What is the Free And Invoice PDF form?

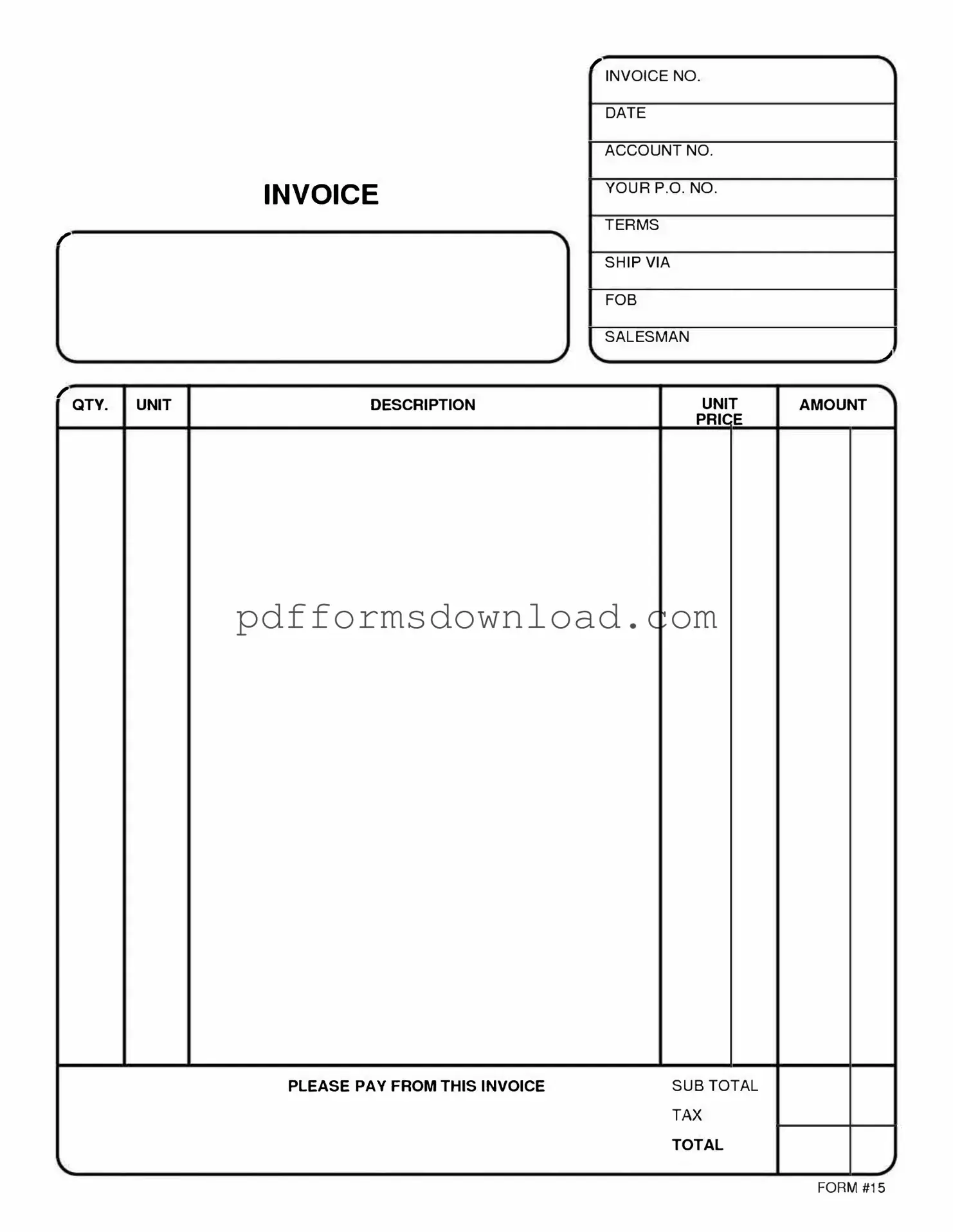

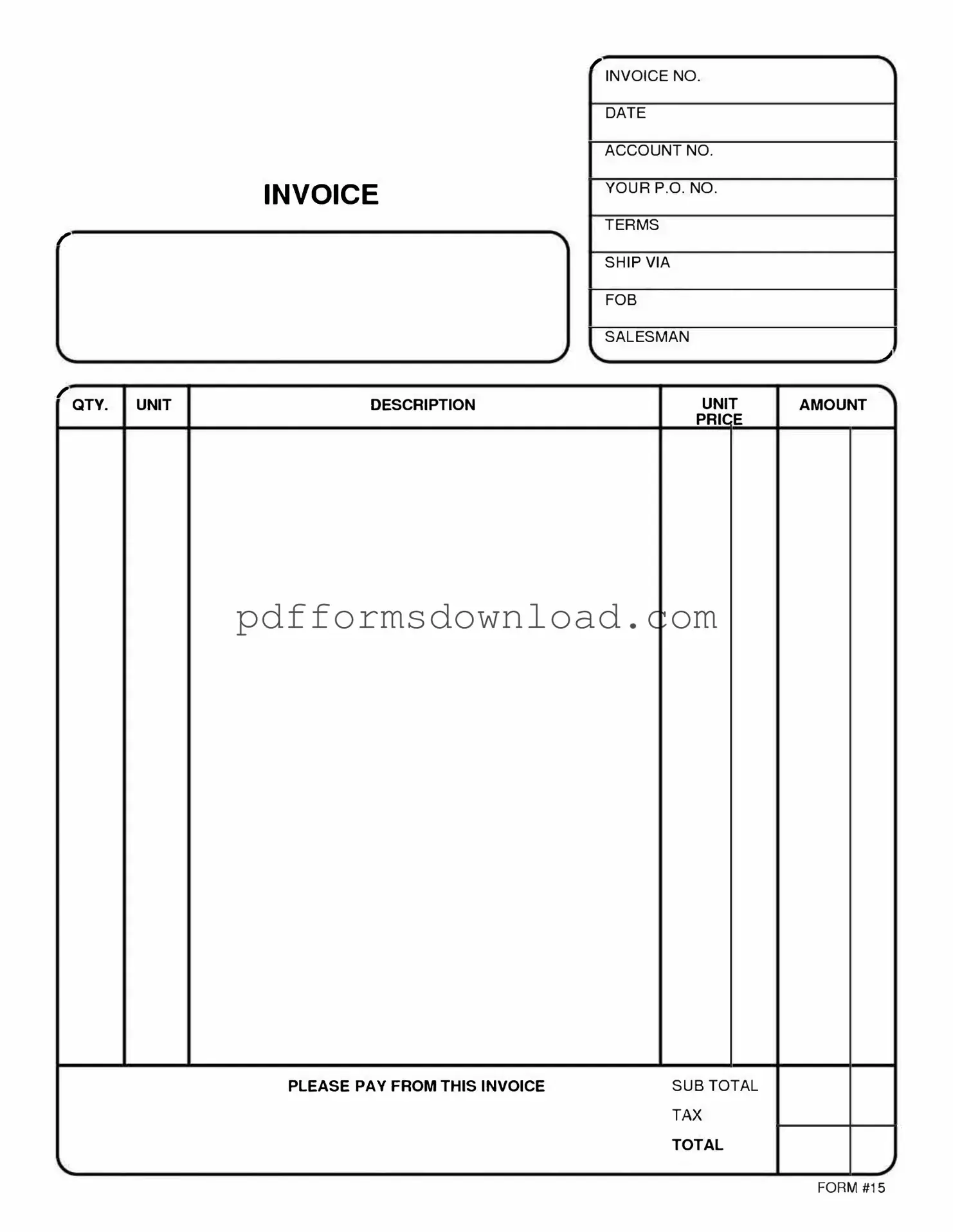

The Free And Invoice PDF form is a document designed to help individuals and businesses create invoices easily. It provides a structured format for detailing services or products rendered, along with the corresponding charges. This form can be filled out and customized to meet specific needs, making it a valuable tool for efficient billing.

How can I access the Free And Invoice PDF form?

You can access the Free And Invoice PDF form online. Many websites offer downloadable versions that can be filled out digitally or printed for manual completion. Simply search for “Free And Invoice PDF form” to find various options that suit your needs.

Is the Free And Invoice PDF form really free?

Yes, the Free And Invoice PDF form is available at no cost. However, while the form itself is free, some platforms may offer additional features or templates for a fee. Always check the terms of use on the website you choose to ensure you understand any potential costs.

Can I customize the Free And Invoice PDF form?

Absolutely! The Free And Invoice PDF form is designed to be customizable. You can add your business logo, change the colors, and modify the layout to reflect your branding. This flexibility allows you to create a professional-looking invoice that meets your specific requirements.

What information should I include in the Free And Invoice PDF form?

When filling out the Free And Invoice PDF form, include essential details such as your business name, contact information, invoice number, date, itemized list of services or products, prices, and payment terms. Ensuring all relevant information is present will help facilitate timely payments.

Can I use the Free And Invoice PDF form for international transactions?

Yes, the Free And Invoice PDF form can be used for international transactions. However, it is important to consider currency differences and any additional information that may be required for international billing, such as tax identification numbers or customs information.

How do I send the completed Free And Invoice PDF form to my clients?

Once you have completed the Free And Invoice PDF form, you can send it to your clients via email or traditional mail. If you choose to email it, save the document as a PDF to maintain its formatting. Alternatively, you can print it out and send a physical copy if preferred.

What should I do if I encounter issues with the Free And Invoice PDF form?

If you encounter issues while using the Free And Invoice PDF form, consider checking the website from which you downloaded it for support resources. Many sites provide FAQs or customer service options. Additionally, you can consult online forums or communities for assistance from other users.

Is there a limit to how many invoices I can create using the Free And Invoice PDF form?

There is no inherent limit to the number of invoices you can create using the Free And Invoice PDF form. As long as you have the form saved on your device, you can fill it out as many times as needed. Just ensure that each invoice is uniquely numbered to avoid confusion.