What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for independent contractors. Unlike traditional employees, independent contractors are not subject to the same payroll tax withholdings. The pay stub provides a clear record of the contractor's income for a specific period, making it easier for them to manage their finances and report income for tax purposes.

Why do independent contractors need a pay stub?

Having a pay stub helps independent contractors keep track of their earnings and expenses. It serves as proof of income, which can be essential when applying for loans, mortgages, or even renting a property. Additionally, it can assist in organizing finances for tax filing, ensuring that all income is accurately reported.

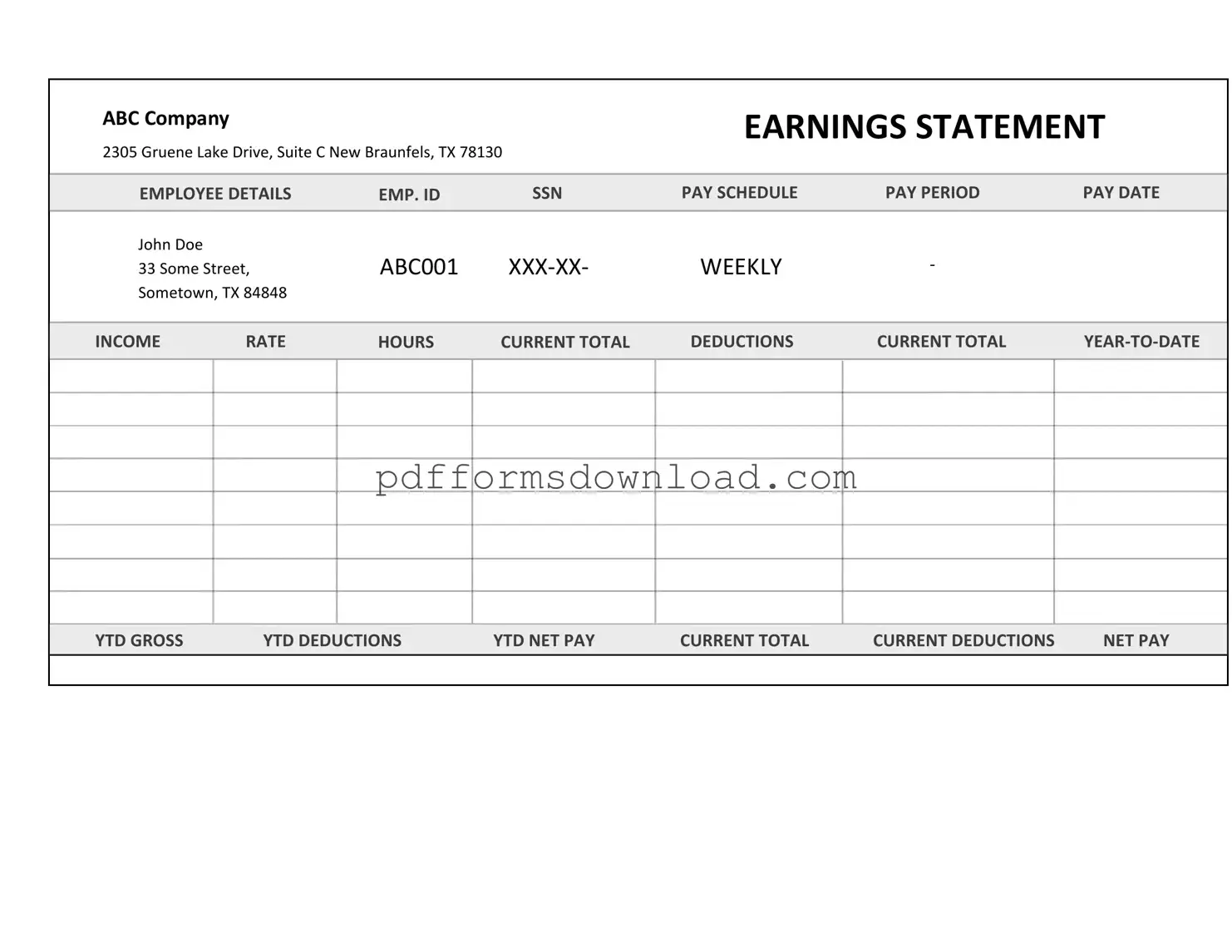

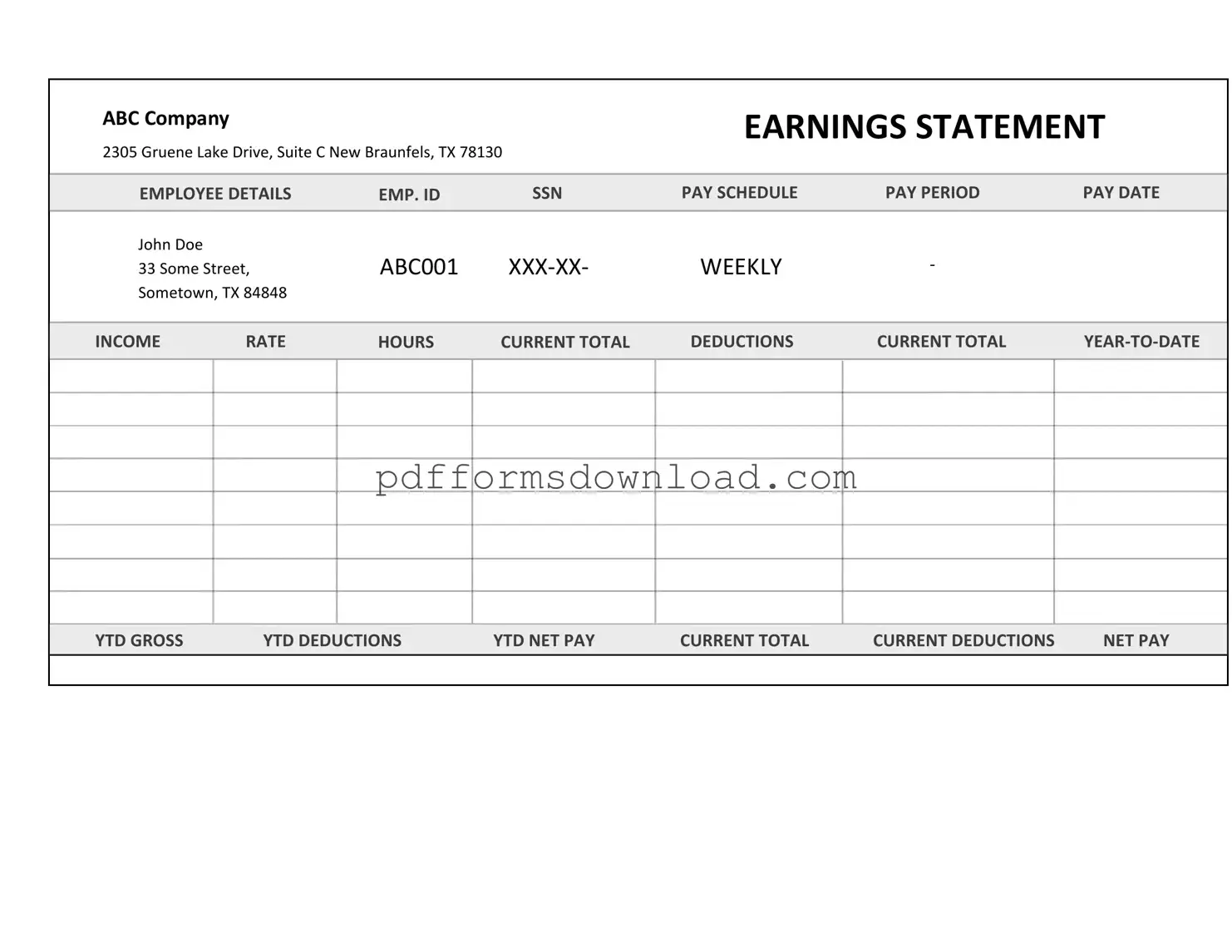

What information is typically included on a pay stub?

A typical Independent Contractor Pay Stub includes the contractor's name, address, and contact information, as well as the pay period dates. It details the total earnings for that period, any deductions (if applicable), and the net pay. Some pay stubs may also include information about the project or client for whom the work was performed.

How is the pay calculated for independent contractors?

Pay for independent contractors is usually based on the terms agreed upon in their contract. This may involve hourly rates, project-based fees, or commission structures. Contractors should ensure that their pay stub reflects the agreed-upon compensation to avoid discrepancies.

Are there any legal requirements for providing pay stubs?

While there is no federal law mandating that independent contractors receive pay stubs, many states have specific regulations. It's essential to check local laws to determine if there are any requirements for providing documentation of payments. Even if not required, providing a pay stub is a good practice for transparency and record-keeping.

Can independent contractors create their own pay stubs?

Yes, independent contractors can create their own pay stubs. There are various templates and software available that can simplify this process. It’s important to ensure that the information is accurate and clearly presented, as this will be used for financial records and potential audits.

What should I do if I notice an error on my pay stub?

If you find an error on your pay stub, it’s important to address it promptly. Contact the client or company that issued the pay stub and provide details of the discrepancy. Keeping a record of all communications can be helpful in resolving the issue. Most companies will want to correct any errors to maintain good working relationships.

How long should I keep my pay stubs?

It is advisable to keep pay stubs for at least three to seven years. This timeframe aligns with the IRS recommendations for retaining tax documents. Keeping these records can be beneficial in case of audits or if you need to reference past income for any reason.

What should I do if I lose my pay stub?

If you lose your pay stub, reach out to the client or company that issued it. They should be able to provide a duplicate or a summary of your earnings for that period. Keeping digital copies of your pay stubs can also help prevent loss in the future.