What is a Florida Power of Attorney form?

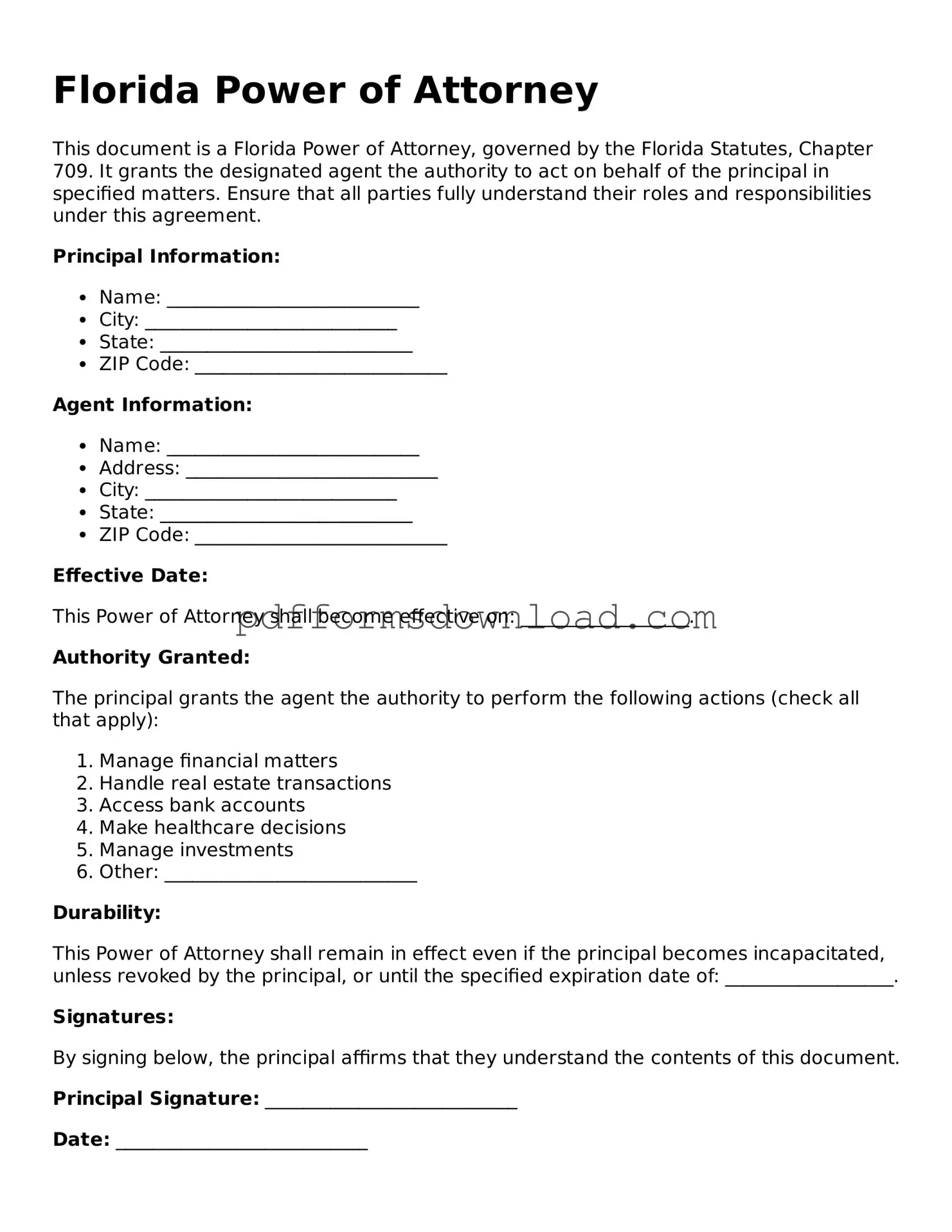

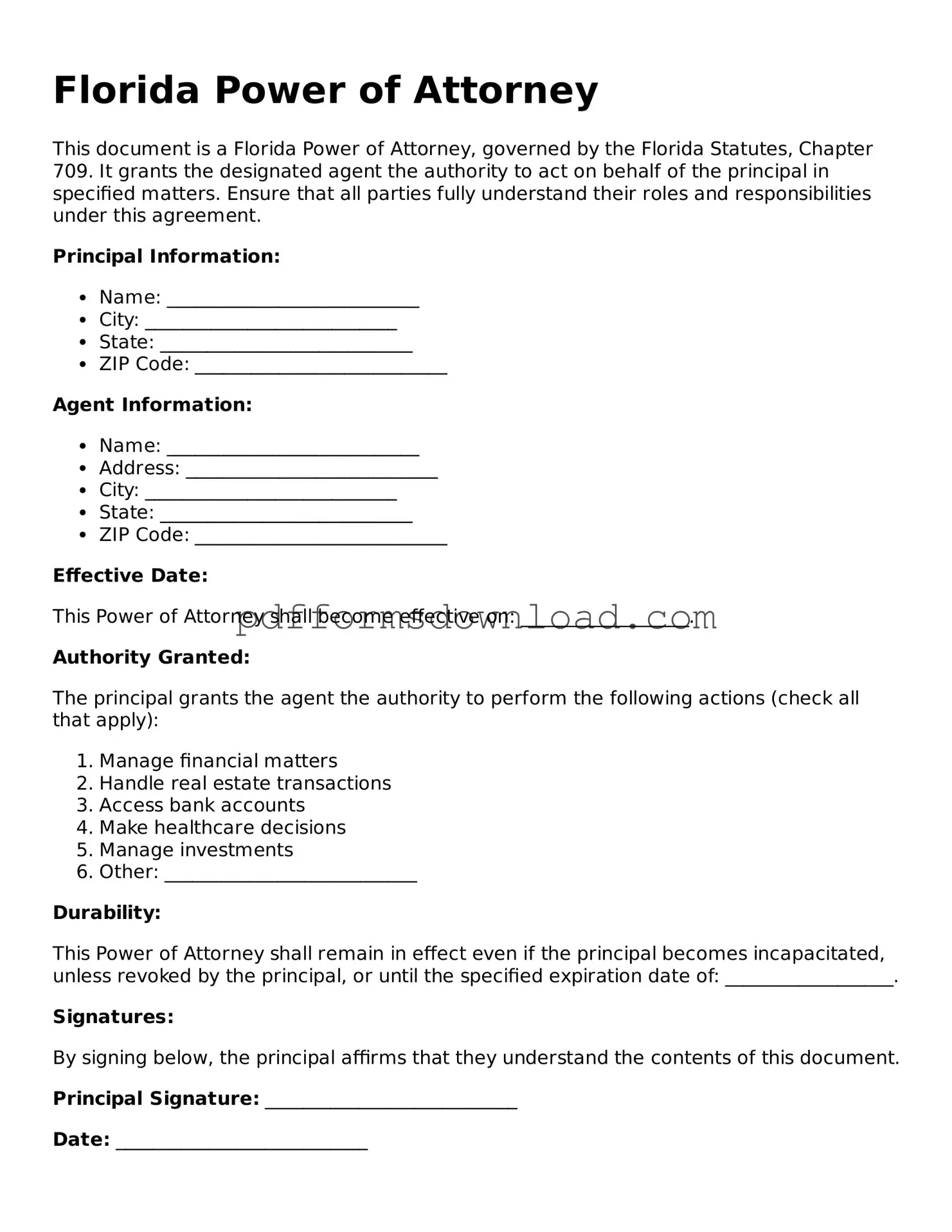

A Florida Power of Attorney form is a legal document that allows one person, known as the principal, to appoint another person, known as the agent or attorney-in-fact, to act on their behalf. This document grants the agent the authority to make decisions regarding financial matters, healthcare, or other specific tasks as defined by the principal.

What types of Power of Attorney are available in Florida?

In Florida, there are several types of Power of Attorney forms. The most common include a General Power of Attorney, which grants broad powers to the agent; a Limited Power of Attorney, which restricts the agent's authority to specific tasks; and a Durable Power of Attorney, which remains effective even if the principal becomes incapacitated. Additionally, there is a Healthcare Power of Attorney, which allows the agent to make medical decisions for the principal if they are unable to do so themselves.

How do I create a Power of Attorney in Florida?

To create a Power of Attorney in Florida, the principal must complete a Power of Attorney form that meets state requirements. The document must be signed by the principal and witnessed by two individuals or notarized. It is advisable to ensure that the form clearly states the powers granted to the agent and any limitations. Consulting with a legal professional can help ensure that the form is valid and meets your specific needs.

Can I revoke a Power of Attorney in Florida?

Yes, a Power of Attorney can be revoked in Florida. The principal must create a written revocation notice and notify the agent and any third parties who may rely on the Power of Attorney. It is important to ensure that the revocation is executed properly to avoid any confusion regarding the agent's authority.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, a Durable Power of Attorney remains in effect, allowing the agent to continue making decisions on their behalf. If a non-durable Power of Attorney is in place, it will become void upon the principal's incapacitation. It is crucial to specify in the document whether the Power of Attorney is durable to ensure continuity of decision-making.

Is it necessary to have a lawyer to create a Power of Attorney in Florida?

While it is not legally required to have a lawyer to create a Power of Attorney in Florida, seeking legal advice can provide clarity and ensure that the document meets all legal requirements. A lawyer can help tailor the document to your specific needs and circumstances, which can be particularly beneficial in complex situations.