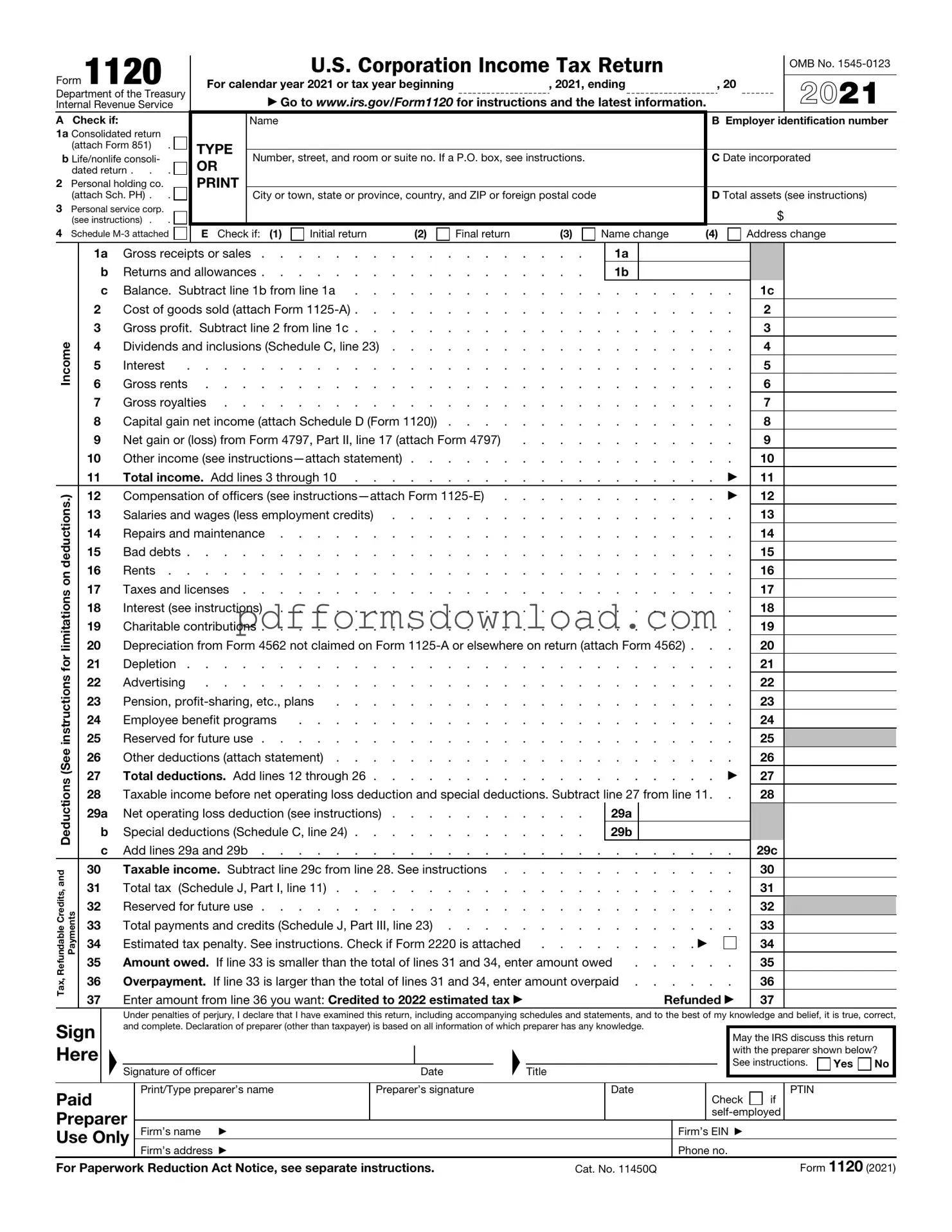

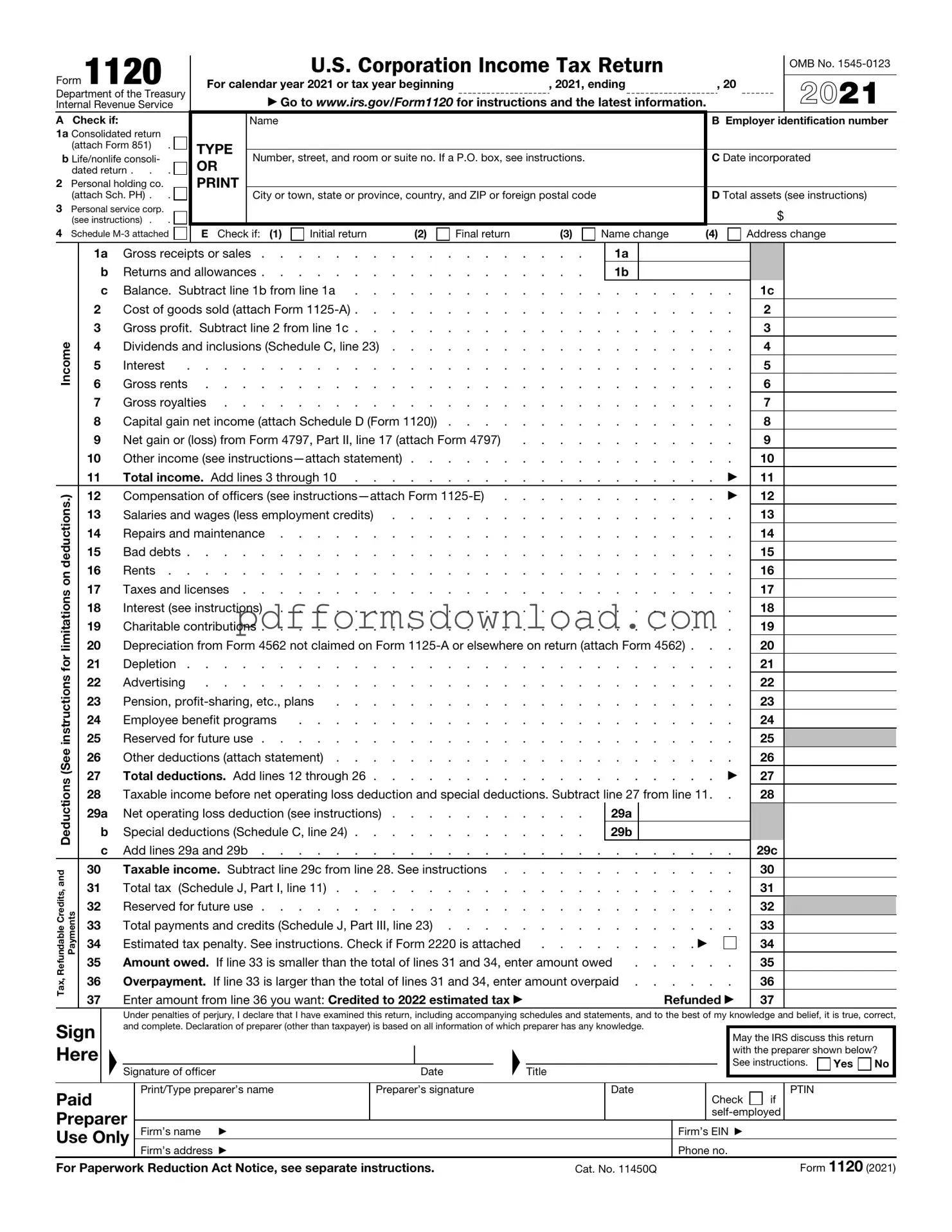

Download IRS 1120 Template

The IRS Form 1120 is a tax return used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. This form is essential for C corporations, as it outlines their financial performance and tax obligations for the fiscal year. Understanding how to accurately complete this form is crucial for compliance and financial planning.

To begin filling out the form, please click the button below.

Make This Document Now

Download IRS 1120 Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your IRS 1120 online — edit, save, and download easily.