What is a Gift Deed?

A Gift Deed is a legal document that transfers ownership of property or assets from one person to another without any exchange of money. This type of deed is often used to give gifts to family members or friends, making it a popular choice for estate planning and asset distribution.

What are the essential elements of a Gift Deed?

To create a valid Gift Deed, certain elements must be present. These include the intent to give, acceptance by the recipient, and the actual transfer of property. The deed should clearly describe the property being gifted and include the names of both the donor and the recipient.

Do I need to have the Gift Deed notarized?

While notarization is not always required, it is highly recommended. A notarized Gift Deed adds an extra layer of authenticity and can help prevent disputes in the future. Some states may have specific requirements regarding notarization, so it’s wise to check local laws.

Can I revoke a Gift Deed after it has been executed?

Generally, once a Gift Deed is executed and the property is transferred, it cannot be revoked. However, there are exceptions, such as if the deed was signed under duress or if the donor was not of sound mind. It is crucial to understand the implications before finalizing a gift.

What types of property can be transferred using a Gift Deed?

A Gift Deed can be used to transfer various types of property, including real estate, vehicles, and personal belongings. However, certain assets, like stocks or bonds, may require different forms of documentation for transfer.

Are there tax implications for giving a gift?

Yes, gifting can have tax implications. The IRS allows individuals to give a certain amount each year without incurring gift tax. If the value of the gift exceeds this annual limit, the donor may need to file a gift tax return. It’s advisable to consult a tax professional to understand the specifics.

Can a minor be a recipient of a Gift Deed?

Yes, a minor can receive a gift. However, because minors cannot legally own property, a guardian or custodian may need to manage the gift until the minor reaches adulthood. Establishing a trust can also be a viable option for managing the gift.

What happens if the recipient refuses the gift?

If the recipient refuses the gift, the Gift Deed becomes void. The donor may then choose to give the property to someone else or retain ownership. It’s important to ensure that the recipient is willing to accept the gift before finalizing the deed.

Is a Gift Deed the same as a Will?

No, a Gift Deed is not the same as a Will. A Gift Deed transfers ownership immediately, while a Will distributes assets after the donor's death. Understanding the differences can help in effective estate planning.

