What is the Florida Commercial Contract form used for?

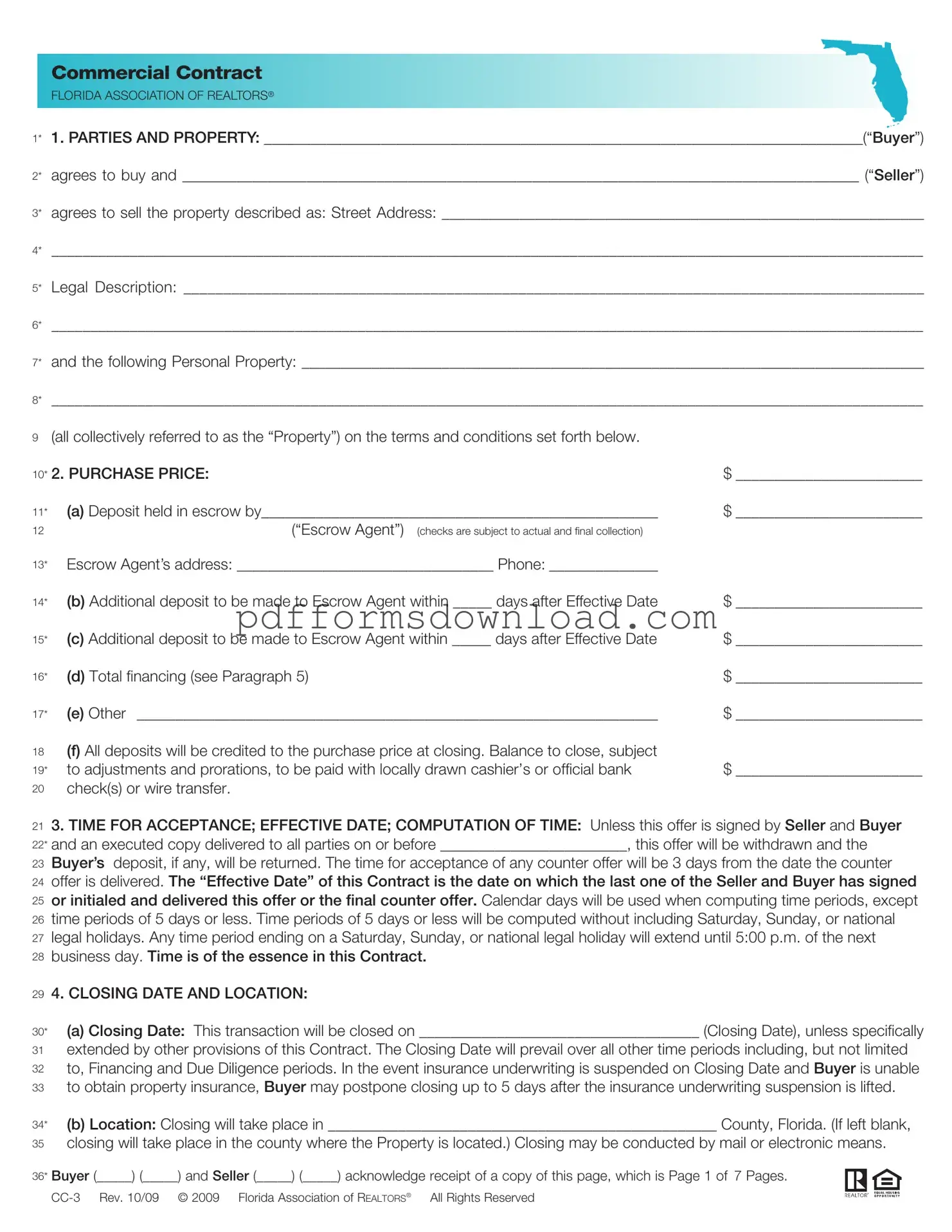

The Florida Commercial Contract form is a legal document designed for real estate transactions involving commercial properties. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This contract includes important details such as the purchase price, property description, and obligations of both parties, ensuring that all aspects of the transaction are clearly defined and agreed upon.

What information is required to complete the contract?

To complete the Florida Commercial Contract, several key pieces of information are needed. First, you must identify the parties involved, including the buyer and seller. Next, provide a detailed description of the property, including its legal description and address. The purchase price and any deposits must also be specified. Additionally, you’ll need to include details about financing, closing dates, and any personal property included in the sale. This thoroughness helps prevent misunderstandings later on.

What happens if the buyer cannot obtain financing?

If the buyer is unable to secure financing after making a good faith effort, they have the option to cancel the contract. The buyer must notify the seller in writing within a specified time frame. If the buyer follows this procedure, their deposit will be returned, and both parties will be released from further obligations under the contract. This provision protects the buyer from being locked into the contract without the necessary funds to complete the purchase.

Can the contract be modified after it is signed?

Yes, the Florida Commercial Contract can be modified after it is signed, but only if both parties agree to the changes. Any modifications must be documented in writing and signed by both the buyer and seller to be enforceable. This ensures that all parties are on the same page and that any adjustments to the terms of the agreement are formally recognized.

What should parties do if there is a dispute regarding the contract?

If a dispute arises concerning the Florida Commercial Contract, the parties should first attempt to resolve the issue through communication and negotiation. If that doesn’t work, they may need to seek legal advice or mediation. The contract also includes provisions for attorney's fees, meaning the prevailing party in any legal dispute may be entitled to recover their legal costs. It's crucial for both parties to understand their rights and obligations under the contract to navigate any potential conflicts effectively.