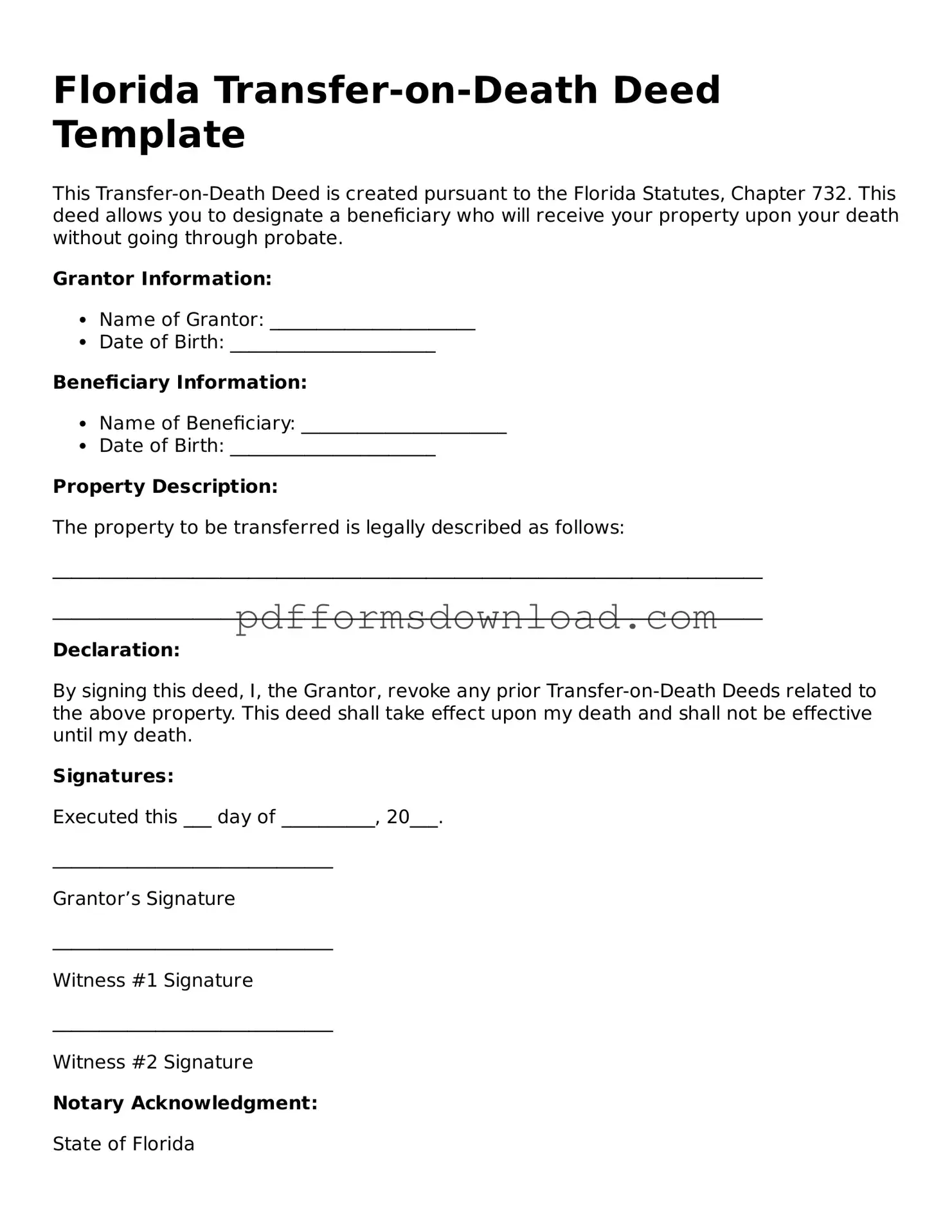

Printable Florida Transfer-on-Death Deed Form

The Florida Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This form provides a straightforward way to ensure that loved ones receive property directly, simplifying the process during a difficult time. To get started with this important document, fill out the form by clicking the button below.

Make This Document Now

Printable Florida Transfer-on-Death Deed Form

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Transfer-on-Death Deed online — edit, save, and download easily.