What is a Lady Bird Deed in Florida?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners in Florida to transfer their real estate to their beneficiaries while retaining the right to live in and use the property during their lifetime. This type of deed is unique because it enables the property owner to maintain control over the property, including the ability to sell or mortgage it, without the need for the beneficiaries' consent. Upon the owner's death, the property automatically transfers to the designated beneficiaries, bypassing the probate process.

Who should consider using a Lady Bird Deed?

This deed is particularly beneficial for homeowners who want to ensure a smooth transfer of their property to their heirs while avoiding the complexities of probate. It is often used by individuals who wish to keep their property within the family, especially elderly homeowners looking to protect their assets from Medicaid claims or other creditors. If you want to maintain control over your property and simplify the inheritance process for your loved ones, a Lady Bird Deed might be a suitable option.

What are the benefits of a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed. Firstly, it allows the property owner to retain full control of the property during their lifetime. Secondly, it avoids probate, which can be time-consuming and costly. Additionally, it can protect the property from Medicaid claims, as the property is not considered part of the owner's estate upon death. Lastly, it provides a straightforward way to transfer property to heirs, ensuring that the owner’s wishes are honored without legal complications.

Are there any drawbacks to a Lady Bird Deed?

While a Lady Bird Deed has many benefits, it may not be suitable for everyone. One potential drawback is that the property may still be subject to certain liens or claims during the owner's lifetime. Furthermore, if the owner wishes to sell the property, they must ensure that the deed is properly updated. Lastly, this type of deed may not be recognized in all states, so if you or your heirs move out of Florida, it may not have the same effect elsewhere.

