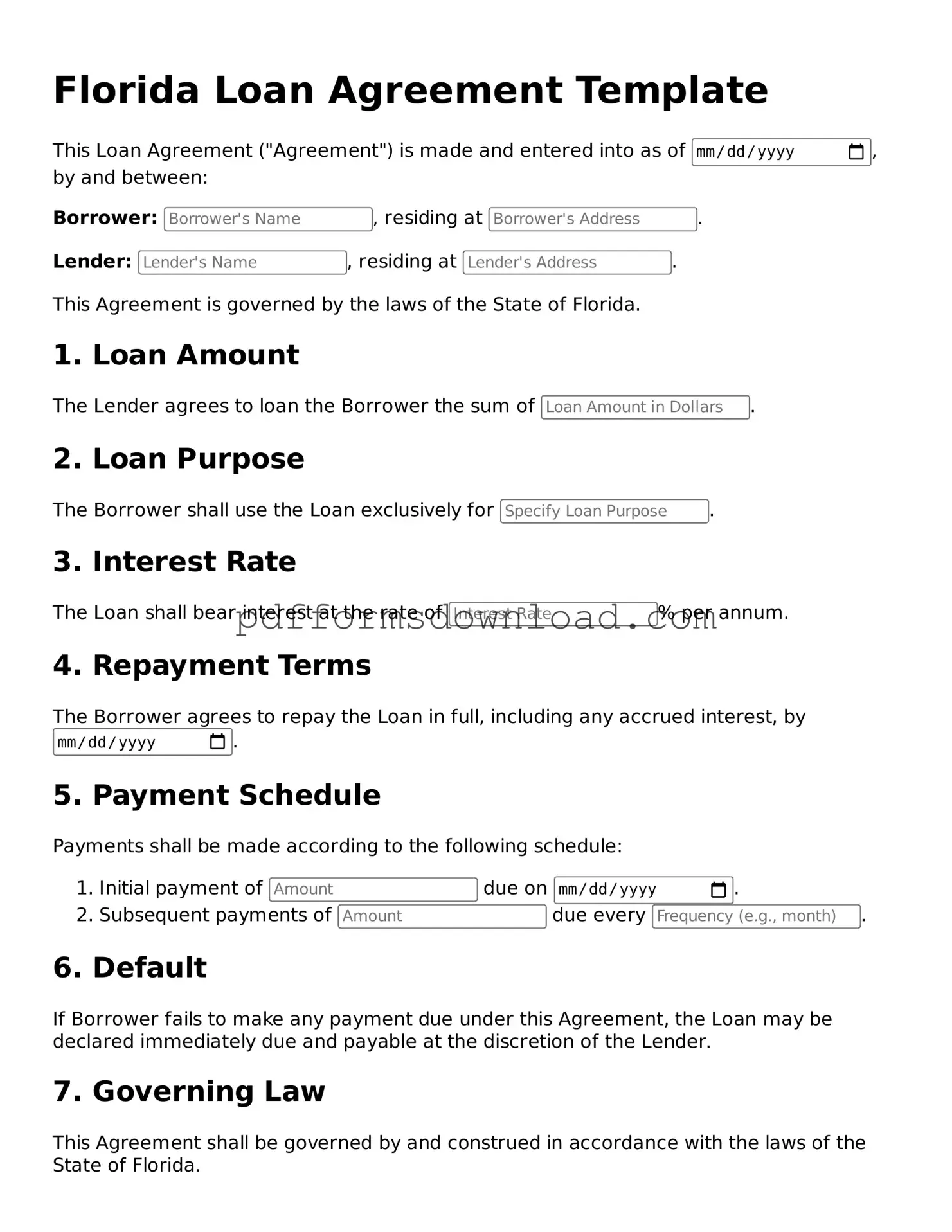

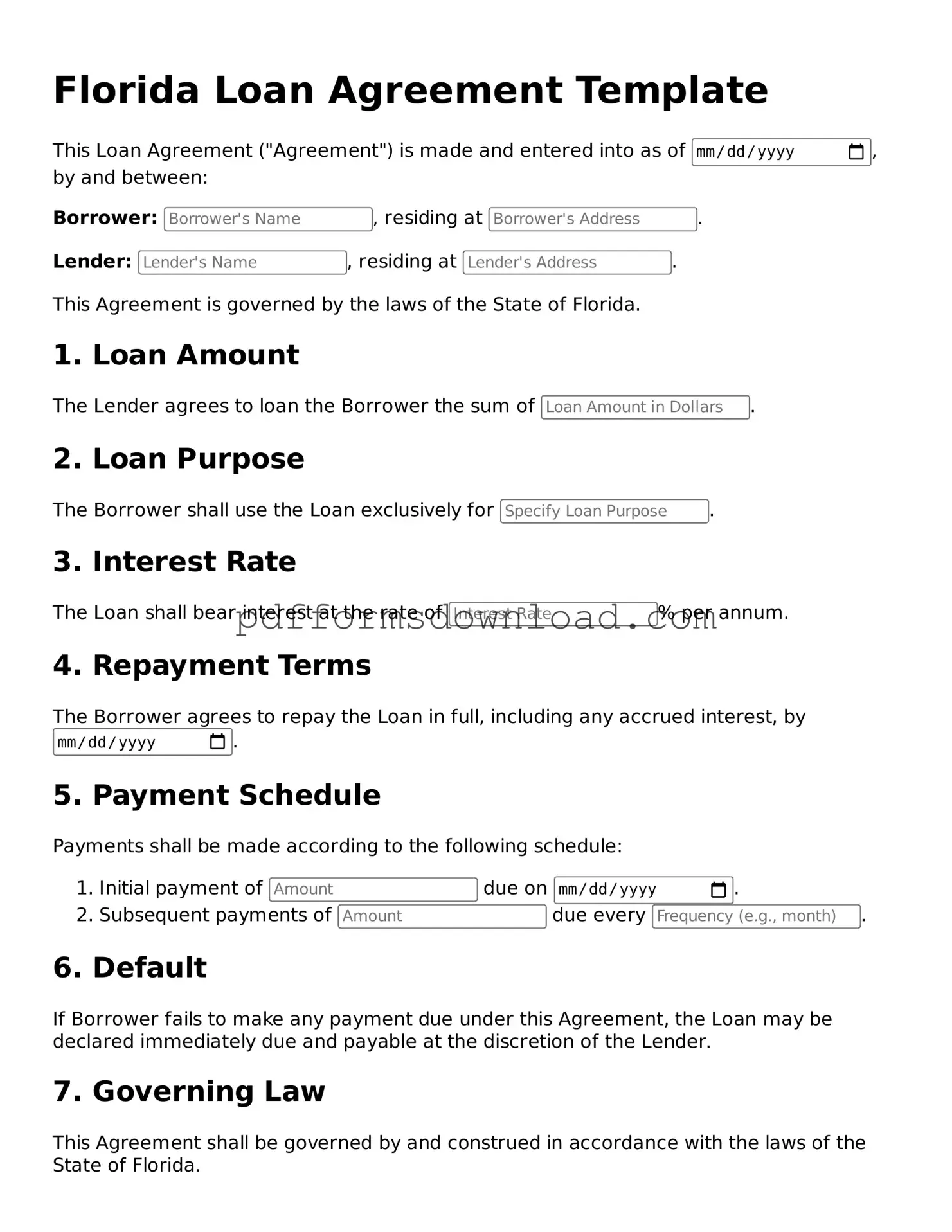

Printable Florida Loan Agreement Form

A Florida Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This form details the amount borrowed, interest rates, repayment schedule, and other essential terms. To ensure a clear understanding of the agreement, it is important to fill out the form accurately by clicking the button below.

Make This Document Now

Printable Florida Loan Agreement Form

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Loan Agreement online — edit, save, and download easily.