What is a Florida Promissory Note?

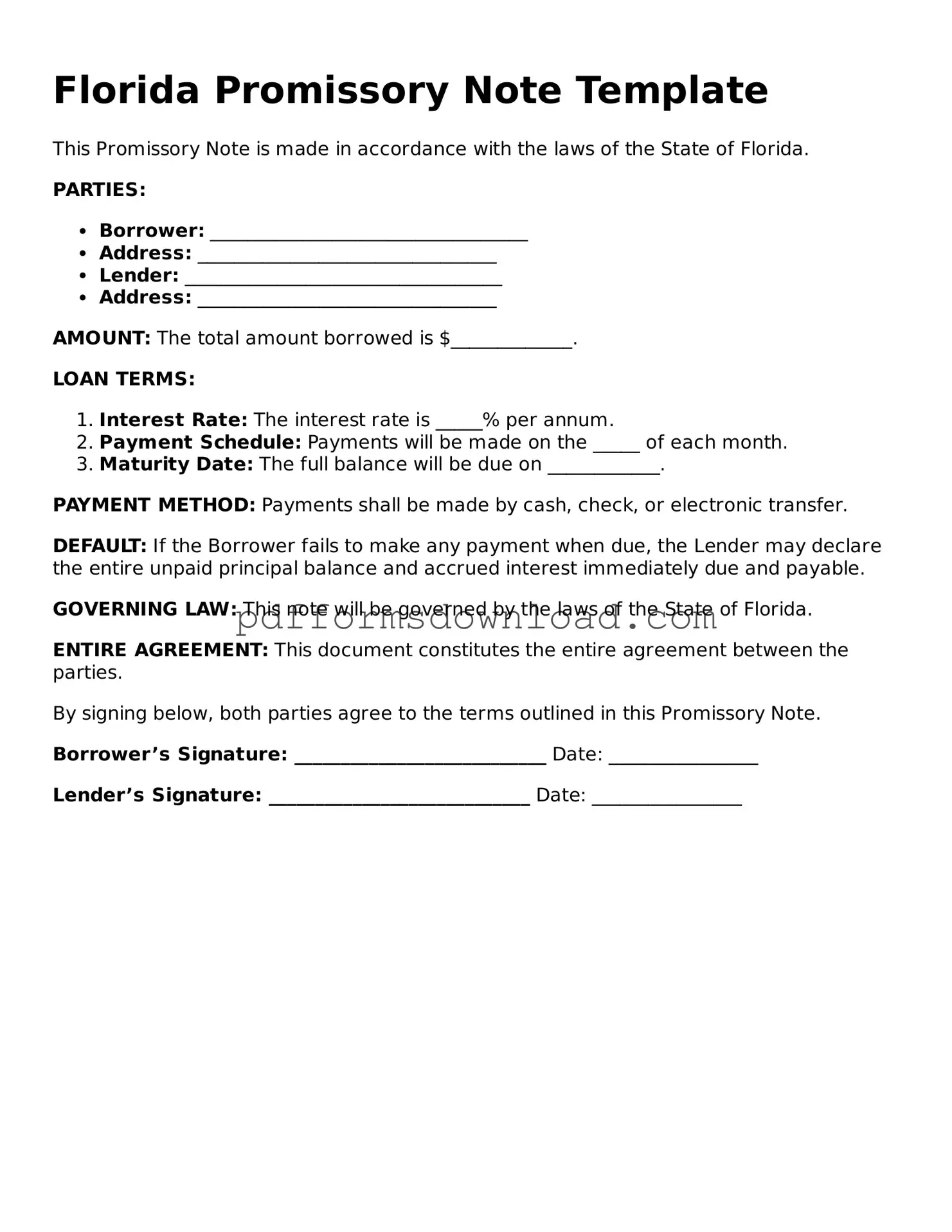

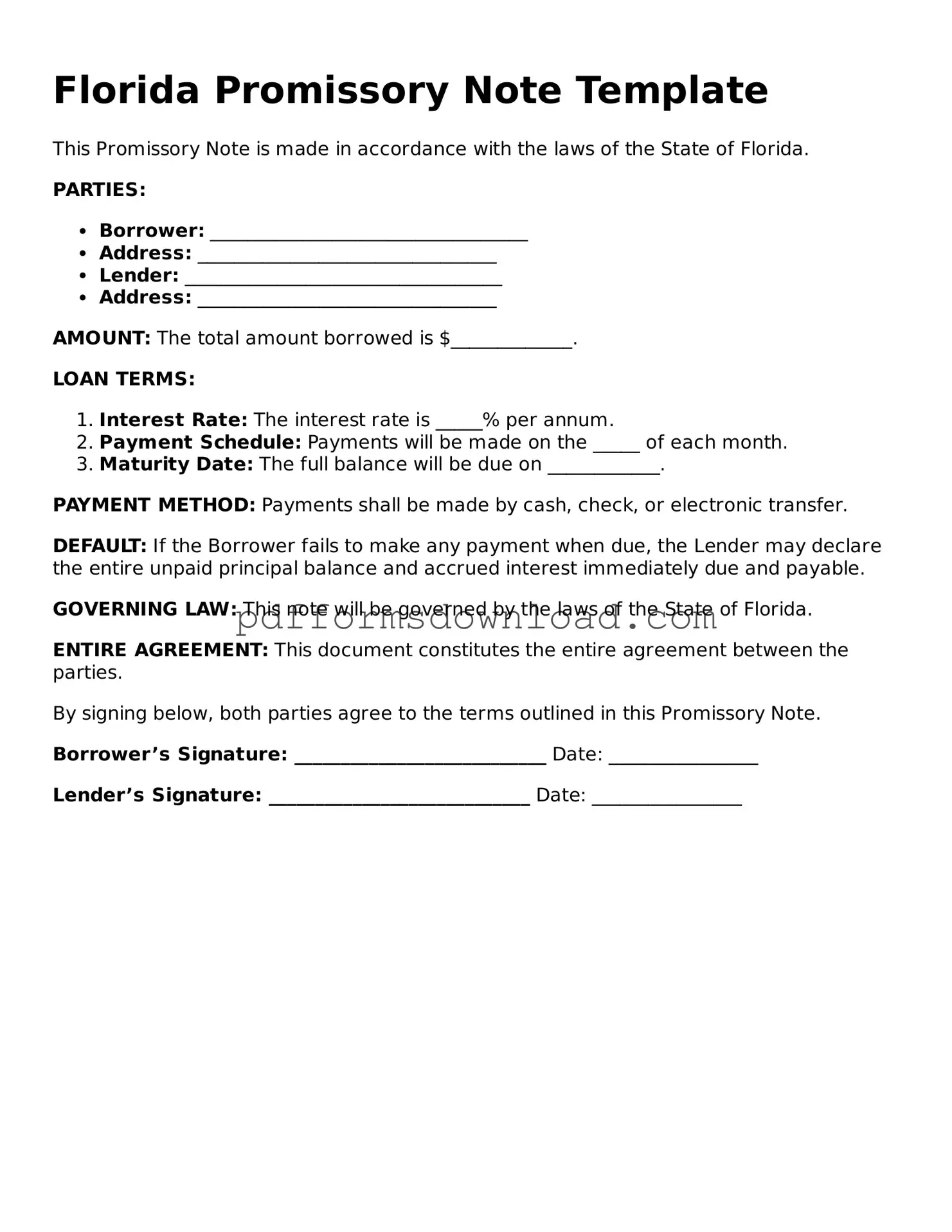

A Florida Promissory Note is a legal document that serves as a written promise from one party to pay a specific sum of money to another party under agreed-upon terms. This document outlines the loan amount, interest rate, repayment schedule, and other important conditions. It acts as a record of the debt and can be enforced in court if necessary.

Who can use a Promissory Note in Florida?

Any individual or business can use a Promissory Note in Florida. Whether you are lending money to a friend, family member, or a business, having a written note protects both parties. It clarifies the terms and helps avoid misunderstandings in the future.

What are the essential components of a Florida Promissory Note?

A well-drafted Promissory Note should include the following key components: the names of the borrower and lender, the loan amount, the interest rate (if applicable), the repayment schedule, and any collateral securing the loan. Additionally, it should specify what happens in case of default, including any penalties or fees.

Do I need a lawyer to create a Promissory Note in Florida?

While it is not legally required to hire a lawyer to create a Promissory Note, doing so can be beneficial. A legal professional can ensure that the document is properly drafted and complies with Florida laws. This can provide peace of mind and help avoid potential disputes down the line.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note. This helps maintain clarity and protects the interests of both the borrower and lender.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They can pursue legal action to recover the owed amount, potentially leading to a court judgment. The terms of the Promissory Note will dictate the lender's rights and remedies in the event of default, so it is crucial to understand these provisions beforehand.

Is a Promissory Note enforceable in Florida?

Yes, a properly executed Promissory Note is enforceable in Florida. If the borrower fails to repay the loan as agreed, the lender can take legal action to collect the debt. Having a signed note strengthens the lender's position in court, making it easier to recover the owed amount.

Are there any tax implications related to a Promissory Note?

Yes, there can be tax implications associated with a Promissory Note. For example, the lender may need to report interest income on their tax return, while the borrower may be able to deduct interest payments if the loan qualifies. It is advisable to consult a tax professional to understand the specific implications based on your situation.