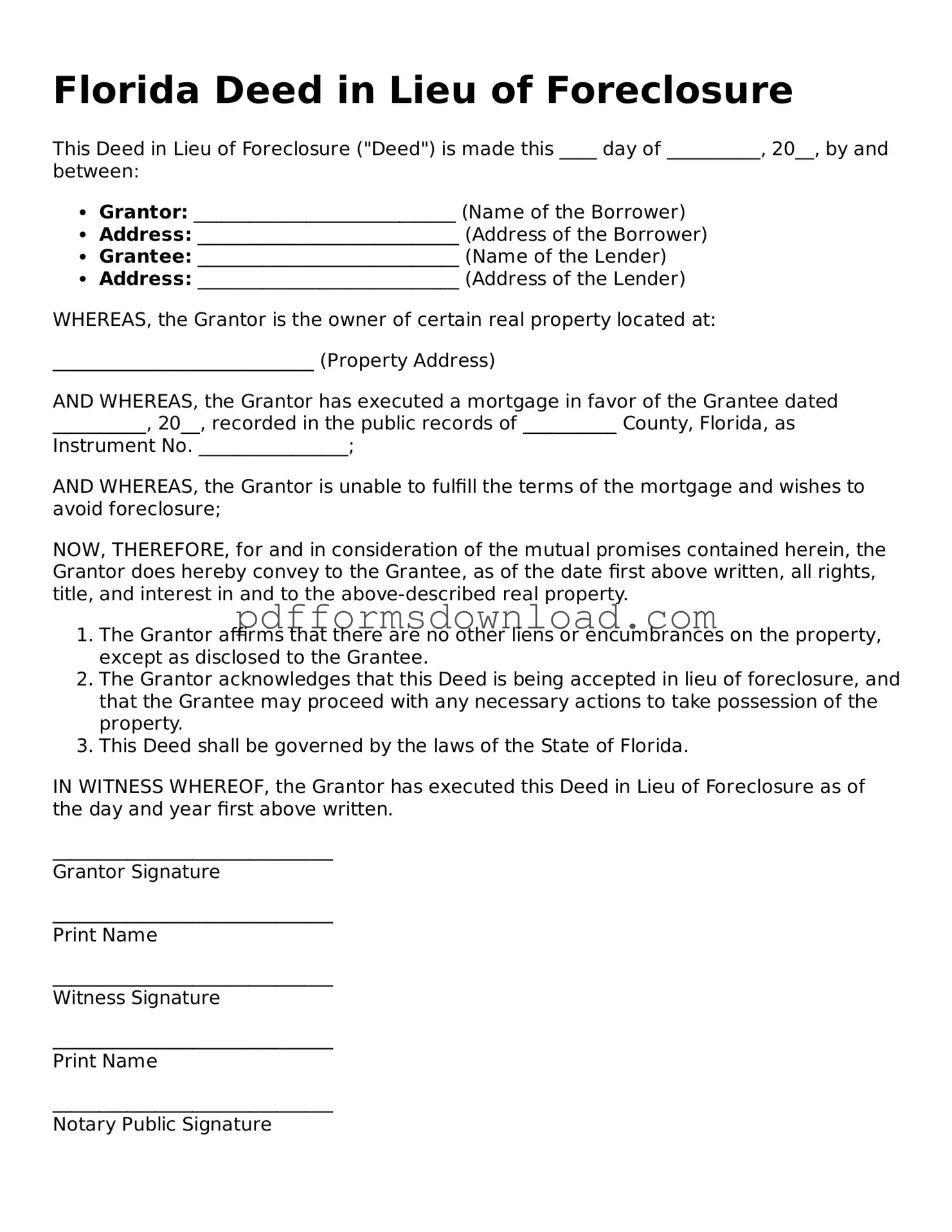

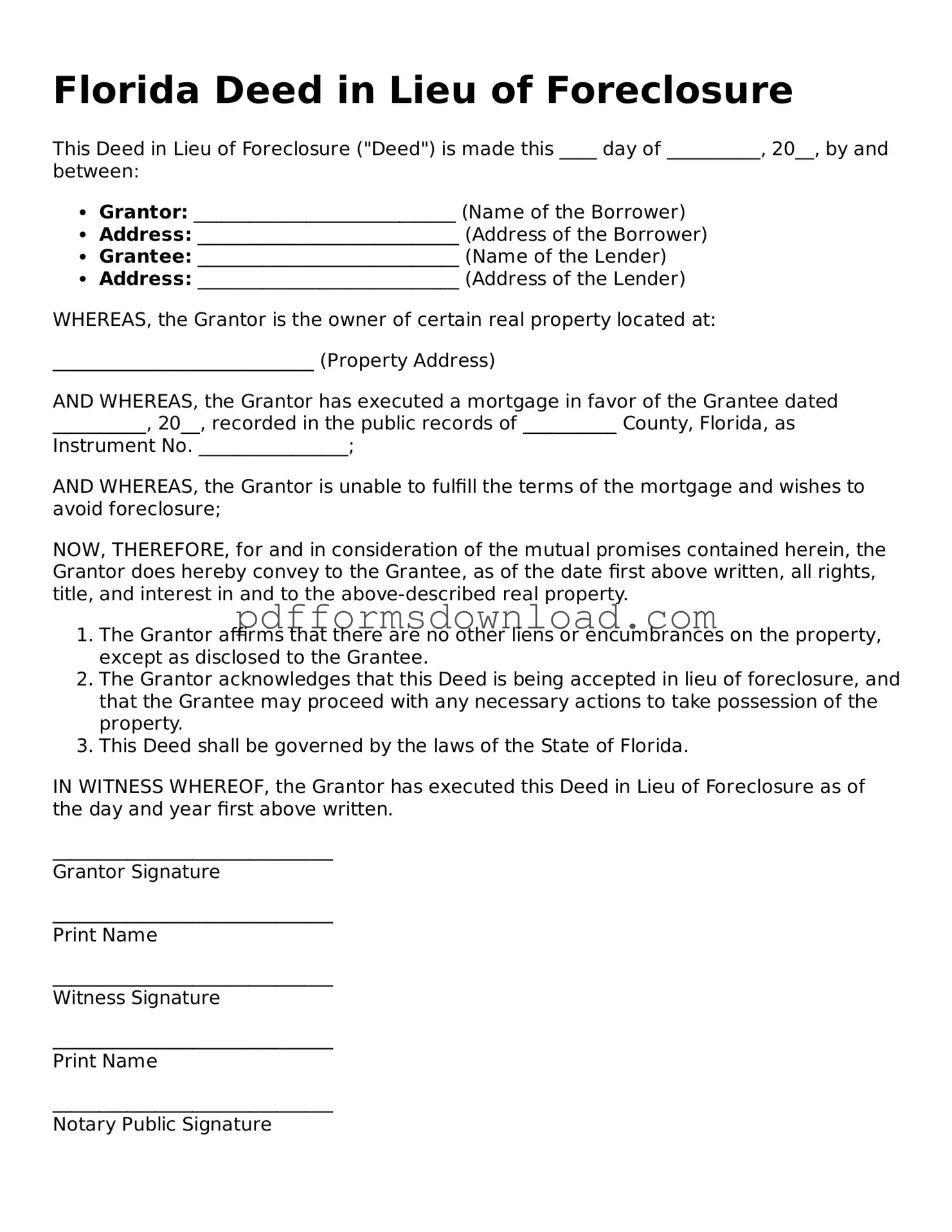

Printable Florida Deed in Lieu of Foreclosure Form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender in exchange for the cancellation of their mortgage debt. This option can provide a more streamlined and less stressful alternative to the foreclosure process. Homeowners facing financial difficulties may find this form beneficial in resolving their situation efficiently.

To take the next step, fill out the form by clicking the button below.

Make This Document Now

Printable Florida Deed in Lieu of Foreclosure Form

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Deed in Lieu of Foreclosure online — edit, save, and download easily.