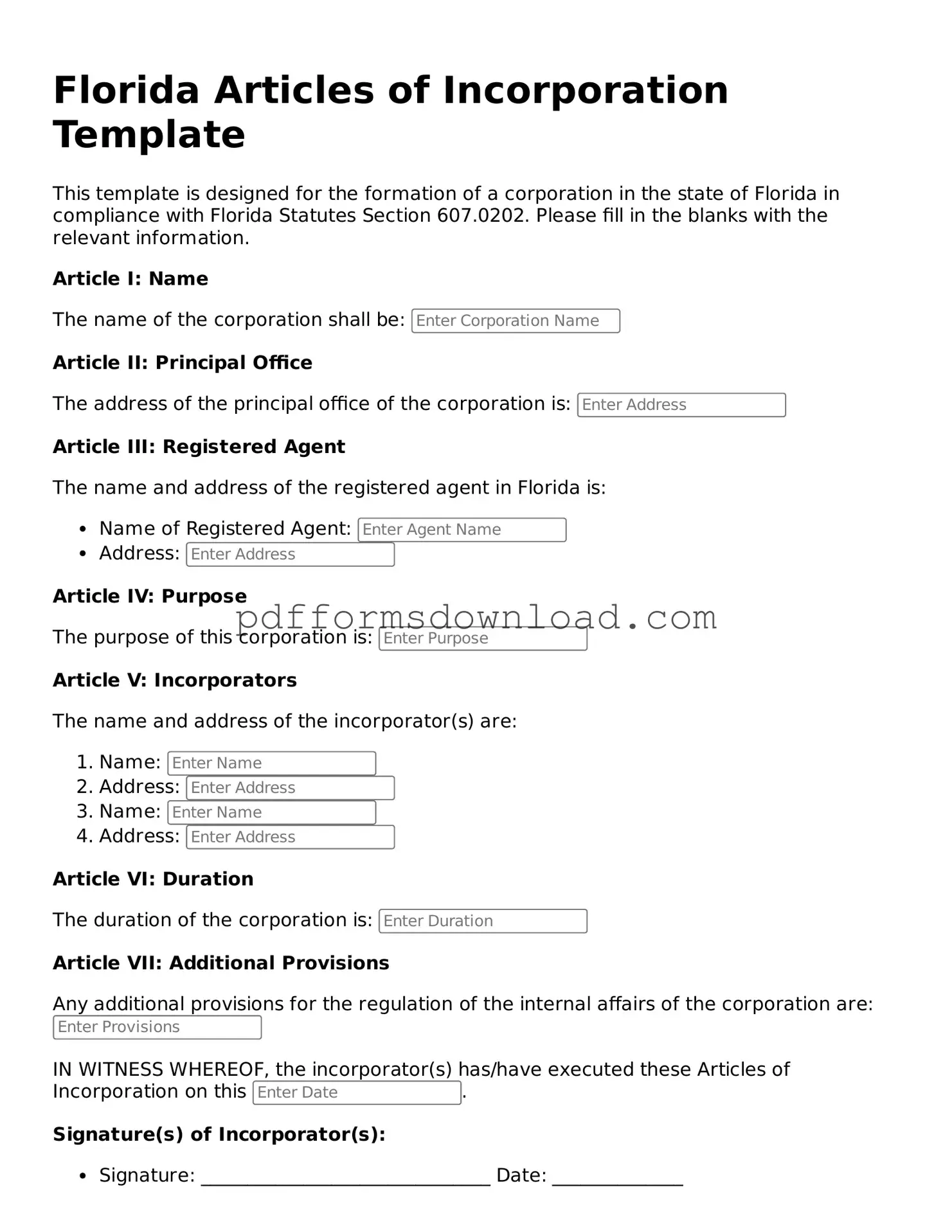

What are the Articles of Incorporation?

The Articles of Incorporation are legal documents that establish a corporation in Florida. This form includes essential information about the corporation, such as its name, purpose, and the names of its directors. Filing these documents is a crucial first step in forming a corporation in the state.

How do I file the Articles of Incorporation in Florida?

You can file the Articles of Incorporation online through the Florida Division of Corporations website, or you can submit a paper form by mail. If you choose to file online, ensure you have all necessary information ready, as the process is straightforward and efficient. For mail submissions, send the completed form along with the required filing fee to the appropriate address.

What information is required on the Articles of Incorporation?

The form requires several key details. You must provide the corporation's name, which must be unique and not already in use. You'll also need to state the purpose of the corporation, list the principal office address, and include the names and addresses of the initial directors. Additionally, the registered agent's name and address must be specified.

What is a registered agent, and why is it important?

A registered agent is an individual or business designated to receive legal documents on behalf of the corporation. This person must have a physical address in Florida. Having a registered agent is important because it ensures that the corporation can be reached for official communications, including legal notices and service of process.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Florida is typically around $70. However, additional fees may apply if you choose expedited processing or if you are filing for specific types of corporations. Always check the Florida Division of Corporations website for the most current fee schedule.

How long does it take to process the Articles of Incorporation?

Processing times can vary. If you file online, you may receive confirmation of your filing within a few business days. Paper submissions may take longer, often up to several weeks. If you need your documents processed quickly, consider opting for expedited services, if available.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. To do this, you will need to complete and file an amendment form with the Florida Division of Corporations. There may be a fee associated with the amendment, and it is important to ensure that any changes comply with state regulations.