Download Gift Letter Template

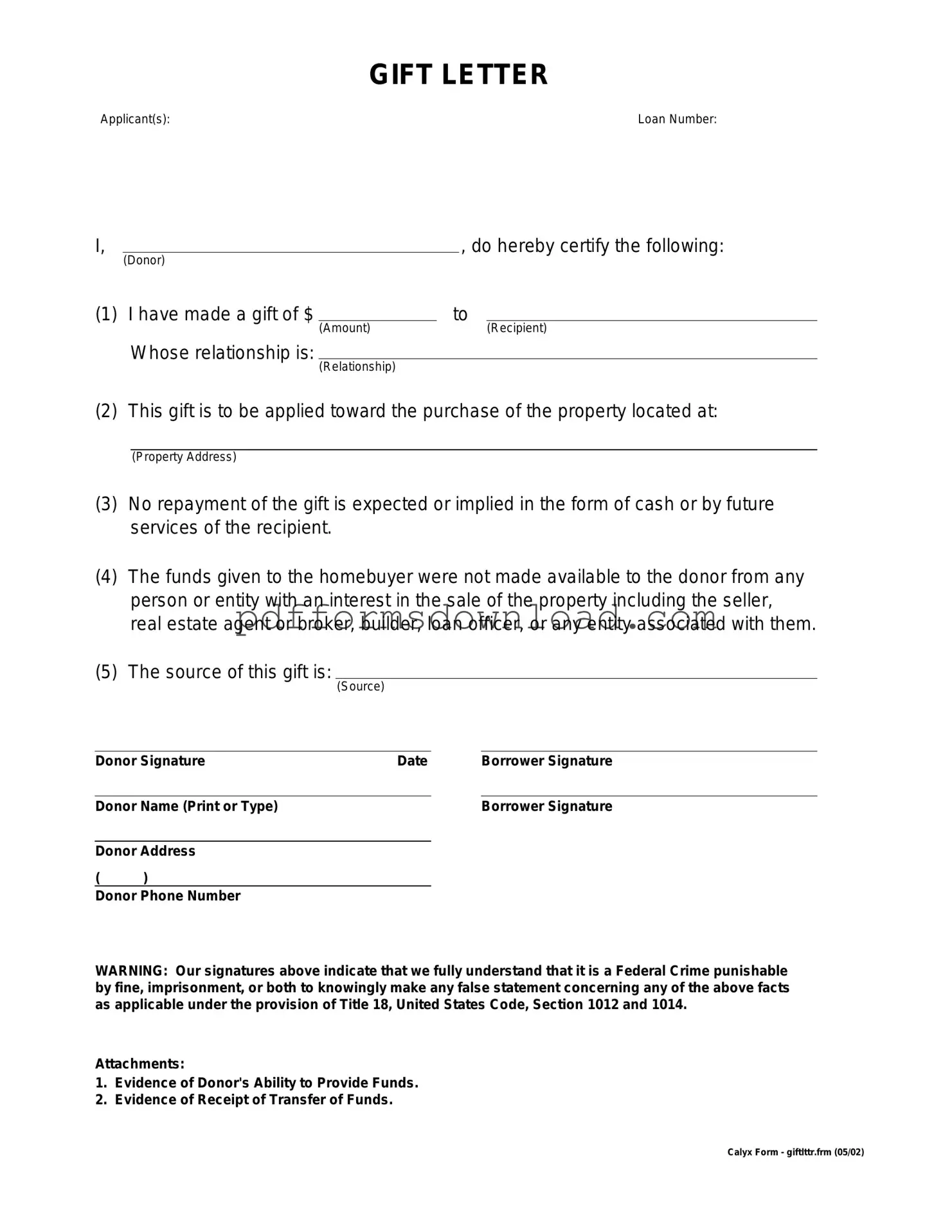

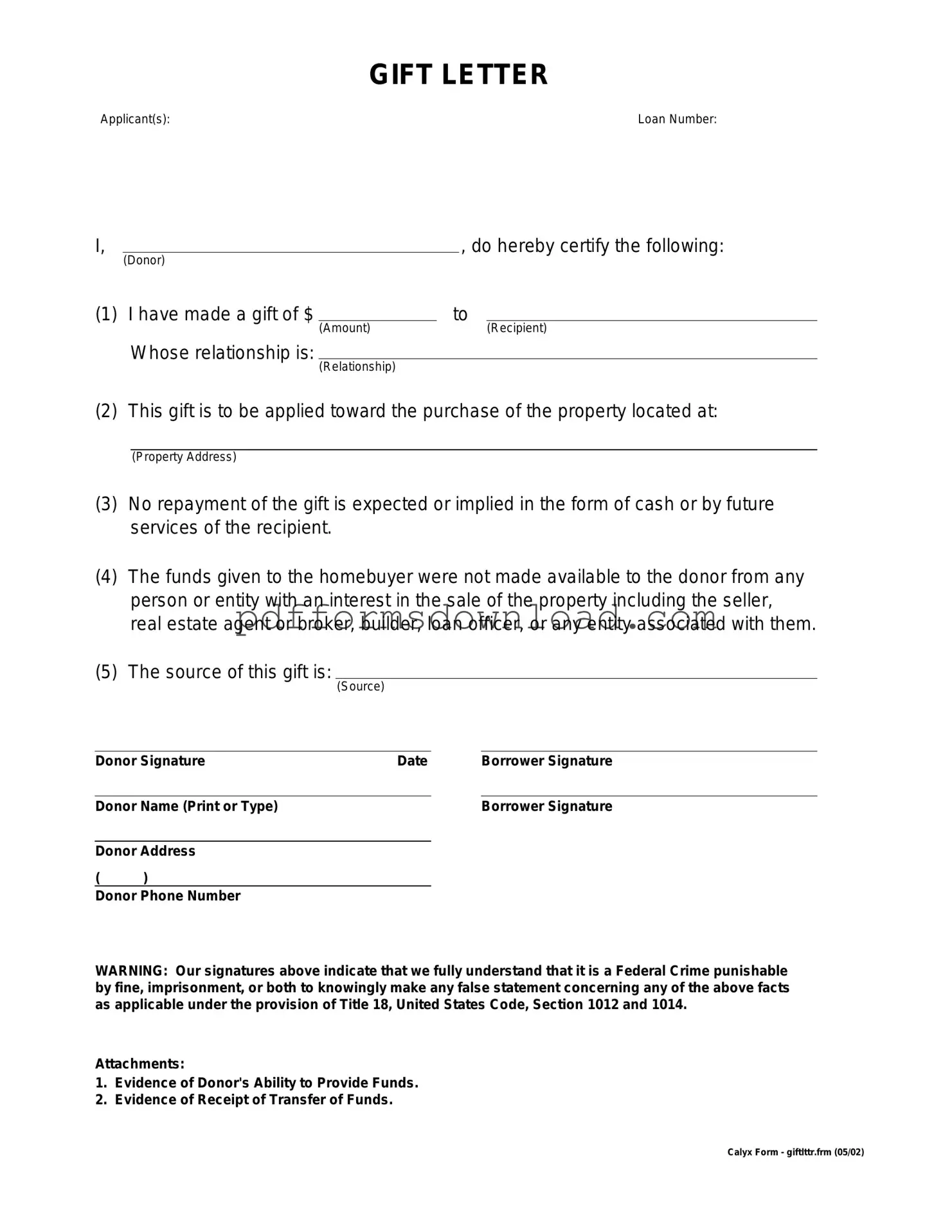

A Gift Letter form is a document that verifies a financial gift given to a borrower, often used in the context of real estate transactions. This form helps lenders confirm that the funds are indeed a gift and not a loan, which can significantly impact the borrower's mortgage application. Understanding its importance is crucial for anyone involved in the home buying process.

To ensure a smooth transaction, consider filling out the Gift Letter form by clicking the button below.

Make This Document Now

Download Gift Letter Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Gift Letter online — edit, save, and download easily.