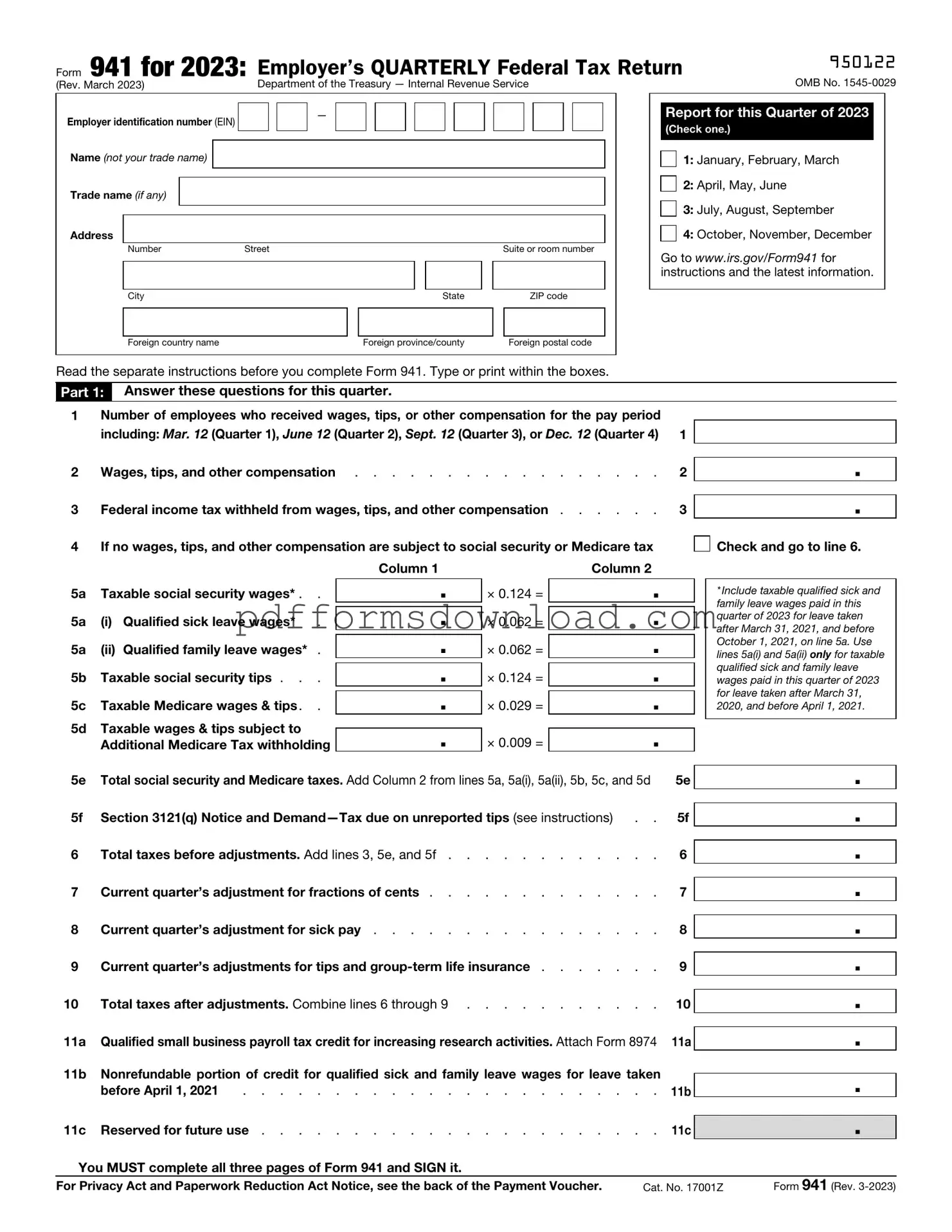

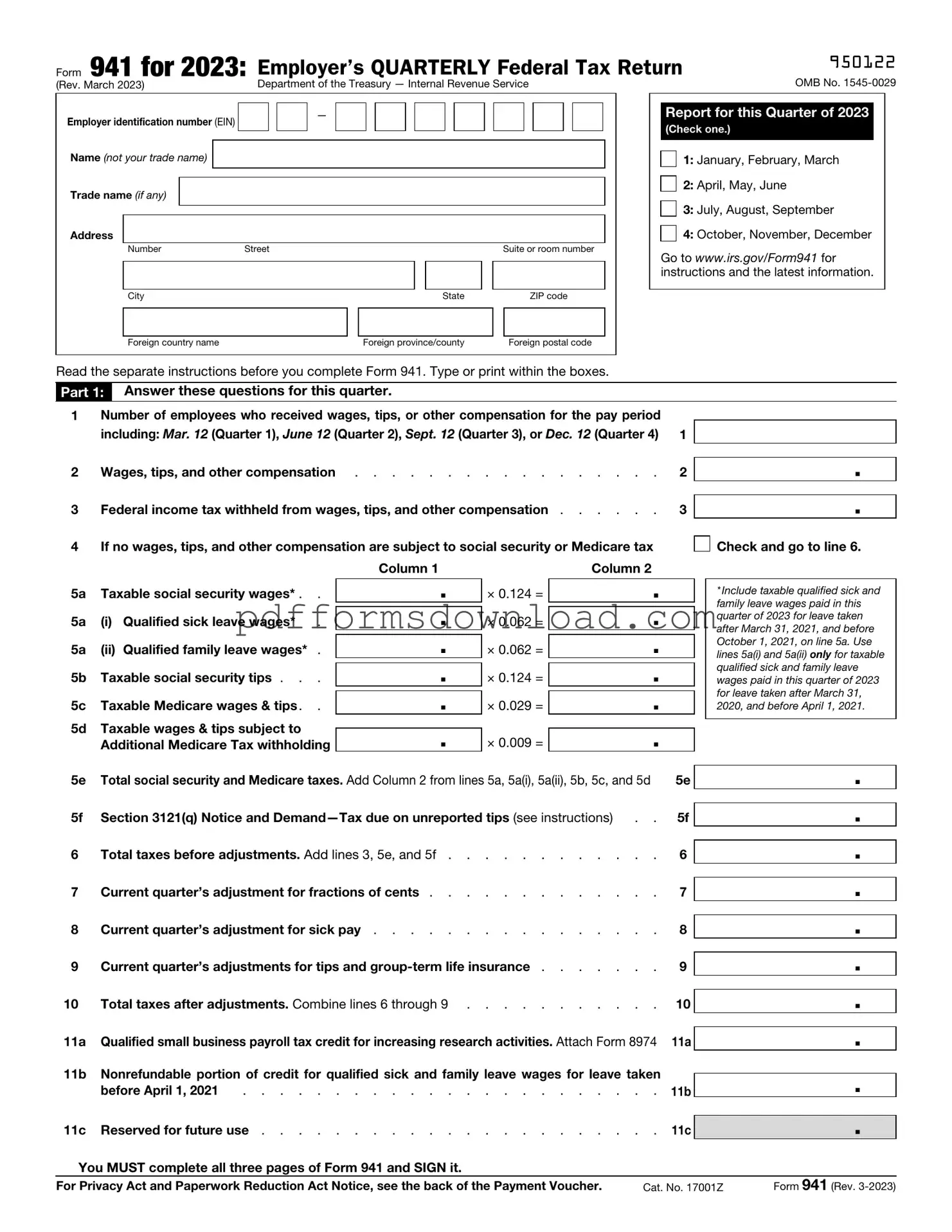

What is the IRS 941 form?

The IRS 941 form, also known as the Employer's Quarterly Federal Tax Return, is a document that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. This form is essential for the IRS to track payroll tax obligations and ensure compliance with federal tax laws.

Who needs to file Form 941?

Any employer who pays wages to employees must file Form 941. This includes businesses of all sizes, as well as non-profit organizations and government entities. If you have employees and withhold federal income tax, Social Security, or Medicare taxes, you are required to submit this form quarterly.

When is Form 941 due?

Form 941 is due on the last day of the month following the end of each quarter. For example, the deadlines are April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. Timely filing is crucial to avoid penalties and interest on any taxes owed.

What information do I need to complete Form 941?

To complete Form 941, you will need various pieces of information, including your business name, address, Employer Identification Number (EIN), and the number of employees. You will also need to report total wages paid, tips, and any federal income tax withheld, along with the amounts for Social Security and Medicare taxes.

Can I file Form 941 electronically?

Yes, employers can file Form 941 electronically using the IRS e-file system. This method is often faster and more efficient than mailing a paper form. Many payroll service providers also offer electronic filing as part of their services, making the process even easier for employers.

What if I make a mistake on Form 941?

If you discover an error after filing Form 941, you can correct it by filing Form 941-X, which is specifically designed for making adjustments to previously filed 941 forms. It’s important to address mistakes promptly to ensure your tax records remain accurate and to avoid potential penalties.

What happens if I don’t file Form 941?

Failing to file Form 941 can lead to significant consequences. The IRS may impose penalties for late filing, and you could also incur interest on any unpaid taxes. In some cases, the IRS might take further action, such as garnishing wages or placing liens on your business assets, to collect owed taxes.

Can I amend Form 941?

Yes, you can amend Form 941 by filing Form 941-X. This allows you to make corrections for any errors or omissions from your original filing. It is important to file an amendment as soon as you identify the need for changes to maintain compliance with tax regulations.

Where can I find more information about Form 941?

For more information about Form 941, including instructions and resources, visit the IRS website. The site offers detailed guidance on completing the form, filing requirements, and answers to frequently asked questions. Additionally, consulting a tax professional can provide personalized assistance tailored to your specific situation.