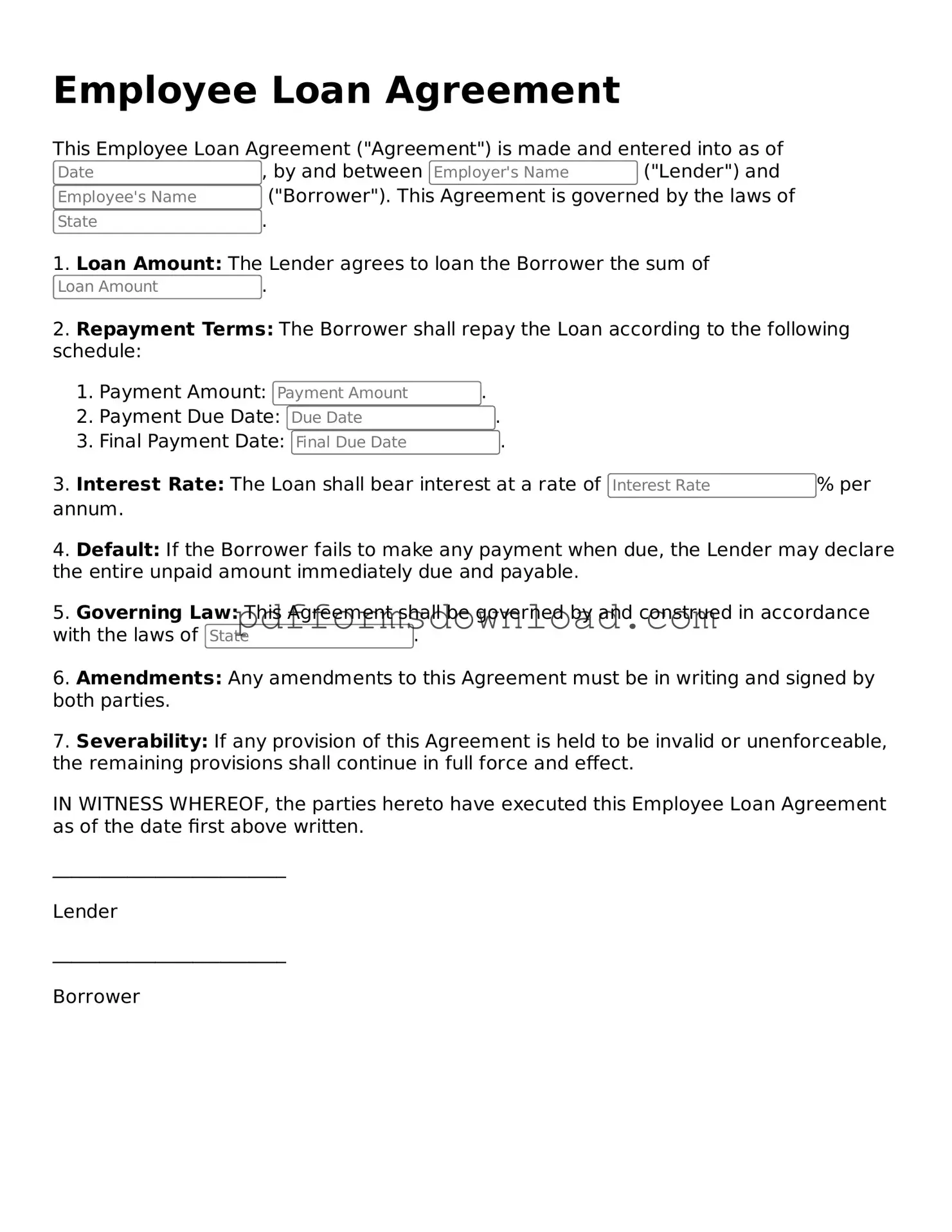

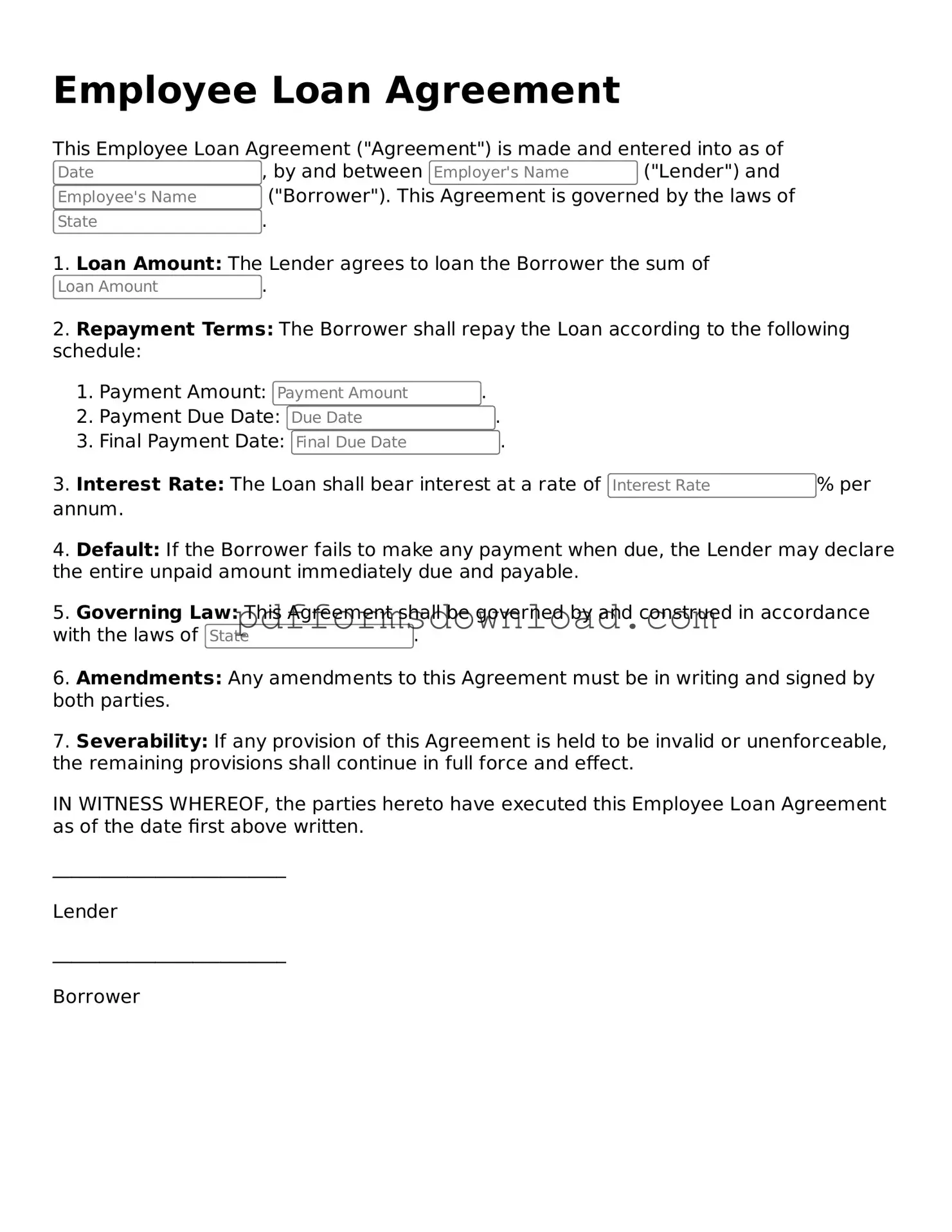

Official Employee Loan Agreement Document

An Employee Loan Agreement form is a legal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement typically includes details such as the loan amount, repayment schedule, and any applicable interest rates. Understanding the components of this form is essential for both employers and employees to ensure clarity and compliance.

To get started with your Employee Loan Agreement, please fill out the form by clicking the button below.

Make This Document Now

Official Employee Loan Agreement Document

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Employee Loan Agreement online — edit, save, and download easily.