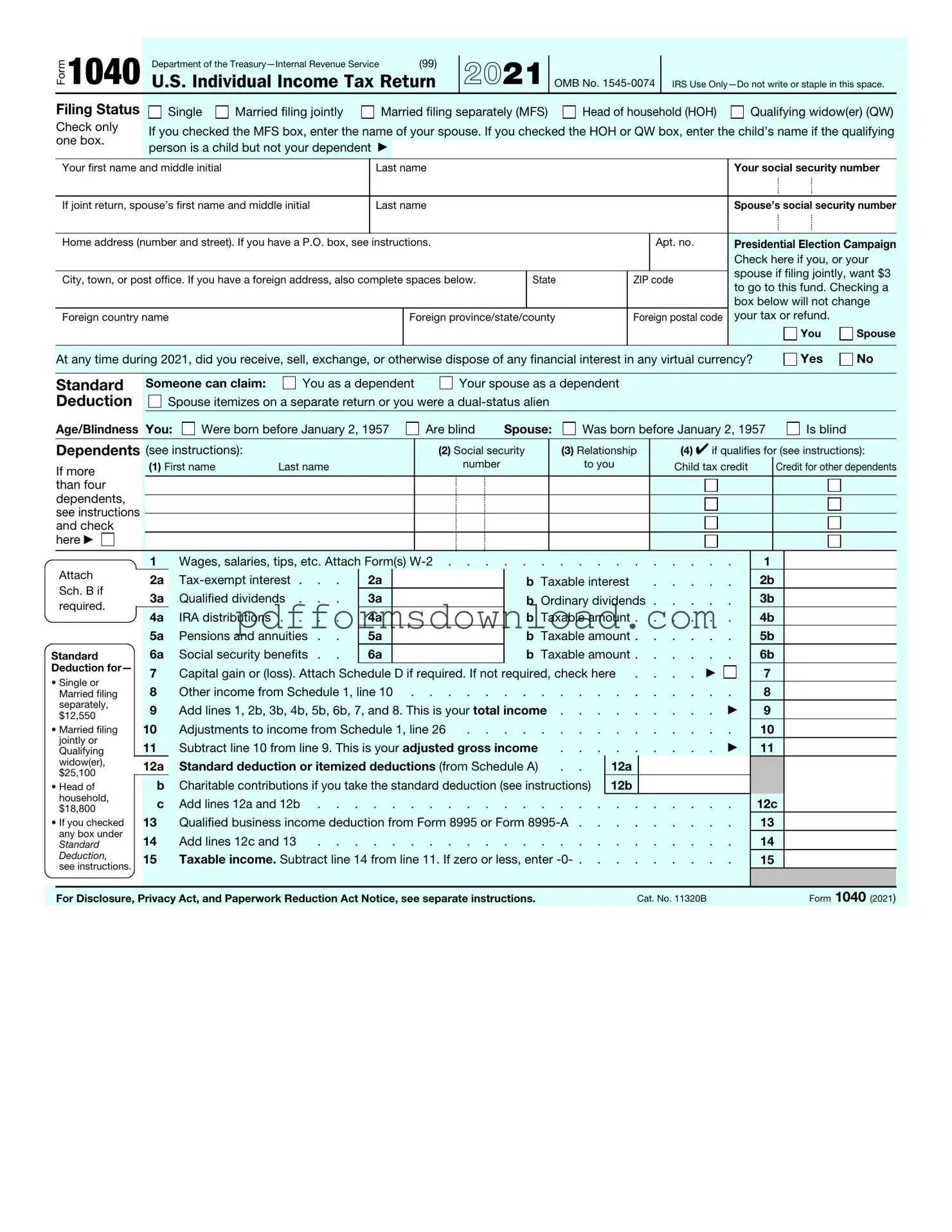

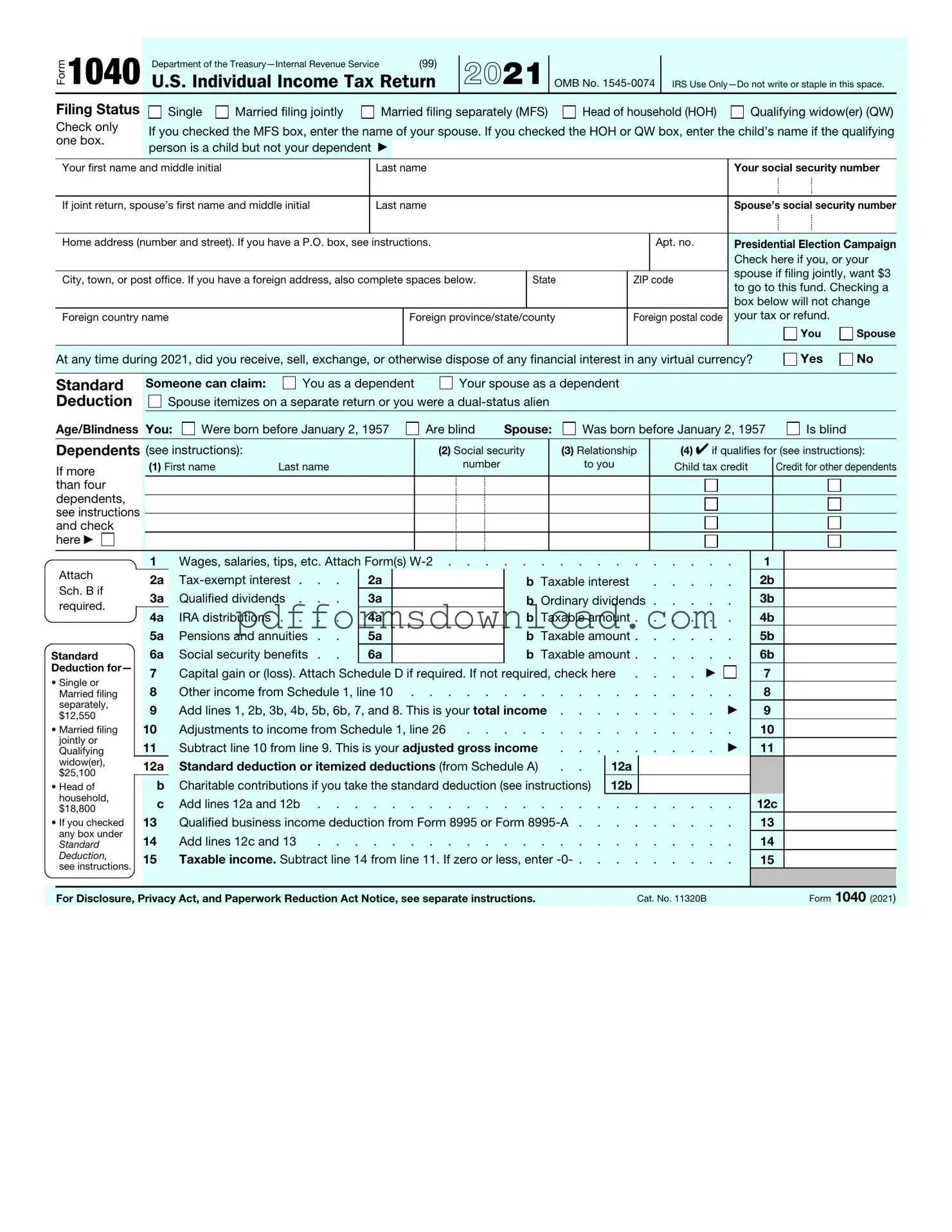

What is the IRS 1040 form?

The IRS 1040 form is the standard individual income tax return form used by U.S. taxpayers to report their annual income. It allows you to calculate your taxable income, determine your tax liability, and claim any deductions or credits you may be eligible for. This form is essential for filing your federal income taxes each year.

Who needs to file the IRS 1040 form?

Generally, if you earn income in the United States, you are required to file a 1040 form. This includes wages, self-employment income, dividends, and interest. There are specific income thresholds based on your filing status, age, and dependency status that determine whether you must file. Even if you earn below these thresholds, it may still be beneficial to file to claim a refund or tax credits.

What are the different versions of the 1040 form?

There are several variations of the 1040 form, including the 1040-SR for seniors and the 1040-NR for non-resident aliens. The 1040-EZ, which was a simplified version, has been discontinued. The main 1040 form can be supplemented with additional schedules to report specific types of income, deductions, or credits.

When is the deadline to file the IRS 1040 form?

The deadline to file your IRS 1040 form is typically April 15th of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. If you need more time, you can file for an extension, which gives you until October 15th to submit your return, but any taxes owed are still due by the original deadline.

What documents do I need to complete the IRS 1040 form?

To complete the 1040 form, gather documents that detail your income, such as W-2s from employers, 1099 forms for freelance work, and any other income statements. Additionally, have records of deductions and credits, such as mortgage interest statements, medical expenses, and receipts for charitable donations. Having these documents organized will make the filing process smoother.

Can I file the IRS 1040 form electronically?

Yes, you can file the IRS 1040 form electronically using various tax preparation software or through a tax professional. E-filing is often faster, and it allows for quicker processing of your return and any refunds. The IRS also offers a free e-filing option for those who meet certain income criteria.

What should I do if I made a mistake on my IRS 1040 form?

If you discover an error after filing your 1040 form, don’t panic. You can file an amended return using Form 1040-X. This form allows you to correct mistakes such as incorrect income, filing status, or deductions. Make sure to submit the amended return as soon as you identify the error to avoid any potential penalties or interest.