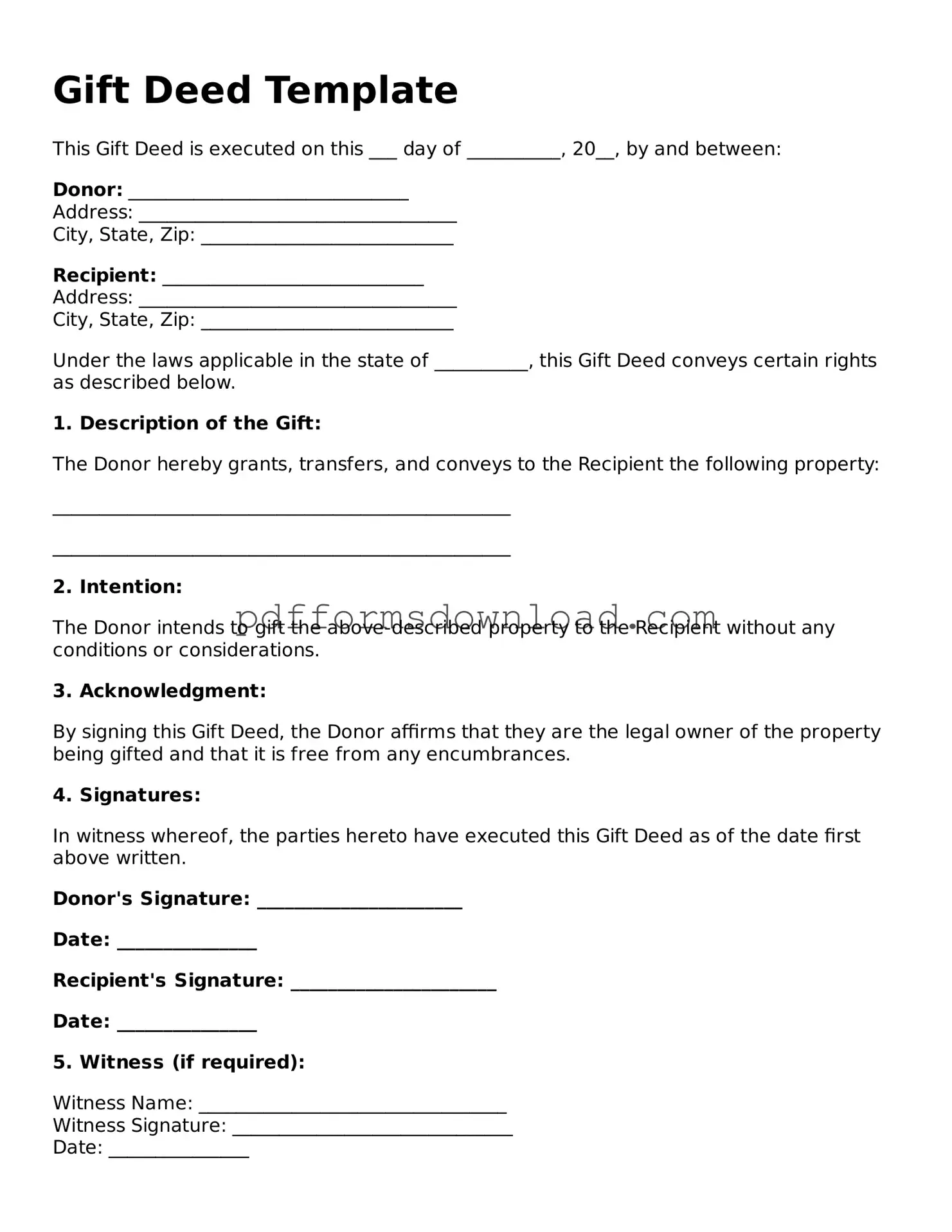

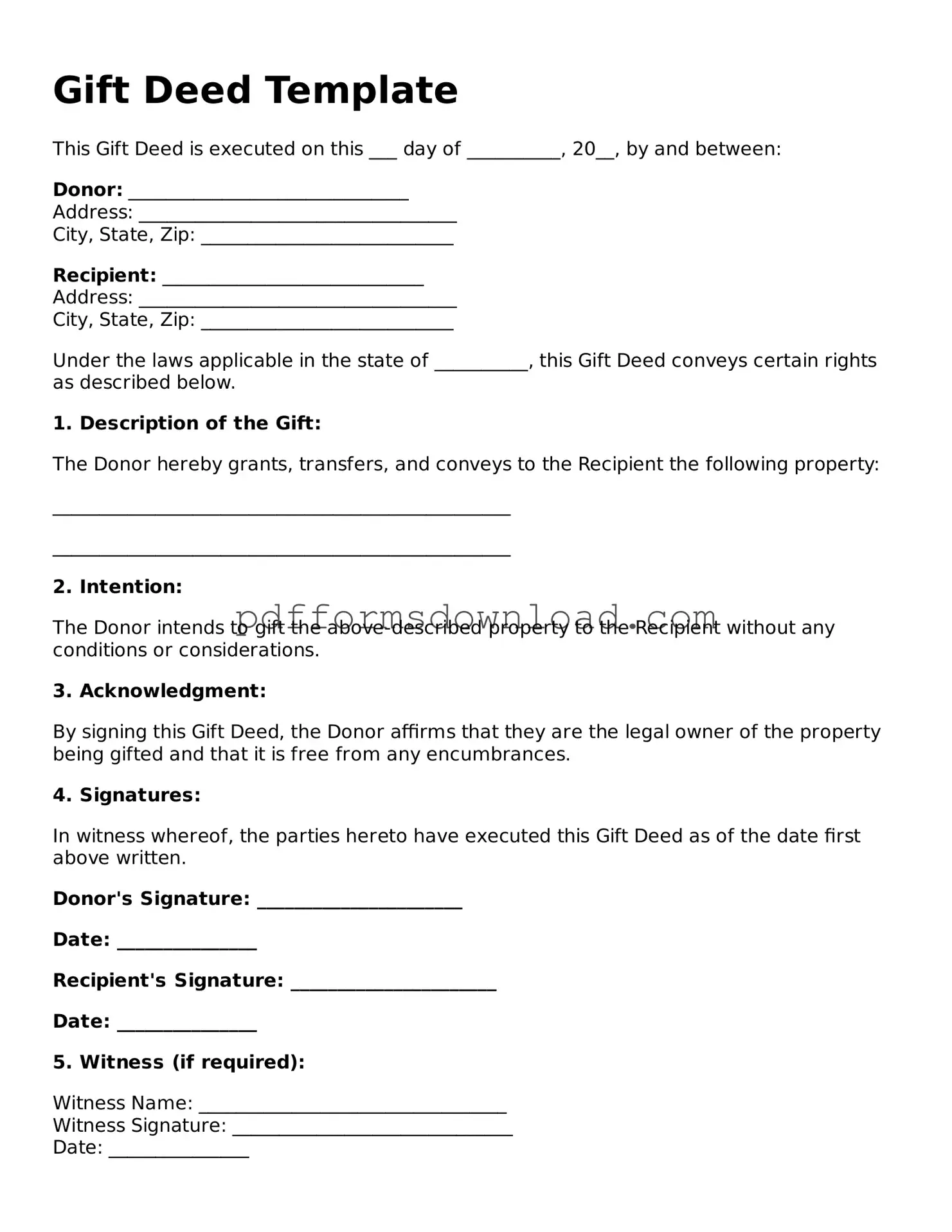

How can I create a Gift Deed?

Creating a Gift Deed typically involves drafting the document, including all necessary details about the property and parties involved. You can find templates online or consult an attorney to ensure it meets legal requirements. Once completed, both parties should sign the deed, and it may be beneficial to have it notarized.