What is an Investment Letter of Intent form?

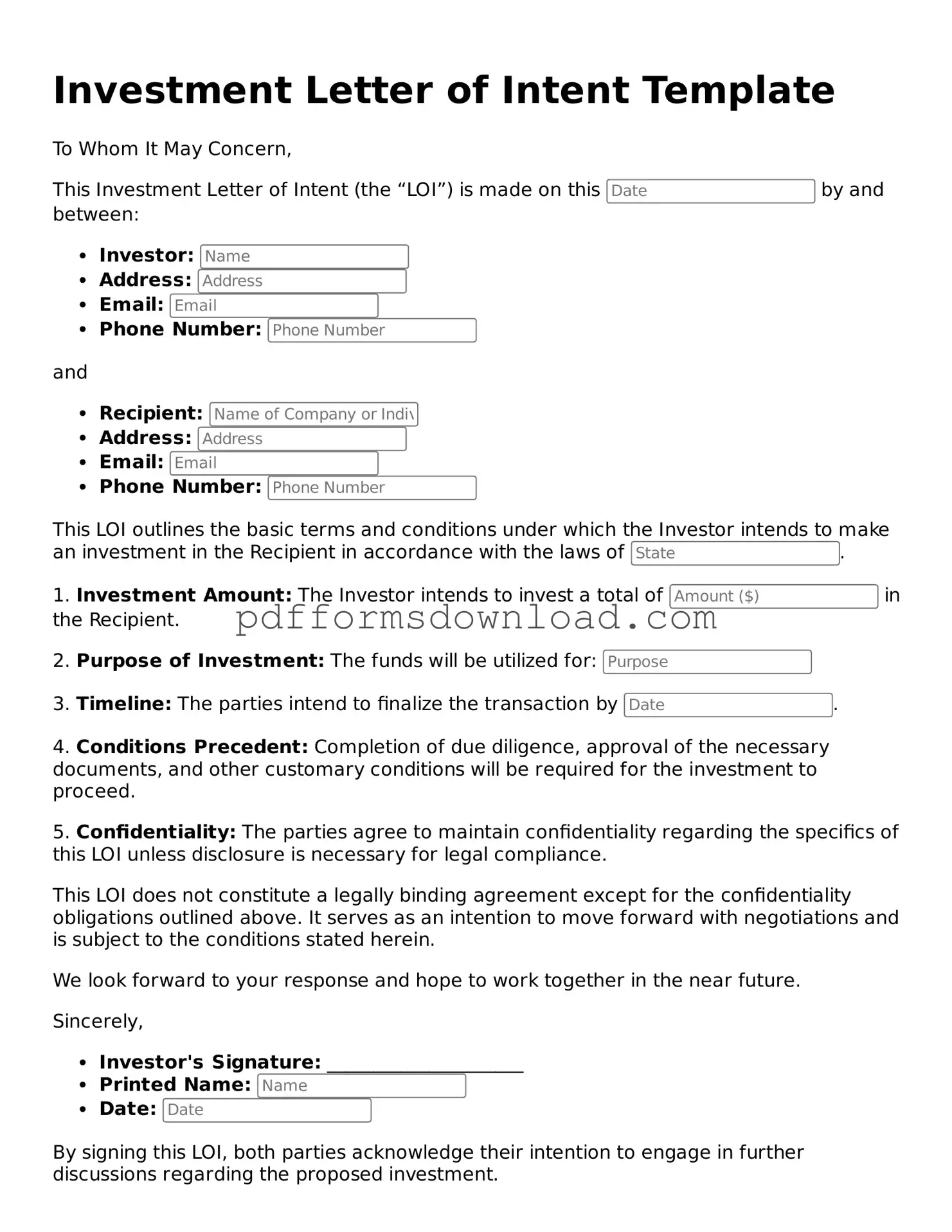

The Investment Letter of Intent form is a document that outlines the preliminary understanding between parties involved in a potential investment. It serves as a way to express interest and intention to move forward with a deal. This form typically includes key details such as the amount of investment, the structure of the deal, and any conditions that must be met before finalizing the investment. While it is not a legally binding contract, it sets the stage for further negotiations and due diligence.

Who should use an Investment Letter of Intent form?

Both investors and companies seeking investment can benefit from using an Investment Letter of Intent form. Investors use it to clarify their intentions and to outline the terms they are considering. Companies, on the other hand, can use the form to gauge the seriousness of potential investors and to ensure that both parties are aligned before entering into more formal agreements. It acts as a useful tool for both sides to communicate their expectations and interests.

What are the key components of an Investment Letter of Intent form?

An effective Investment Letter of Intent form typically includes several important components. First, it outlines the parties involved, including their names and contact information. Next, it details the investment amount and the proposed structure of the deal. Additionally, the form may include timelines for due diligence, conditions that need to be satisfied, and any confidentiality agreements. Finally, it often contains a statement indicating that the letter is non-binding, which helps clarify the nature of the agreement.

Is an Investment Letter of Intent legally binding?

Generally, an Investment Letter of Intent is not legally binding. It is meant to express the intent to negotiate further and to outline key terms. However, certain sections of the letter, such as confidentiality or exclusivity clauses, may be binding if explicitly stated. It is important for both parties to understand which parts of the document carry legal weight and which do not. Consulting with legal counsel can help clarify these distinctions.

How can an Investment Letter of Intent benefit both parties?

An Investment Letter of Intent can provide several benefits to both investors and companies. For investors, it helps to establish a clear framework for negotiations and ensures that their interests are documented. For companies, it can attract serious investors by demonstrating their commitment to the investment process. Additionally, this document can streamline communication and minimize misunderstandings, making the negotiation process smoother for everyone involved.