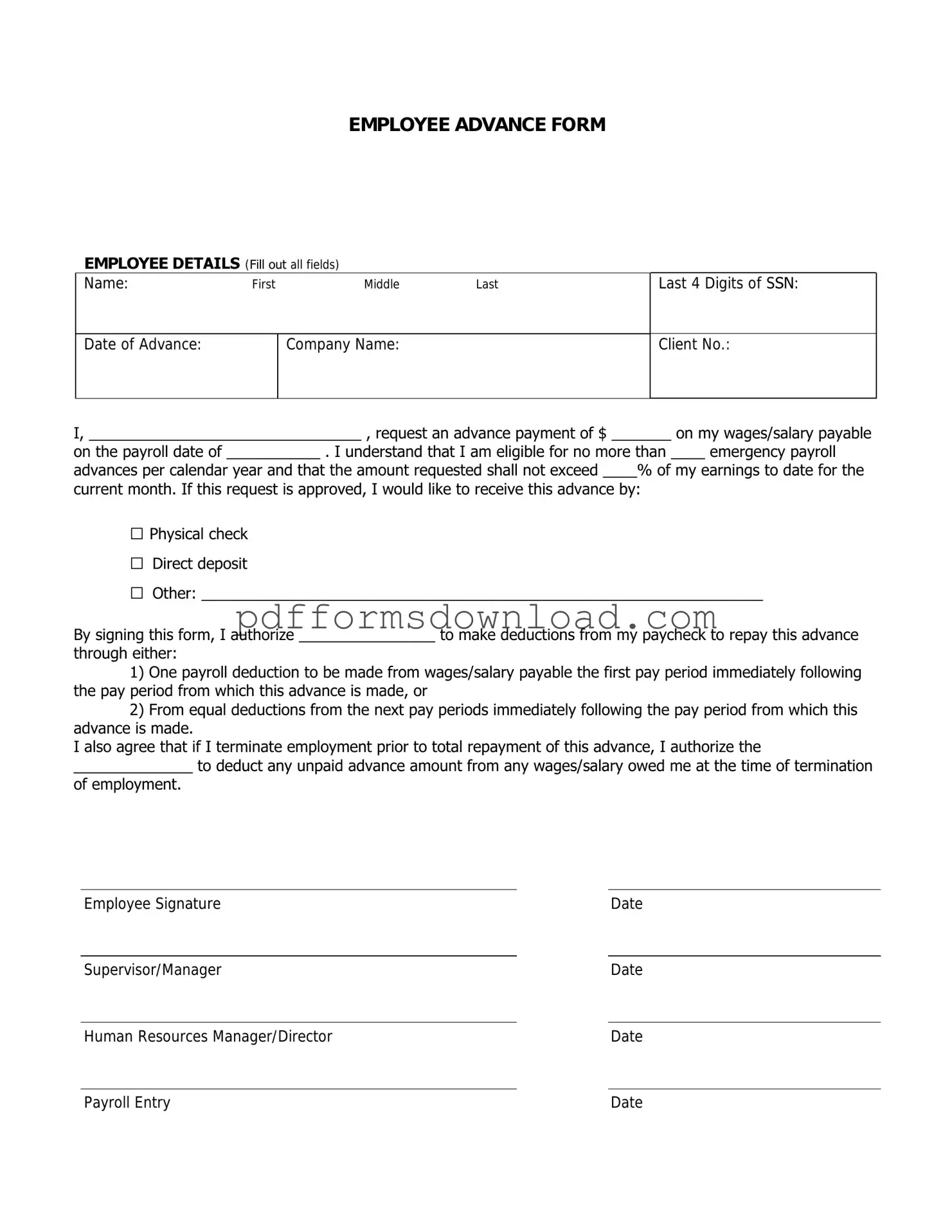

Download Employee Advance Template

The Employee Advance form is a document used by employees to request an advance on their salary or wages for various reasons, such as unexpected expenses or emergencies. This form helps employers manage cash flow while providing support to their employees in times of need. To initiate your request, please fill out the form by clicking the button below.

Make This Document Now

Download Employee Advance Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Employee Advance online — edit, save, and download easily.