Download Generic Direct Deposit Template

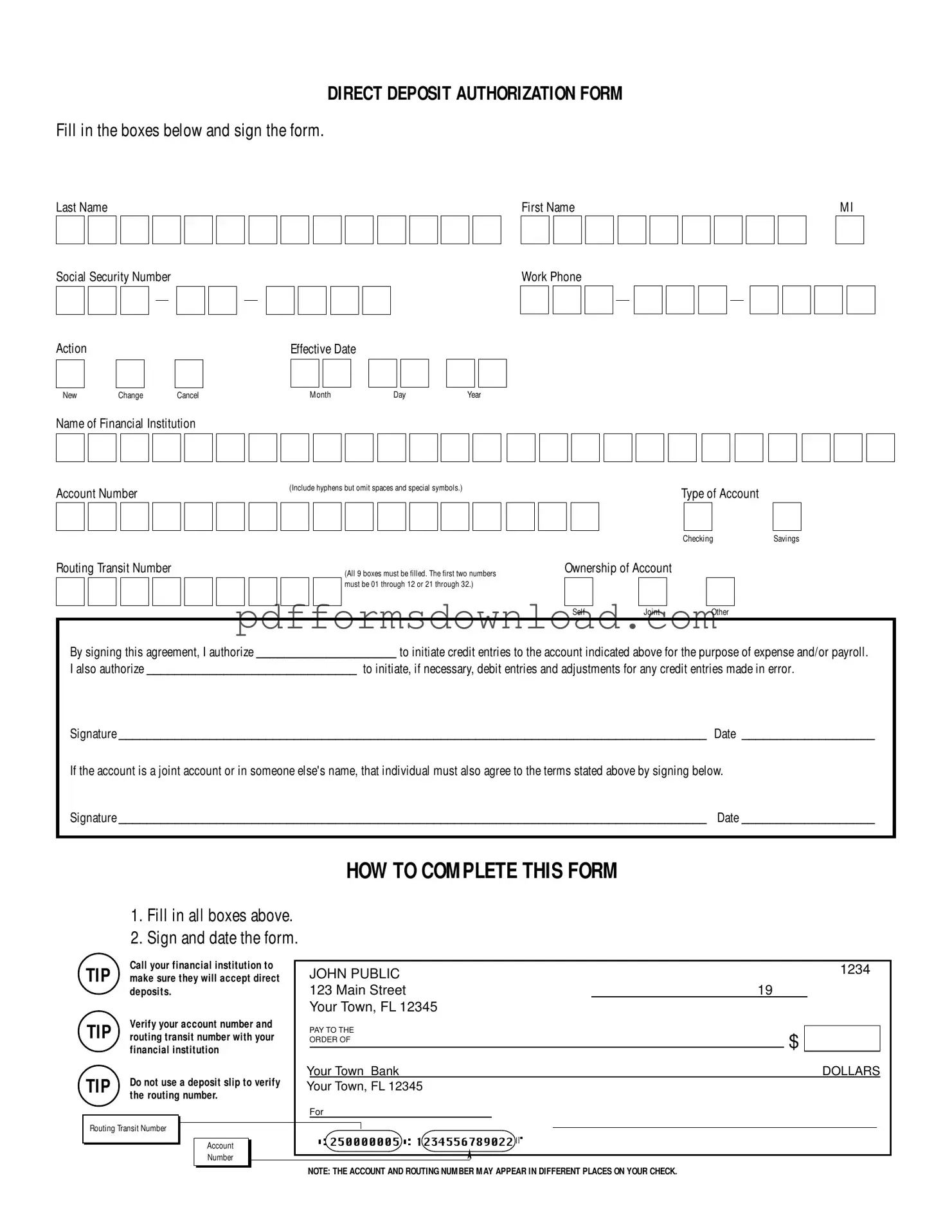

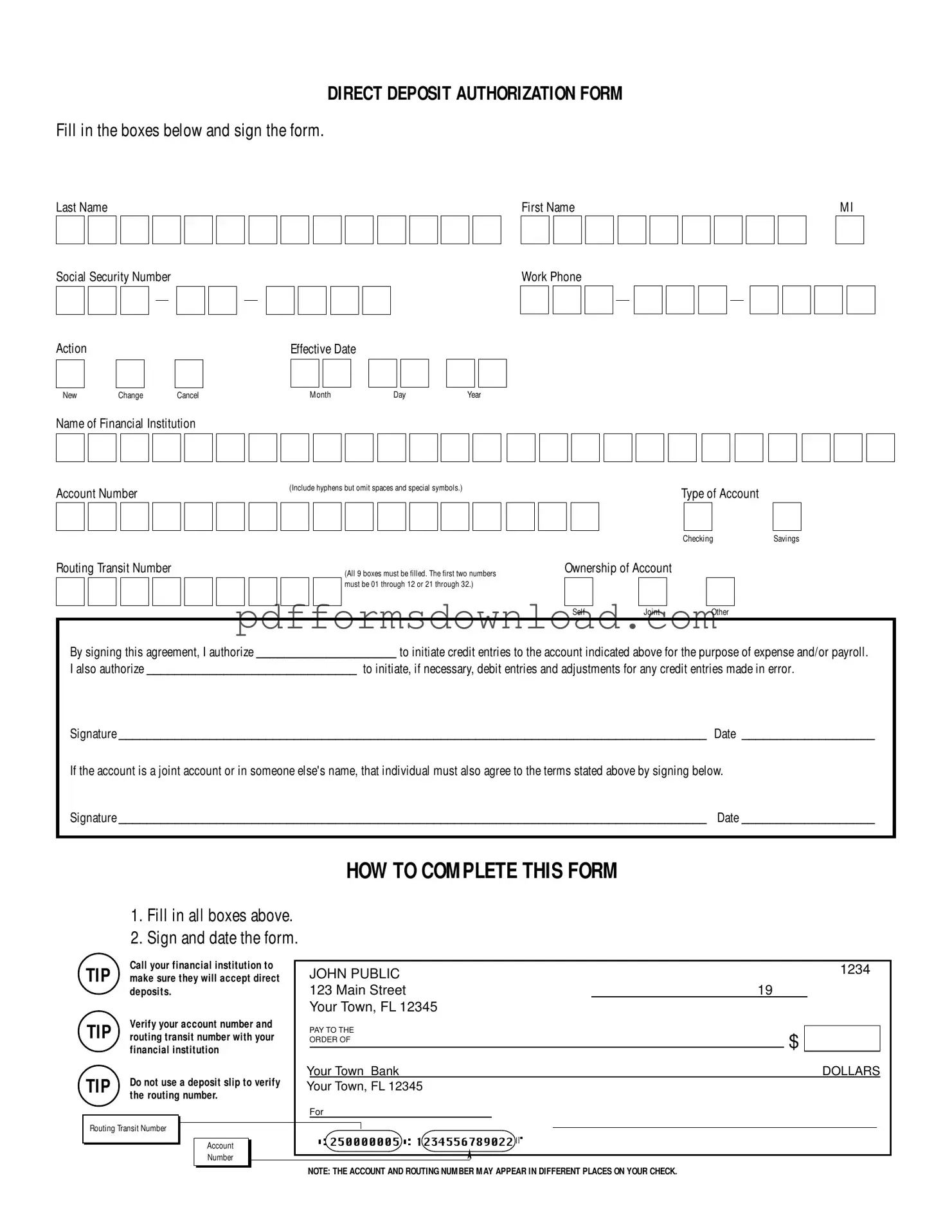

The Generic Direct Deposit Authorization Form is a document that allows individuals to authorize their employer or another entity to deposit funds directly into their bank account. This form requires personal information, including the account holder's name, Social Security number, and banking details. To begin the process of setting up direct deposit, fill out the form by clicking the button below.

Make This Document Now

Download Generic Direct Deposit Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Generic Direct Deposit online — edit, save, and download easily.