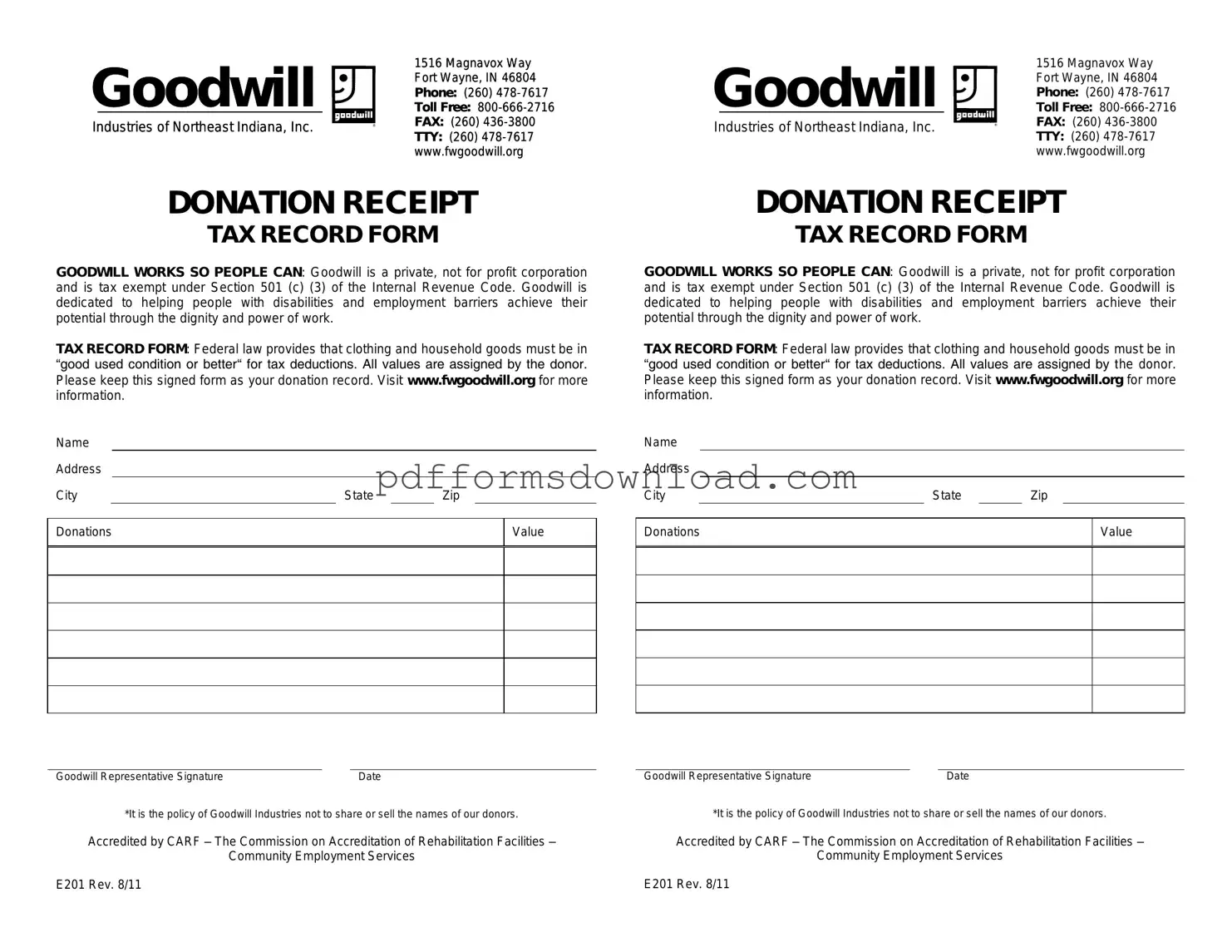

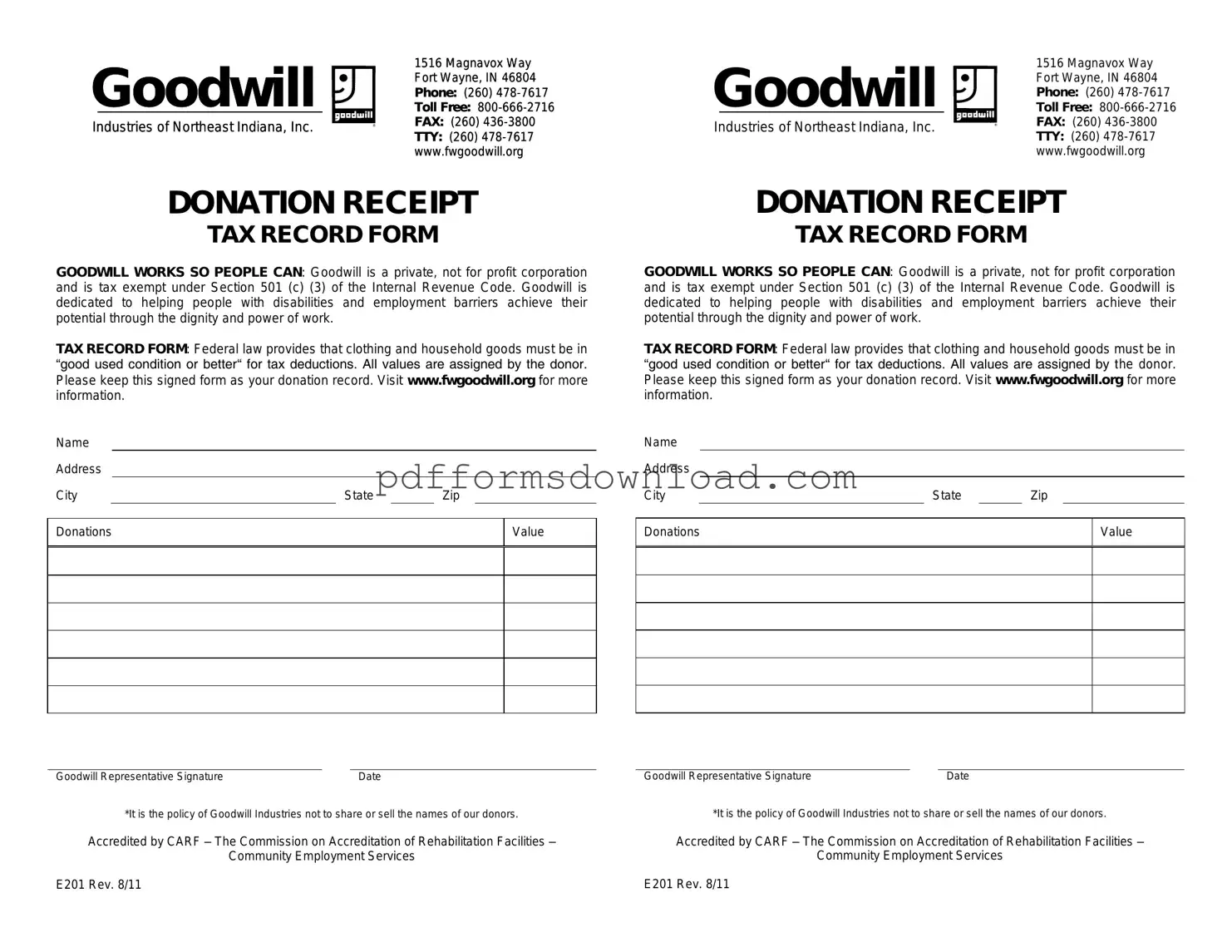

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided to individuals who donate items to Goodwill Industries. This form serves as proof of the donation for tax purposes and includes information about the items donated and their estimated value.

How can I obtain a Goodwill donation receipt?

You can obtain a Goodwill donation receipt at the time of your donation. Simply ask the staff at the donation center for a receipt when you drop off your items. They will provide you with a form to fill out or a pre-printed receipt based on your donation.

What information is included on the receipt?

The receipt typically includes the name and address of the donor, the date of the donation, a description of the items donated, and a statement indicating that no goods or services were received in exchange for the donation. Some receipts may also include a space for the donor to estimate the value of the items.

Is the Goodwill donation receipt form necessary for tax deductions?

Yes, the receipt is important if you plan to claim a tax deduction for your donation. The IRS requires documentation for charitable contributions, and the Goodwill receipt serves as proof of your donation. Keep it with your tax records.

Can I estimate the value of my donated items?

Yes, you can estimate the value of your donated items. Goodwill does not assign a specific value to the items, so it is up to you to determine their worth based on fair market value. Many donors refer to online resources or donation value guides for assistance in estimating values.

What if I lose my Goodwill donation receipt?

If you lose your receipt, it may be difficult to claim a tax deduction for that donation. However, you can still contact the Goodwill location where you made the donation. They may be able to provide you with a duplicate receipt or other documentation to help support your claim.

Can I donate items without receiving a receipt?

Yes, you can donate items without receiving a receipt. However, if you wish to claim a tax deduction, it is advisable to request a receipt at the time of your donation. It serves as proof of your charitable contribution.

Are there any restrictions on what I can donate?

Goodwill accepts a wide range of items, but there are some restrictions. Generally, items should be in good condition and usable. Goodwill does not accept items such as hazardous materials, appliances that do not work, or items that may pose a safety risk. It is best to check with your local Goodwill for specific guidelines.