What is a Florida Deed form?

A Florida Deed form is a legal document used to transfer ownership of real property in the state of Florida. This form outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions of the transfer. It is essential for ensuring that the transfer is recognized by the state and protects the rights of both the buyer and seller.

What types of deeds are available in Florida?

Florida recognizes several types of deeds, including Warranty Deeds, Quit Claim Deeds, and Special Warranty Deeds. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it. A Quit Claim Deed, on the other hand, transfers whatever interest the seller has in the property without any guarantees. Special Warranty Deeds offer a middle ground, providing some assurances about the title but only for the period during which the seller owned the property.

Do I need a lawyer to complete a Florida Deed form?

While it is not legally required to have a lawyer when completing a Florida Deed form, it is highly recommended. A legal professional can ensure that the deed is filled out correctly and complies with all state laws. This can prevent potential disputes or issues in the future, making the investment in legal assistance worthwhile.

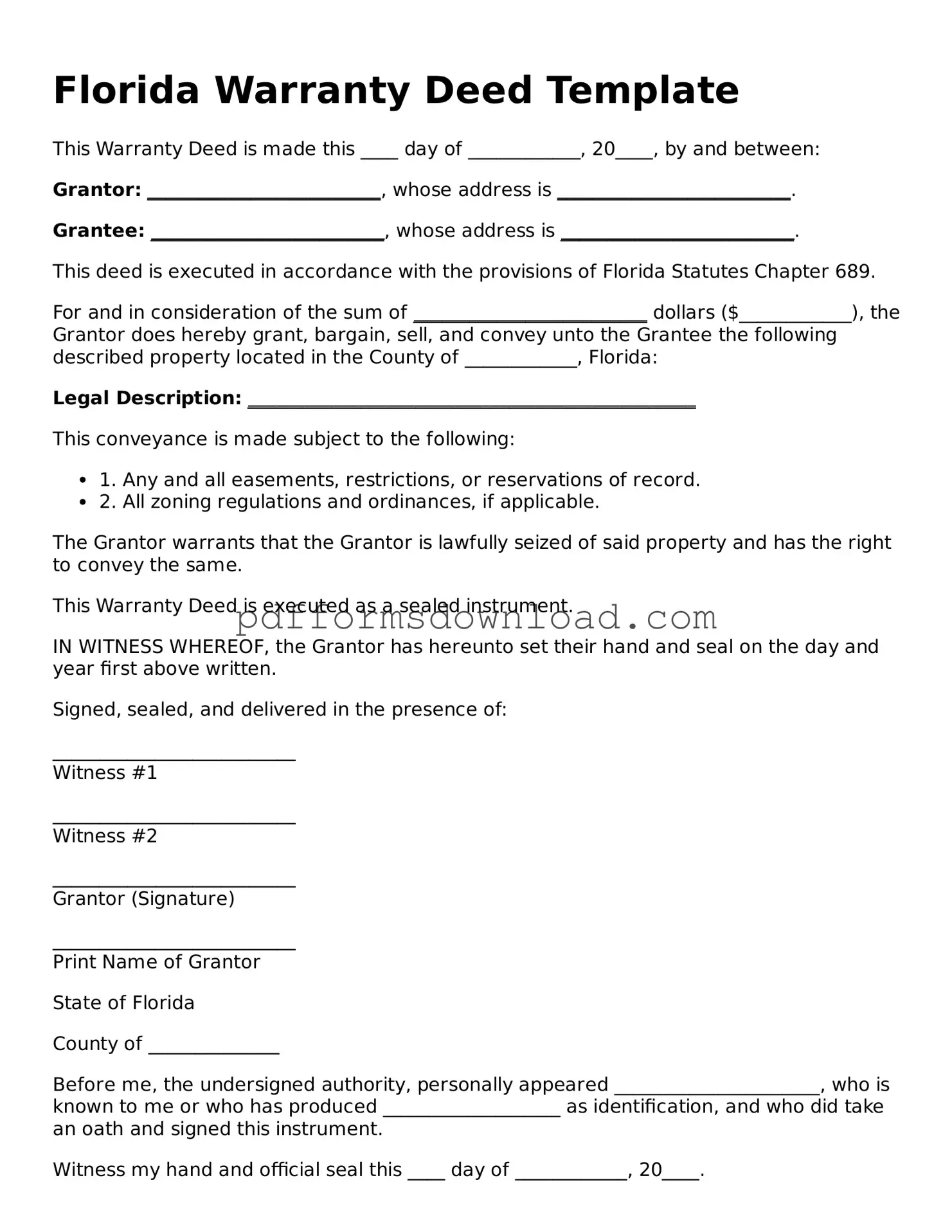

How do I fill out a Florida Deed form?

Filling out a Florida Deed form involves several steps. Start by entering the names of the grantor (seller) and grantee (buyer). Next, provide a clear description of the property, including its address and legal description. Be sure to include any necessary details about the transaction, such as the purchase price or any conditions. Finally, the deed must be signed by the grantor in the presence of a notary public.

Is there a fee to file a Florida Deed?

Yes, there is typically a fee to file a Florida Deed with the county clerk's office. The fees can vary by county, so it’s important to check with your local office for the exact amount. Additionally, there may be documentary stamp taxes that apply based on the sale price of the property. Budgeting for these costs is crucial when planning a property transfer.

Can I record a Florida Deed myself?

Yes, you can record a Florida Deed yourself, but it’s important to ensure that all paperwork is completed accurately. After filling out the deed, you will need to take it to the county clerk's office for recording. However, if you are unsure about the process, consulting with a professional can help avoid mistakes that could complicate the transfer.

What happens if a Florida Deed is not recorded?

If a Florida Deed is not recorded, the transfer of property ownership may not be recognized by third parties. This can lead to complications, especially if the property is sold again or if disputes arise. Recording the deed provides public notice of the ownership change, protecting the rights of the new owner.

Can I change a Florida Deed after it has been signed?

Once a Florida Deed has been signed and recorded, making changes is not straightforward. If you need to correct an error or make a change, a new deed must be created and executed. This process ensures that all parties have clear and accurate documentation of the property ownership.

What should I do if I lose my Florida Deed?

If you lose your Florida Deed, don’t panic. You can obtain a copy from the county clerk’s office where the deed was originally recorded. There may be a small fee for this service. Having a copy is important for your records and can help in future transactions involving the property.

How can I ensure my Florida Deed is legally binding?

To ensure your Florida Deed is legally binding, follow all state requirements. This includes having the deed properly filled out, signed by the grantor, and notarized. Once completed, recording the deed with the county clerk’s office is crucial. This step provides public notice of the transfer and protects your ownership rights.