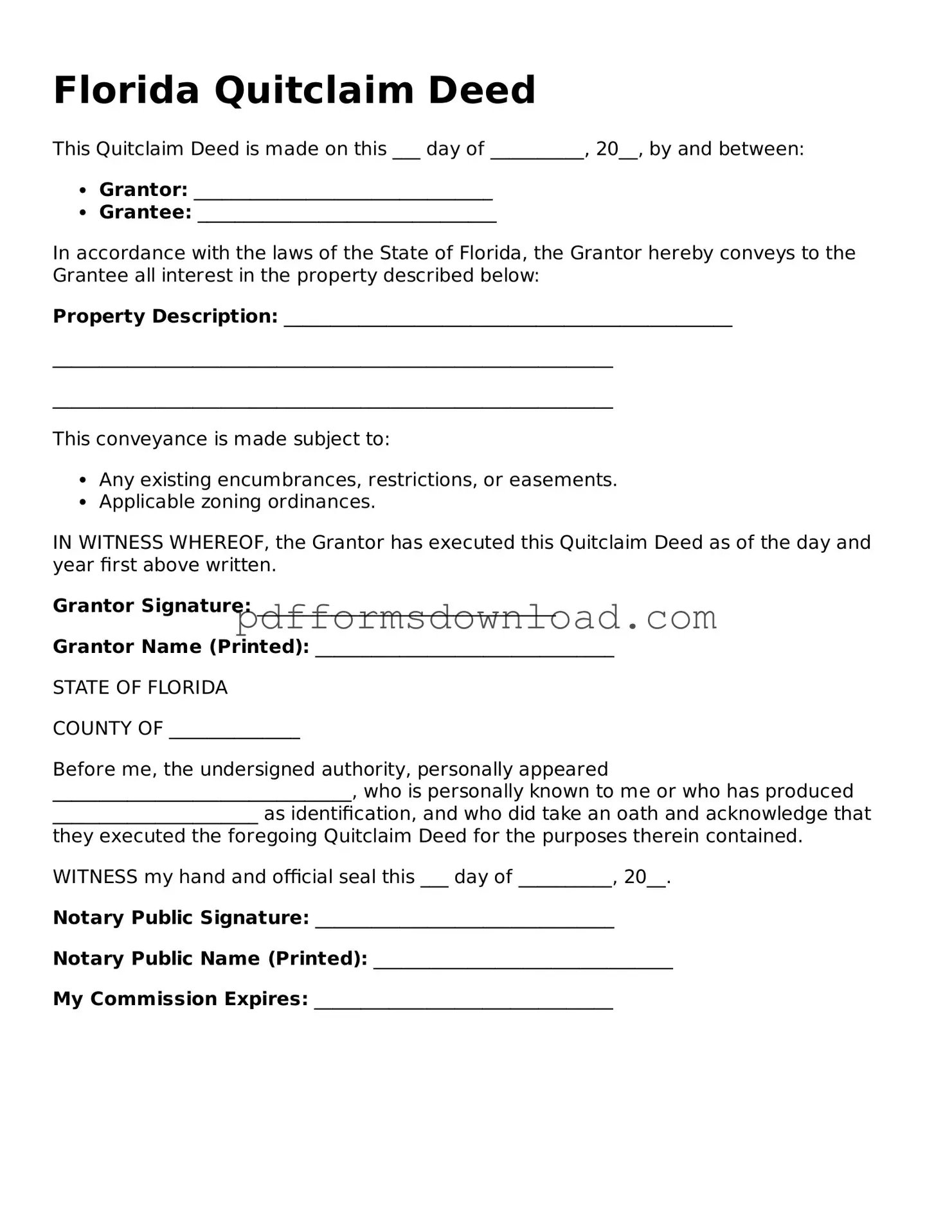

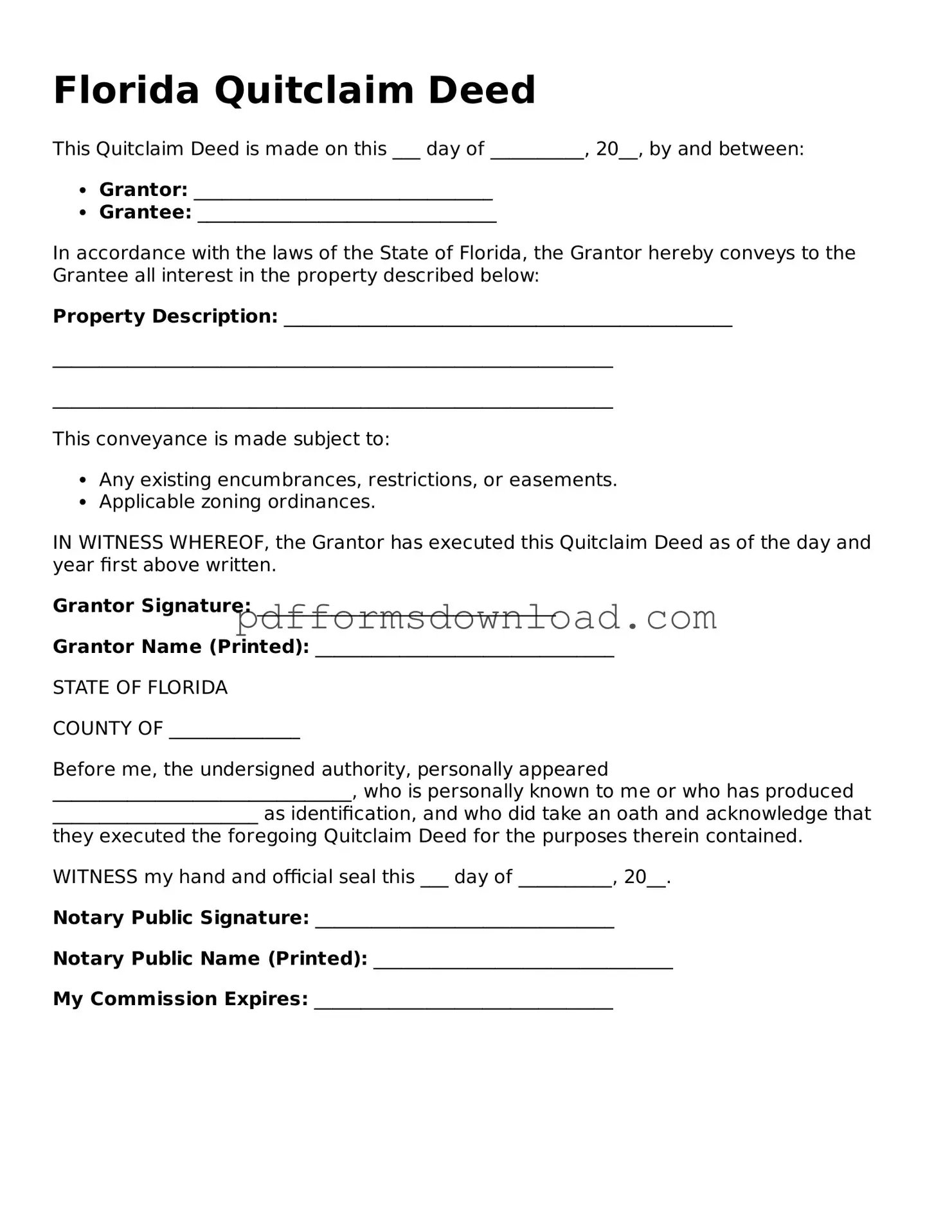

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another without any warranties or guarantees. This means the person transferring the property does not guarantee that they own the property free and clear of any claims or liens. It’s often used in situations like transferring property between family members or in divorce settlements.

You might consider using a Quitclaim Deed in various situations, such as gifting property to a relative, transferring property to a trust, or when changing the title after a divorce. It's a straightforward way to transfer ownership without the complexities of a warranty deed.

What information is needed to complete a Quitclaim Deed?

To complete a Quitclaim Deed, you will need the names and addresses of both the grantor (the person transferring the property) and the grantee (the person receiving the property). You will also need a legal description of the property, which can typically be found on the current deed or property tax records.

How do I file a Quitclaim Deed in Florida?

To file a Quitclaim Deed in Florida, you must first complete the form accurately. After signing it in front of a notary public, you can file it with the county clerk's office where the property is located. There may be a filing fee, so check with the local office for specific requirements.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides guarantees about the property’s title and protects the buyer against any future claims. In contrast, a Quitclaim Deed offers no such protections, making it a riskier option for the grantee.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and filed, it generally cannot be revoked unilaterally. However, the original grantor may be able to create a new deed to transfer the property back, or both parties may agree to a new arrangement. Legal advice is recommended in such situations.

Are there tax implications when using a Quitclaim Deed?

There can be tax implications when transferring property via a Quitclaim Deed, particularly regarding gift taxes if the property is given without compensation. It’s important to consult with a tax professional to understand any potential tax consequences based on your specific situation.

What happens if the Quitclaim Deed is not recorded?

If a Quitclaim Deed is not recorded, the transfer of ownership may not be recognized by third parties. This can lead to complications, especially if the grantor attempts to sell the property again or if disputes arise. Recording the deed provides public notice of the ownership change.

Can a Quitclaim Deed be used to transfer property to a business entity?

Yes, a Quitclaim Deed can be used to transfer property to a business entity, such as an LLC or corporation. However, it’s important to ensure that the deed is properly executed and that the entity is correctly identified to avoid any legal issues in the future.