Download Erc Broker Market Analysis Template

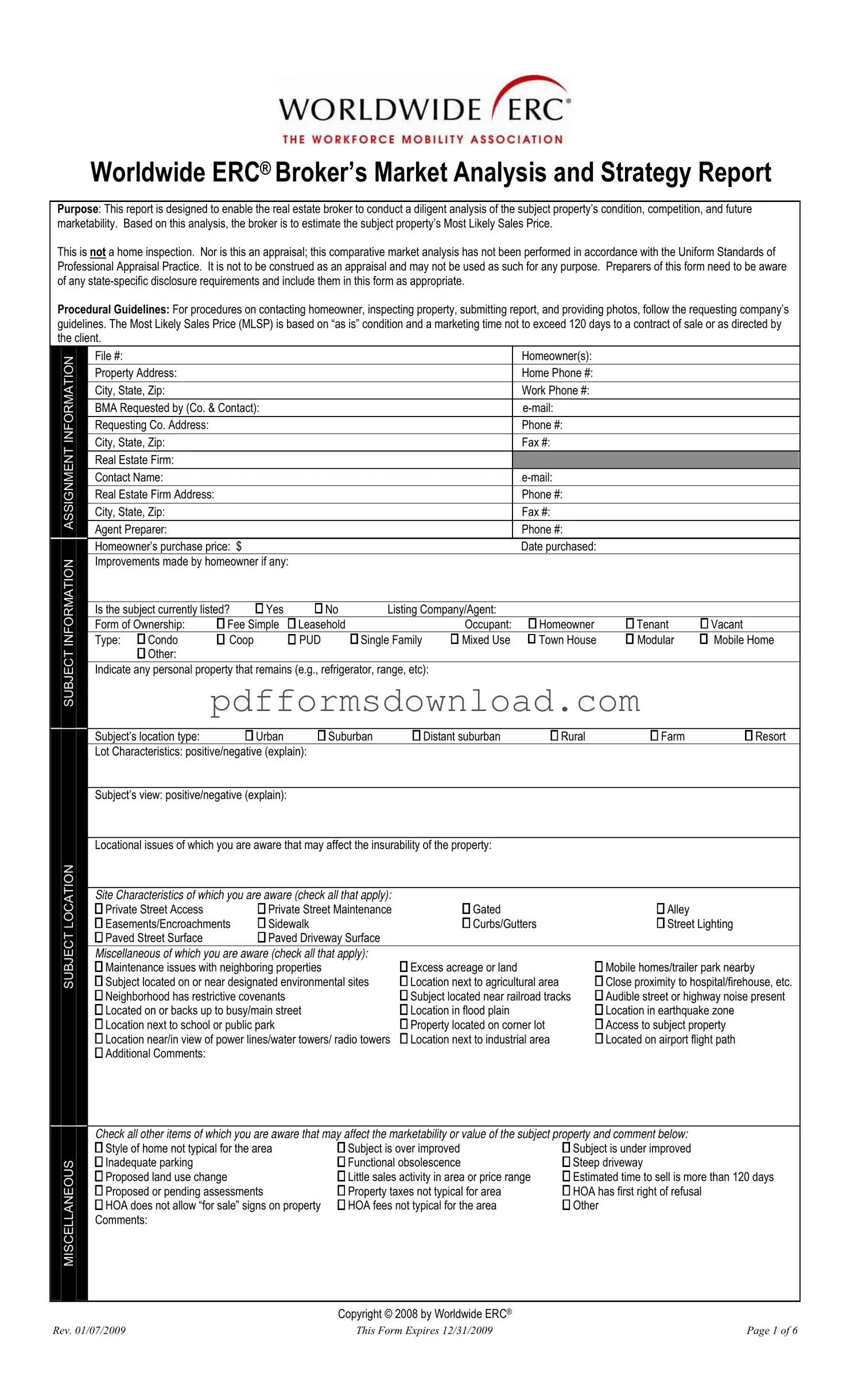

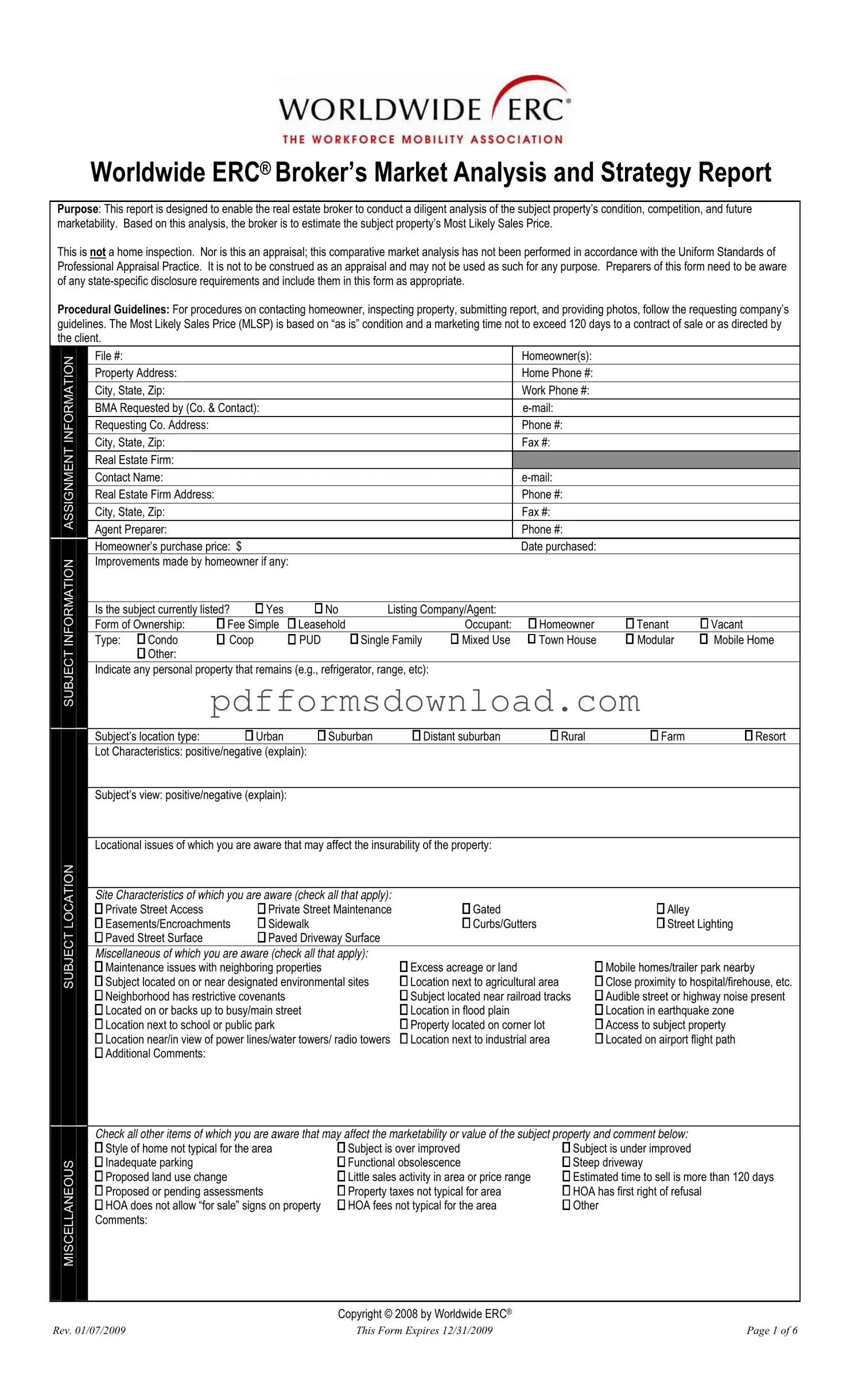

The Worldwide ERC® Broker’s Market Analysis and Strategy Report is a crucial tool for real estate brokers. It allows them to evaluate a property’s condition, competition, and potential marketability, ultimately estimating the Most Likely Sales Price (MLSP). This analysis is not an appraisal or home inspection but serves as a comprehensive comparative market analysis tailored to the needs of the broker and their clients.

If you are ready to begin your analysis, please fill out the form by clicking the button below.

Make This Document Now

Download Erc Broker Market Analysis Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Erc Broker Market Analysis online — edit, save, and download easily.