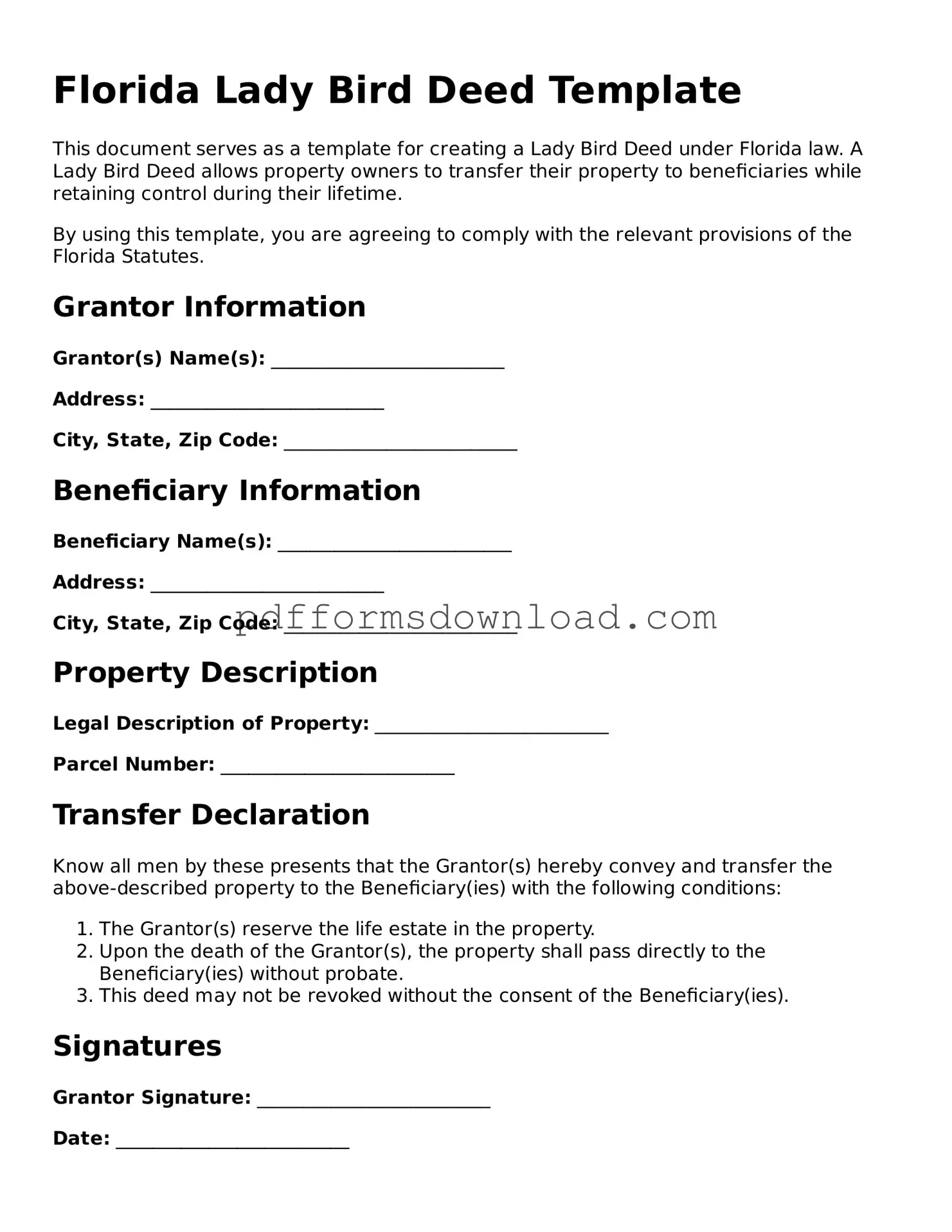

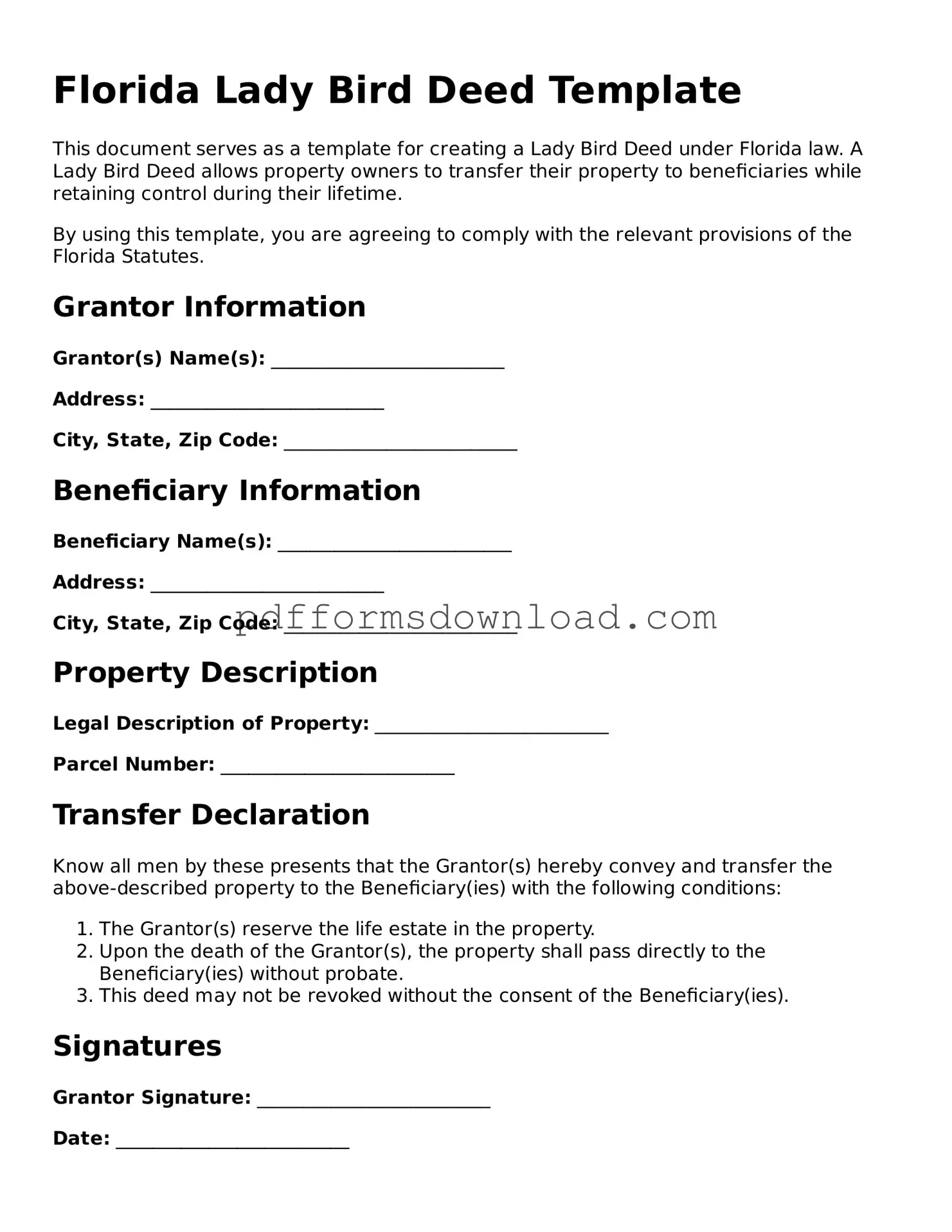

How do I create a Lady Bird Deed in Florida?

Creating a Lady Bird Deed in Florida typically involves drafting the deed with the necessary legal language and details about the property and beneficiaries. It is advisable to work with a qualified attorney or a legal professional familiar with Florida real estate law to ensure that the deed is correctly executed and recorded. After the deed is prepared, it must be signed and notarized, then filed with the county clerk’s office where the property is located. This process helps to ensure that the deed is legally binding and enforceable.