What is a Florida Golf Cart Bill of Sale?

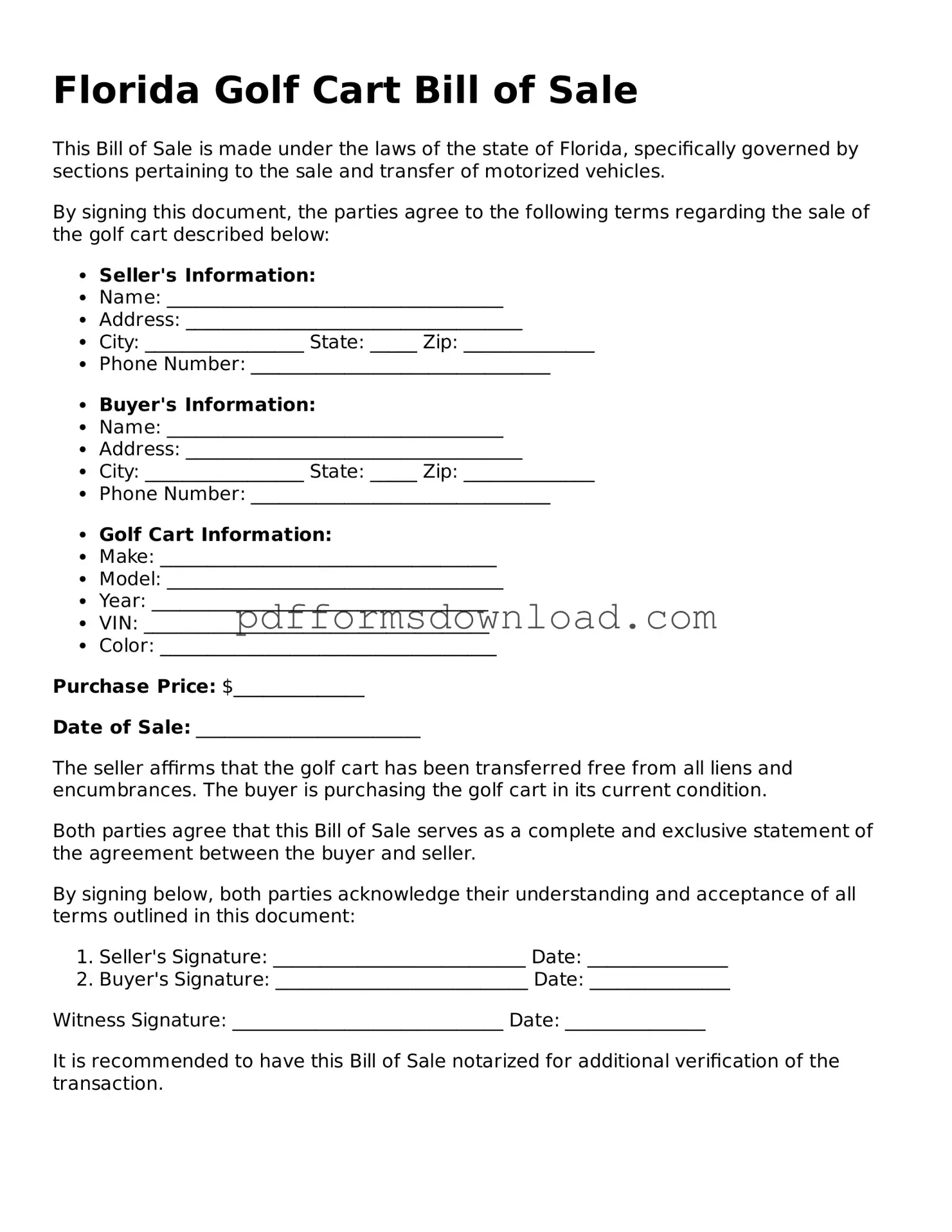

A Florida Golf Cart Bill of Sale is a legal document that records the sale of a golf cart between a seller and a buyer. This form includes essential details about the transaction, such as the purchase price, the identification of both parties, and a description of the golf cart being sold. This document serves as proof of ownership and can be important for registration purposes or future resale.

Is a Golf Cart Bill of Sale required in Florida?

While it is not legally required to have a Bill of Sale for a golf cart in Florida, it is highly recommended. This document provides protection for both the buyer and the seller by clearly outlining the terms of the sale. It can help resolve disputes that may arise after the transaction and serves as a record of the transfer of ownership.

What information should be included in the Bill of Sale?

A comprehensive Golf Cart Bill of Sale should include the names and addresses of both the seller and the buyer, the date of the sale, the purchase price, and a detailed description of the golf cart, including its make, model, year, and Vehicle Identification Number (VIN). Additionally, it should specify the condition of the cart at the time of sale and any warranties or guarantees provided by the seller.

Can I create my own Golf Cart Bill of Sale?

Yes, you can create your own Golf Cart Bill of Sale. However, it is essential to ensure that all necessary information is included to protect both parties. Many templates are available online, which can simplify the process. Just make sure to review any document you create to ensure it meets your needs and complies with local laws.

How do I complete the Golf Cart Bill of Sale?

To complete the Golf Cart Bill of Sale, both the seller and buyer should fill out their respective sections with accurate information. The seller should provide details about the golf cart, including its condition, and the buyer should include their contact information. Both parties should then sign and date the document to validate the transaction. It is advisable for both parties to retain a copy for their records.

What if the golf cart has a lien?

If there is a lien on the golf cart, it is crucial to address this before completing the sale. The seller must pay off the lien or obtain a lien release from the lender. This ensures that the buyer receives clear title to the golf cart. It is wise to verify the status of any liens through the appropriate channels before finalizing the transaction.

Do I need to register the golf cart after purchase?

In Florida, golf carts must be registered if they are going to be operated on public roads. After purchasing a golf cart, the buyer should check with their local Department of Motor Vehicles (DMV) to determine the registration requirements. Having a Bill of Sale can facilitate this process, as it serves as proof of ownership.

Can I use the Bill of Sale for tax purposes?

Yes, a Golf Cart Bill of Sale can be used for tax purposes. It serves as proof of purchase and can help establish the cost basis for any future tax assessments. Buyers should keep this document in a safe place, as it may be required when filing taxes or if questions arise regarding the purchase.