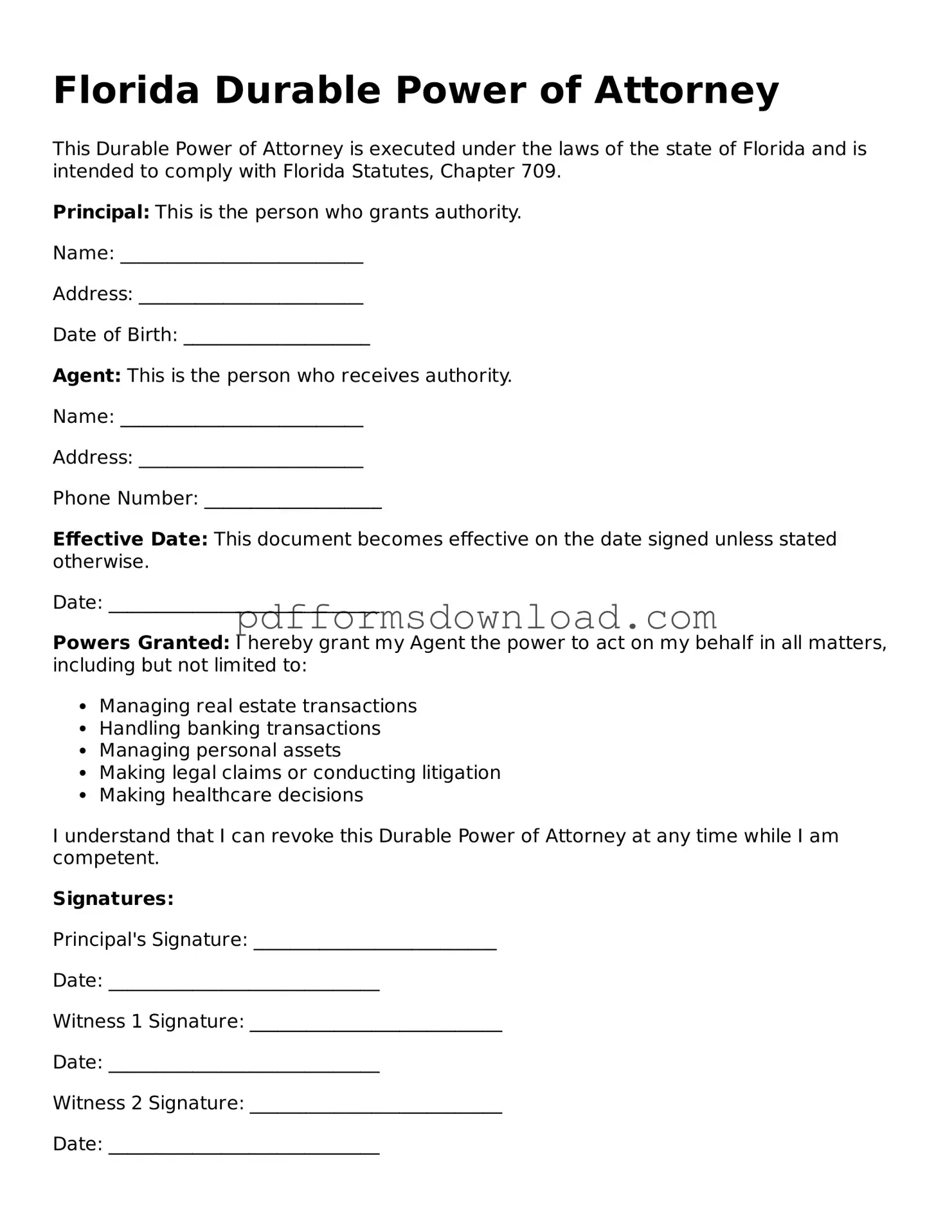

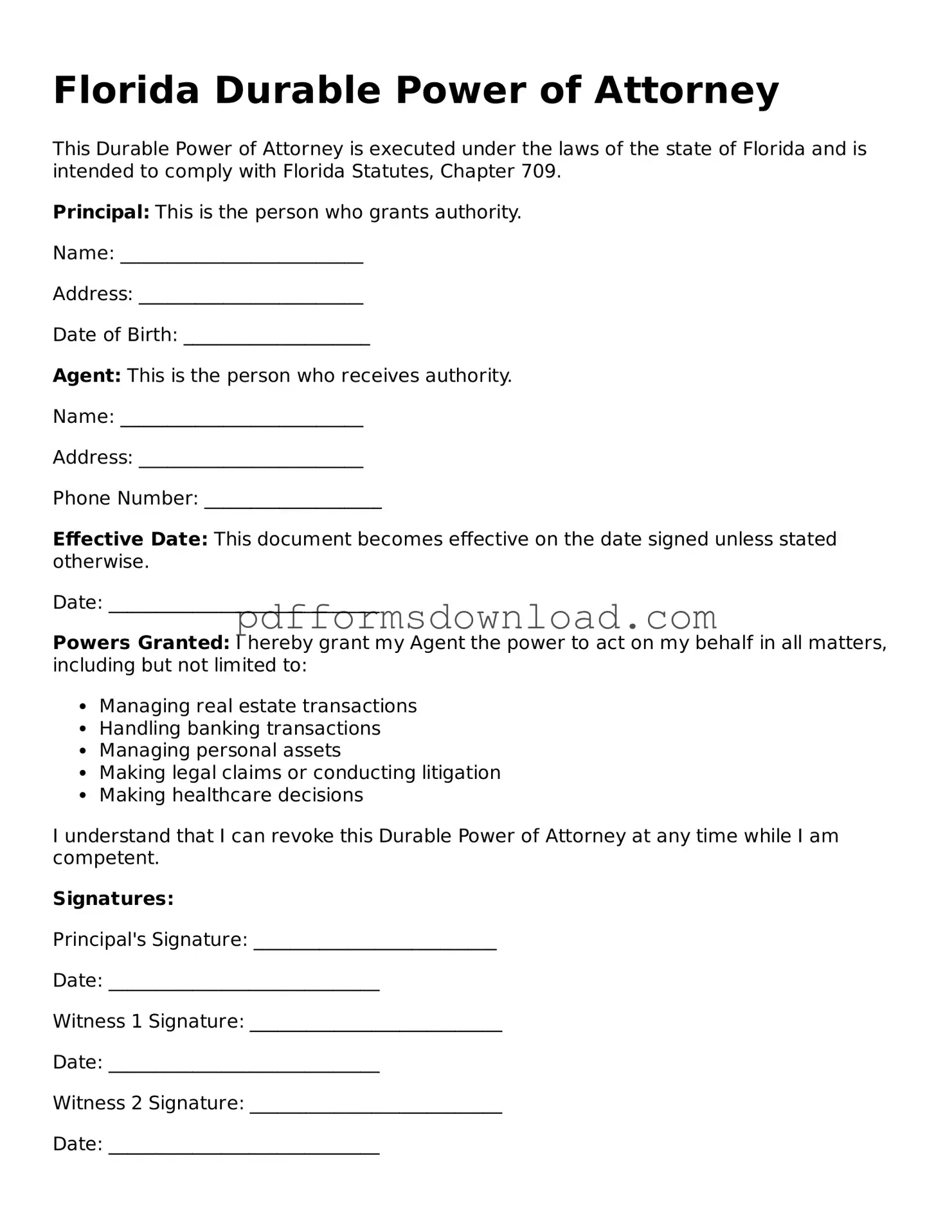

What is a Florida Durable Power of Attorney?

A Florida Durable Power of Attorney is a legal document that allows you to designate someone to make decisions on your behalf regarding financial and legal matters. This authority remains in effect even if you become incapacitated, ensuring your interests are protected when you cannot make decisions for yourself.

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney is crucial for ensuring that your financial affairs are managed according to your wishes. It provides peace of mind, knowing that someone you trust will handle your affairs if you are unable to do so. Additionally, it can help avoid potential legal complications and delays in decision-making during emergencies.

Who can be appointed as my agent?

You can appoint any competent adult as your agent. This person can be a family member, friend, or a trusted advisor. It is important to choose someone who understands your values and wishes, as they will be responsible for making significant decisions on your behalf.

What powers can I grant to my agent?

The powers granted can vary based on your preferences. Commonly, agents are given authority over financial matters, such as managing bank accounts, paying bills, and handling investments. You can also specify powers related to real estate transactions, tax matters, and business operations. Clearly outlining these powers in the document is essential.

Can I limit the powers of my agent?

Yes, you can place limitations on the powers granted to your agent. It is advisable to specify which powers are included and which are excluded. This ensures that your agent acts within the boundaries you set, providing you with greater control over your affairs.

Is a Durable Power of Attorney valid if I become incapacitated?

Yes, one of the primary features of a Durable Power of Attorney is that it remains valid even if you become incapacitated. This is what distinguishes it from a regular Power of Attorney, which typically becomes void in such circumstances. Your agent can continue to act on your behalf without interruption.

Do I need to have my Durable Power of Attorney notarized?

In Florida, it is recommended to have your Durable Power of Attorney notarized to ensure its validity. While notarization is not always legally required, having a notary public witness your signature can help prevent disputes and provide additional legal protection.

Can I revoke my Durable Power of Attorney?

You can revoke your Durable Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any relevant institutions. This action ensures that your previous agent no longer has authority over your affairs.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your loved ones may need to go through a court process to obtain guardianship. This can be time-consuming, costly, and emotionally challenging. Having a Durable Power of Attorney in place can prevent this situation and provide a clear plan for your care and financial management.

How can I get started with creating a Durable Power of Attorney?

To create a Durable Power of Attorney, consider consulting with a qualified attorney who specializes in estate planning. They can help you understand your options, draft the document according to your wishes, and ensure that it complies with Florida laws. Taking this step can safeguard your future and provide clarity for your loved ones.